Pacira BioSciences (PCRX): Assessing Valuation After New PROBE Consortium Osteoarthritis AI Initiative

Pacira BioSciences (PCRX) is stepping deeper into the osteoarthritis opportunity by joining the PROBE Consortium, a global AI and big data initiative that aims to redesign how OA is diagnosed, monitored, and treated.

See our latest analysis for Pacira BioSciences.

At a share price of $26.55, Pacira has delivered a strong year to date share price return of about 45 percent, even though the 1 year total shareholder return of roughly 36 percent still sits against a weak 3 year total shareholder return. This suggests that recent momentum is rebuilding confidence after a tough stretch.

If Pacira’s latest OA move has you thinking more broadly about healthcare opportunities, this could be a smart moment to scan healthcare stocks for other compelling ideas.

With earnings growing faster than revenue, a modest discount to analyst targets, and a long recent drawdown, is Pacira still trading below its true potential, or has the market already priced in its next leg of growth?

Most Popular Narrative: 8.4% Undervalued

With Pacira closing at $26.55 against a narrative fair value near $29, the current setup frames a modest upside built on execution and pipeline progress.

The new strategic partnership with Johnson & Johnson MedTech for ZILRETTA is expected to double sales coverage and significantly expand reach across new physician specialties and healthcare systems, providing a forward catalyst for revenue growth in 2026 and beyond.

Curious how this collaboration, alongside rising non opioid demand and expanding margins, adds up to that upside case, including future earnings power and valuation multiples? Explore the narrative to see which specific growth and profitability assumptions are most important in supporting that fair value estimate.

Result: Fair Value of $29.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on faster uptake of EXPAREL and smooth execution of partnerships, as slower adoption or pricing pressure could quickly challenge the thesis.

Find out about the key risks to this Pacira BioSciences narrative.

Another Lens on Valuation

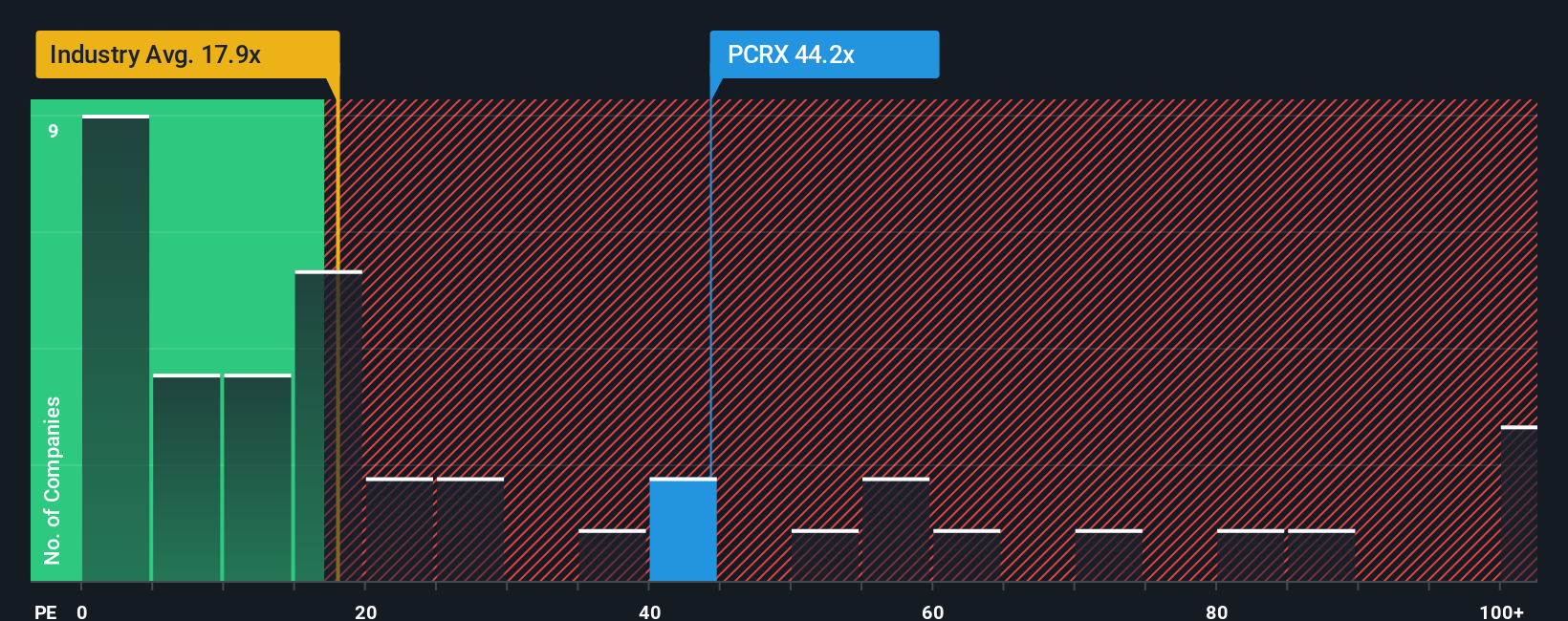

While the consensus narrative sees Pacira as modestly undervalued, the earnings multiple tells a different story. Shares trade at about 53 times earnings, far richer than the US pharma sector at roughly 20 times and a fair ratio closer to 22 times, suggesting meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pacira BioSciences Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom view in minutes, Do it your way.

A great starting point for your Pacira BioSciences research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Pacira might fit your strategy, but you could miss potential returns if you ignore other opportunities our focused stock screeners are surfacing right now.

- Target potential price turnarounds by reviewing these 3635 penny stocks with strong financials that pair small market caps with balance sheets built to handle volatility.

- Explore the next wave of automation by scanning these 24 AI penny stocks focused on monetizing real world AI adoption rather than just hype.

- Seek a wider margin of safety by filtering for these 912 undervalued stocks based on cash flows where future cash flows indicate the market may not fully reflect the story.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal