Nissan Motor (TSE:7201) Valuation Check After Recent Share Price Rebound

Nissan Motor (TSE:7201) shares have quietly climbed about 13% over the past month, even as the stock remains down year to date. This has prompted investors to revisit what is actually driving this recovery.

See our latest analysis for Nissan Motor.

That recent 1 month share price return of nearly 13% looks more like a rebound than a full trend change, given the year to date share price return is still firmly negative and the 1 year total shareholder return is also in the red. This hints that sentiment is improving but not yet fully convinced.

If Nissan’s move has you rethinking the auto space, this could be a good moment to explore other auto manufacturers that might offer a stronger mix of growth and resilience.

With the share price still below where it started the year and earnings volatility keeping analysts cautious, investors now face a key question: is Nissan undervalued after a difficult spell, or already pricing in any recovery ahead?

Most Popular Narrative Narrative: 18% Overvalued

With Nissan Motor last closing at ¥396.3 versus a narrative fair value near ¥336, the gap reflects a cautious view on how far this rebound can run.

The analysts have a consensus price target of ¥344.688 for Nissan Motor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥430.0, and the most bearish reporting a price target of just ¥250.0.

Want to see what kind of earnings turnaround and margin reset could justify this stance? The narrative leans on a sharp profit swing and disciplined valuation multiples. Curious how those projections stack up over the next few years? Read on to uncover the assumptions behind that fair value line.

Result: Fair Value of ¥335.94 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cash burn and fierce China competition could quickly undercut the hoped for margin recovery and force a rethink on Nissan’s valuation narrative.

Find out about the key risks to this Nissan Motor narrative.

Another View on Value

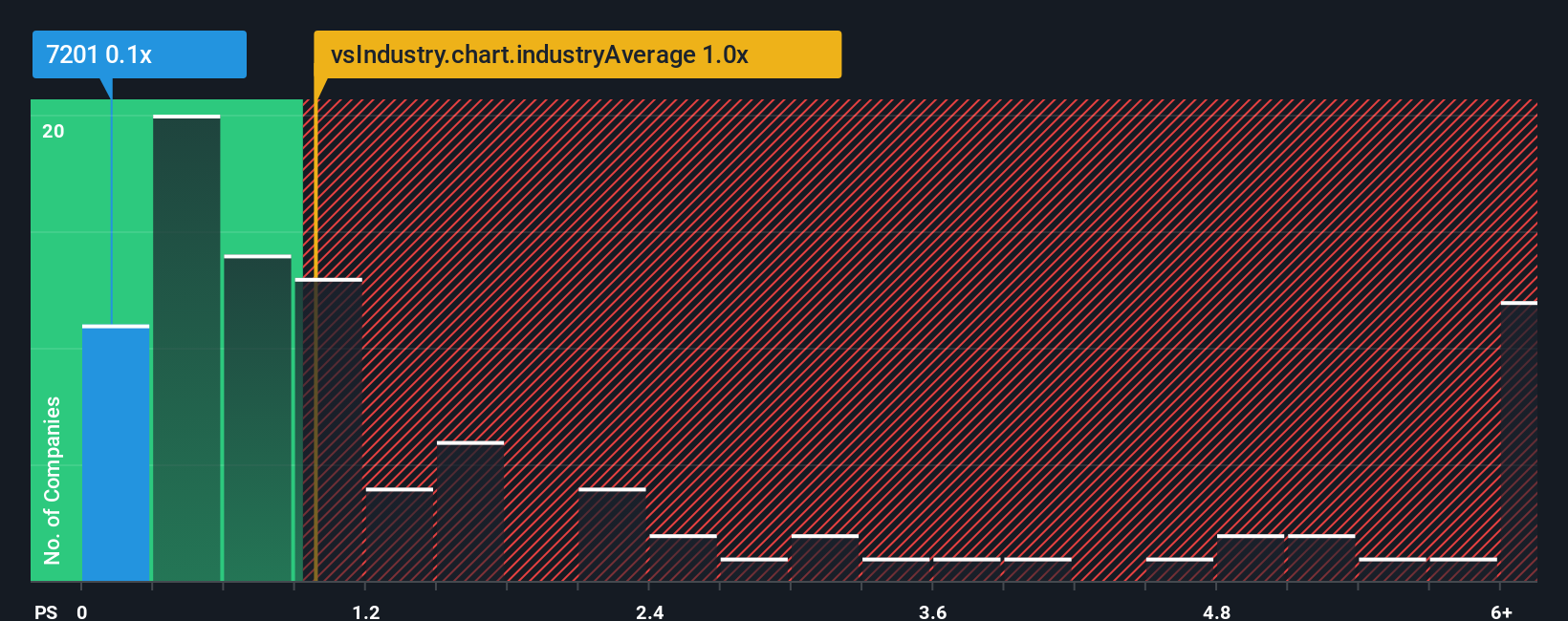

While the narrative fair value suggests Nissan is overvalued, its price to sales ratio of 0.1x looks strikingly cheap next to peers at 0.3x and the Asian auto average at 1.0x, and even below a 0.6x fair ratio. Is the market underpricing a potential recovery, or correctly flagging risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nissan Motor Narrative

If you see things differently or prefer to dive into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Nissan Motor research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Instead of stopping at Nissan, put Simply Wall Street’s Screener to work so you do not miss other compelling opportunities hiding in plain sight.

- Capture potential mispricings by targeting companies trading below their intrinsic value through these 913 undervalued stocks based on cash flows that highlight strong cash flow dynamics.

- Ride structural growth trends in medical innovation by focusing on these 29 healthcare AI stocks using data driven tools transforming diagnostics and treatment.

- Position yourself for emerging digital asset trends by assessing businesses exposed to blockchain and tokenization via these 80 cryptocurrency and blockchain stocks with robust underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal