Can the strongest annual returns in the past five years continue until 2026 in the Wangbond bull market?

Driven by the Federal Reserve's interest rate cuts, easing inflationary pressure, and a slowing labor market, the bond market is expected to end 2025 with its best performance in the past five years. However, many market participants warned that after entering 2026, the return space for bonds may not be as good as this year.

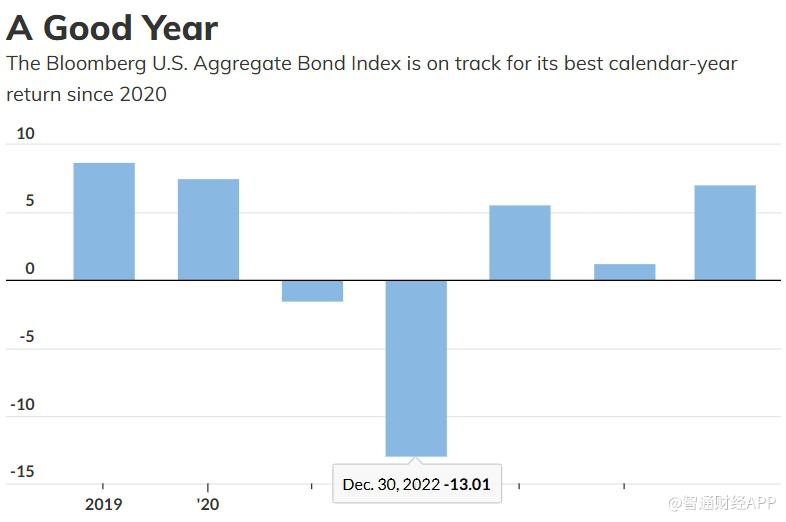

The Zhitong Finance App learned that the data showed that as of Thursday, the cumulative return of the US Composite Bond Index in 2025 had exceeded 7%. The index covers US Treasury bonds, government-related bonds, corporate bonds, and mortgage-backed securities and asset-backed securities. In contrast, the index's return in 2024 was only 1.25%, compared to 5.5% in 2023. This round of rebound occurred after bond investors were still struggling to break out of the historic trough. In 2022, the Federal Reserve implemented the fastest rate hike cycle in nearly 40 years to curb inflation, causing the index to fall by more than 13% that year, the worst performance on record.

Although bond prices have since recovered some of their losses, the market generally believes that the strong momentum of 2025 may not fully continue until 2026. On the one hand, some investors are skeptical about whether the Federal Reserve can continue to cut interest rates sharply in 2026; on the other hand, US Treasury yields have declined markedly this year, making the price appeal of entering the market to buy bonds lower. Since bond prices have an inverse relationship with yield, falling yields mean that prices have been pushed up.

Take the 10-year US Treasury yield as an example. This important benchmark yield, which affects mortgage loans, car loans, corporate financing costs, and government borrowing costs, has dropped from about 4.58% in January this year to 4.12% now. Market expectations for further interest rate cuts and signs of economic slowdown have jointly boosted bond prices.

Collin Martin, head of fixed income research and strategy at Carson Wealth Management Research Center, said that the outstanding performance of bonds in 2025 was mainly due to two factors: one was higher coupon income, and the other was capital gains brought about by rising prices. He pointed out that at the beginning of the year, bond yields were at a high level, making the interest income received by investors significantly higher than in the past few years, and as the Federal Reserve cut interest rates and yields gradually declined, bond prices also rose.

Looking back on previous trends, at the end of 2024 and the beginning of 2025, US Treasury yields rose due to market concerns that the Trump administration's tariffs and trade policies might push up inflation again. However, the inflation performance remained relatively stable, enabling the Federal Reserve to shift its policy focus to weakening the labor market. Since this year, the Federal Reserve has cut the policy interest rate by 25 basis points three times. According to the latest November inflation data, consumer prices rose 2.7% year on year, down from 3% as of September.

As a “stabilizer” in traditional portfolios, bonds still play an important role in many investors' asset allocation due to their stability, profitability, and risk diversification characteristics. The classic “60/40” combination (i.e. 60% stocks, 40% bonds) remains the core structure of most retirement investment proposals. Bonds not only provide returns through term notes, but may also cause a certain price appreciation and be paid at face value at maturity.

Martin believes that even if there is less room for bond prices to rise in 2026 than in 2025, bonds will still have allocation value. He stressed that the main purpose of holding bonds is to obtain stable income rather than betting on a sharp rise in prices; at the same time, bonds can still provide diversification and long-term stability in portfolios, and the 60/40 allocation concept has not been abandoned. He anticipates that the bond market may still achieve positive returns next year, but the intensity may be difficult to replicate this year's performance.

Daniel Tenengauzer, senior foreign exchange analyst at InTouch Capital Markets, pointed out that although bonds are expected to have the best performance year since 2020, the current environment is very different from that year. Five years ago, the global economy fell into recession, and bonds strengthened sharply as markets bet on large-scale fiscal stimulus; now, with economic fundamentals still relatively stable, it is still questionable whether further stimulus measures by the Federal Reserve or the Trump administration can have the same effect.

Tenengauzer warned that if additional fiscal stimulus reignites inflationary pressure, it may be bad for the bond market. He pointed out that under such circumstances, the yield on 30-year US bonds may rise, triggering the risk of long-term bond sell-off. Therefore, from this perspective, the outlook for 2026 bonds is not very positive.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal