Assessing Argan (AGX) Valuation After Strong Earnings Growth and Sustained Dividend Payments

Argan (AGX) just delivered another earnings step up, with higher net income and earnings per share for both the third quarter and year to date, and supported it with a steady quarterly dividend.

See our latest analysis for Argan.

Despite a sharp pullback in the last month, with a 30 day share price return of minus 14.4 percent, Argan’s year to date share price return of roughly 107 percent and a 1 year total shareholder return of about 116 percent still underline strong momentum. This is supported by upbeat earnings and a fresh dividend, while management’s ongoing hunt for acquisitions hints that investors are reassessing both its growth runway and risk profile at the current 296.56 dollars share price.

If Argan’s run has you rethinking where growth could come from next, it might be worth scanning fast growing stocks with high insider ownership to spot other fast moving ideas backed by committed insiders.

With earnings climbing, a fresh dividend, and shares still trading below analyst targets, the key question now is whether Argan remains undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 18% Undervalued

With Argan last closing at 296.56 dollars against a narrative fair value of 361 dollars, the valuation case leans toward meaningful upside backed by detailed long term projections.

The analysts have a consensus price target of $230.333 for Argan based on their expectations of its future earnings growth, profit margins and other risk factors. In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $142.0 million, and it would be trading on a PE ratio of 28.6x, assuming you use a discount rate of 8.1%.

Curious how Argan gets from today’s earnings to that higher valuation world? The narrative leans on powerful growth, firm margins and a richer future multiple. Want to see exactly how those assumptions stack up across the next few years and why they point to that fair value? Dive into the full story behind the numbers.

Result: Fair Value of $361.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change quickly if major gas projects face delays, permitting setbacks, or if faster decarbonization shrinks long term gas demand.

Find out about the key risks to this Argan narrative.

Another View: Multiples Signal Caution

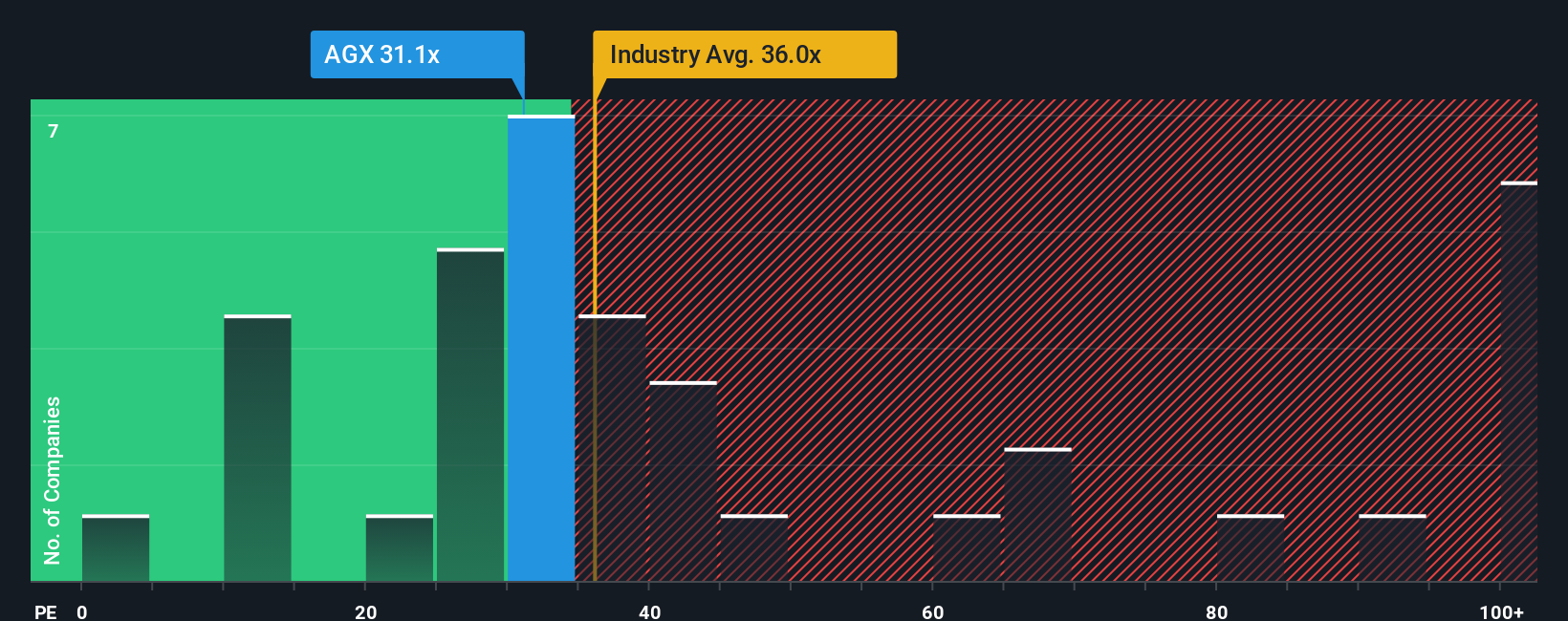

While the narrative fair value suggests upside, the current price looks stretched against earnings. Argan trades on a 34.3 times price to earnings ratio versus a 31.7 times industry average and a 32.5 times fair ratio, which hints at limited margin for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Argan Narrative

If you see the outlook differently or want to dig into the numbers yourself, you can build a personalized Argan thesis in minutes, Do it your way.

A great starting point for your Argan research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street’s screener to work so you do not miss high conviction opportunities beyond Argan that fit your strategy.

- Capture potential cash flow upside by targeting these 912 undervalued stocks based on cash flows that the market may be mispricing today.

- Position early in emerging innovation by focusing on these 24 AI penny stocks reshaping entire industries with intelligent automation.

- Focus on income potential and stability by zeroing in on these 13 dividend stocks with yields > 3% that may strengthen your portfolio’s long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal