Assessing Nexstar Media Group’s (NXST) Valuation After DirecTV Antitrust Case Is Revived by Appeals Court

A U.S. appeals court has revived DirecTV’s antitrust lawsuit against Nexstar Media Group (NXST), forcing the broadcaster to defend allegations of inflating retransmission fees, a turn that injects fresh legal and regulatory risk into the stock.

See our latest analysis for Nexstar Media Group.

Despite the legal noise, Nexstar’s share price has held up well, with a strong year to date share price return and a solid multi year total shareholder return suggesting momentum remains broadly constructive rather than exhausted.

If this legal twist has you reassessing your media exposure, it could be a good time to compare Nexstar with other fast growing stocks with high insider ownership that might be drawing smart money attention.

With Nexstar trading below analyst targets yet delivering robust multi year returns, the real question now is whether investors are still getting an undervalued cash generator, or if the market has already priced in the next leg of growth?

Most Popular Narrative Narrative: 11.3% Undervalued

With Nexstar’s fair value estimate sitting above the recent 205.75 share price, the dominant narrative frames this broadcaster as a mispriced cash engine.

Ongoing balance sheet strength, operational efficiencies, and disciplined capital allocation including share repurchases and dividend growth are expected to enable strong EPS growth and return of capital to shareholders, further supporting stock undervaluation.

Curious how modest top line expectations can still justify a higher valuation multiple and richer margins ahead? The narrative leans on specific earnings, margin and buyback assumptions that could reshape how investors view this cash flow profile. Want to see exactly what has to go right for that upside to hold?

Result: Fair Value of $231.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued pay TV subscriber losses and Nexstar’s heavy reliance on volatile political advertising could quickly undermine the undervaluation upside that investors are banking on.

Find out about the key risks to this Nexstar Media Group narrative.

Another Lens on Value

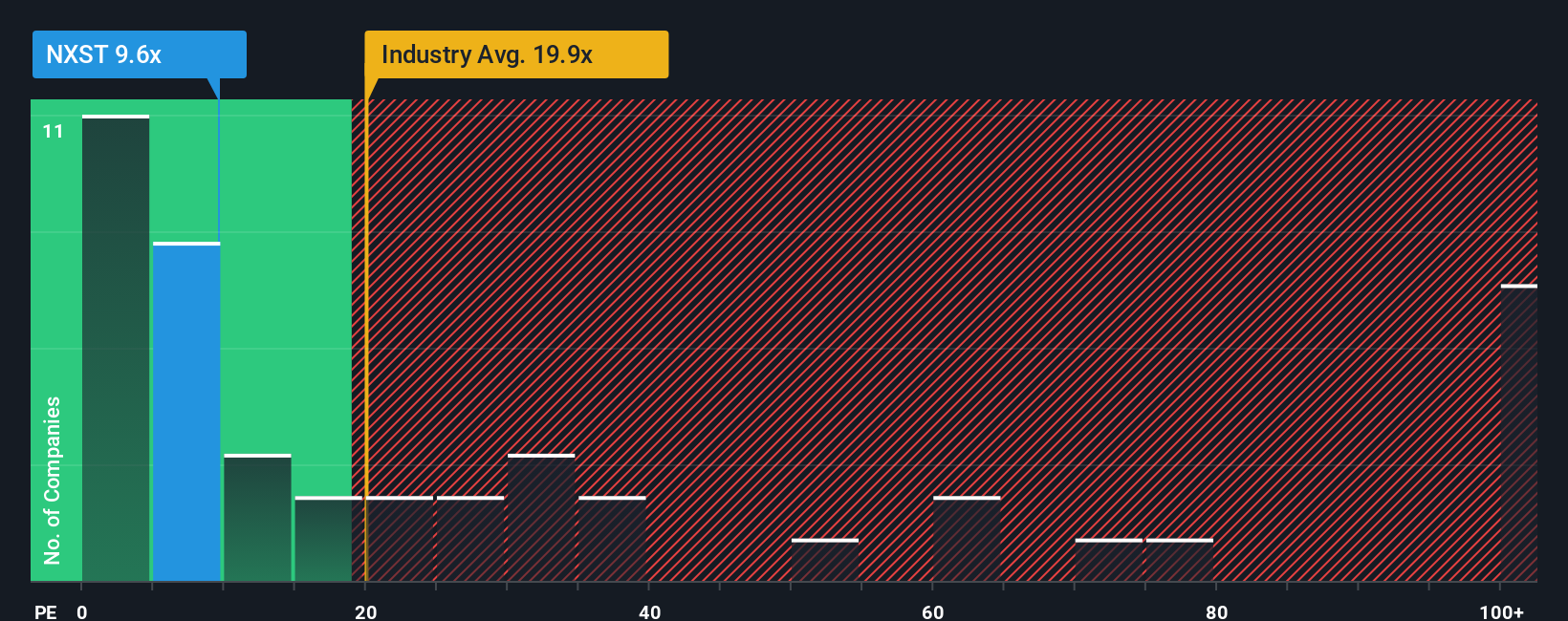

On earnings-based valuation, Nexstar looks more mixed. Its price to earnings ratio of 12.5 times is higher than close peers at 10.6 times, yet still well below the broader US Media sector at 16.1 times and under our 18.8 times fair ratio. This suggests room for rerating but also some near term multiple risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nexstar Media Group Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in just minutes: Do it your way.

A great starting point for your Nexstar Media Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, use the Simply Wall Street Screener to uncover fresh opportunities that match your strategy and sharpen your next investment decision.

- Capture early stage potential by scanning these 3635 penny stocks with strong financials that already back their stories with solid financials and credible balance sheets.

- Position yourself at the front of the AI wave by targeting these 24 AI penny stocks shaping how data, automation, and intelligent systems transform entire industries.

- Explore future cash flow opportunities by focusing on these 13 dividend stocks with yields > 3% that aim to keep paying investors even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal