Asian Growth Companies With Strong Insider Ownership

Amidst global economic shifts and interest rate adjustments, Asian markets are navigating a complex landscape marked by concerns over technology valuations and inflationary pressures. In this environment, growth companies with high insider ownership often stand out as potentially resilient investments, as insider stakes can signal confidence in a company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.8% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Here we highlight a subset of our preferred stocks from the screener.

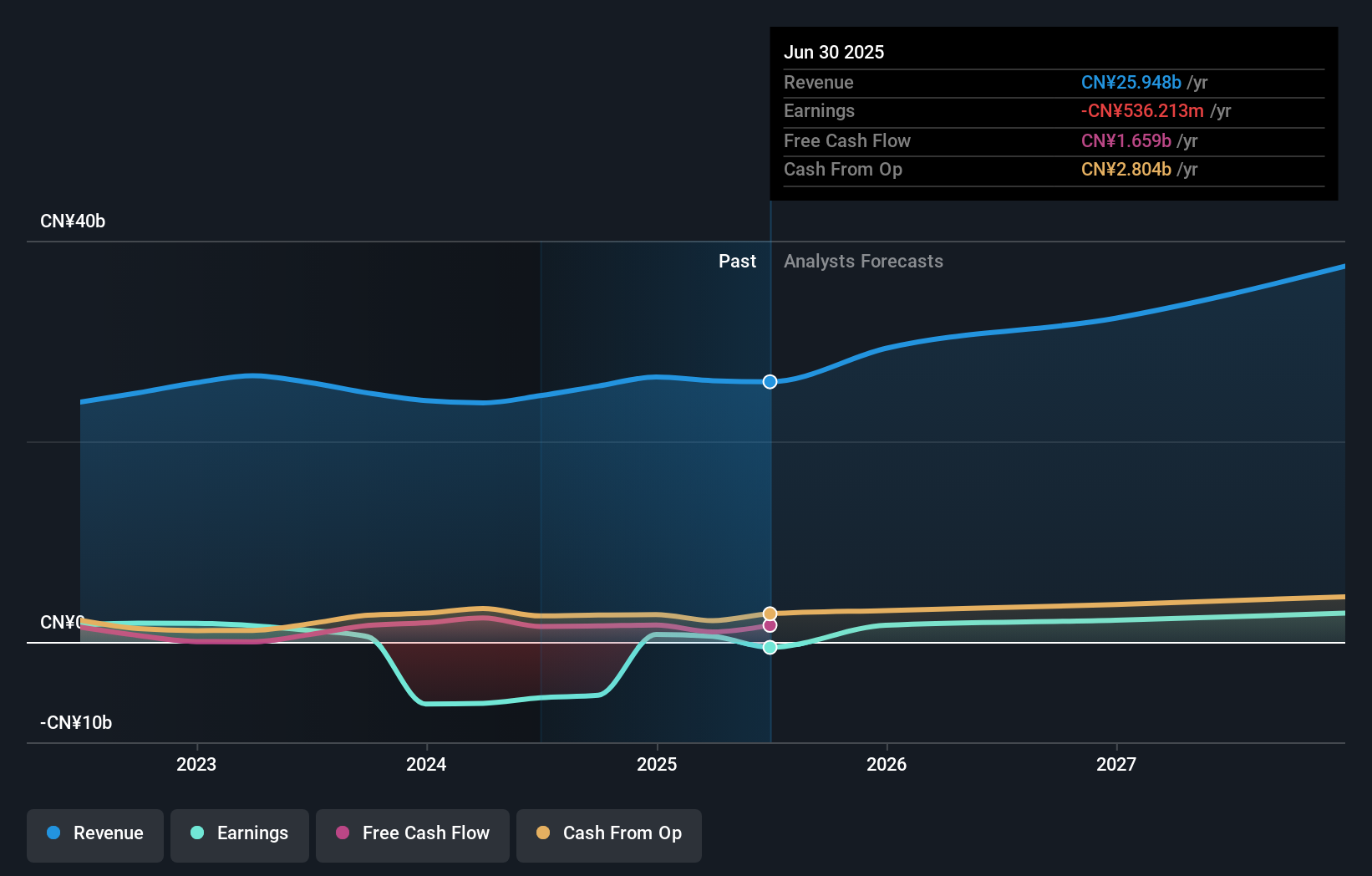

Ninestar (SZSE:002180)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ninestar Corporation is involved in the R&D, production, processing, and sales of self-produced printers and printer consumables and accessories, with a market cap of CN¥26.88 billion.

Operations: Ninestar's revenue segments include self-produced printers and printer consumables and accessories.

Insider Ownership: 10.2%

Ninestar is experiencing challenges with a recent net loss of CNY 356.18 million for the first nine months of 2025, compared to a net income last year. However, it is forecasted to achieve profitability within three years and expects revenue growth at 22% annually, surpassing the Chinese market average. Despite low projected return on equity and no significant insider trading activity recently, it trades at good value relative to peers and industry standards.

- Dive into the specifics of Ninestar here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Ninestar's current price could be quite moderate.

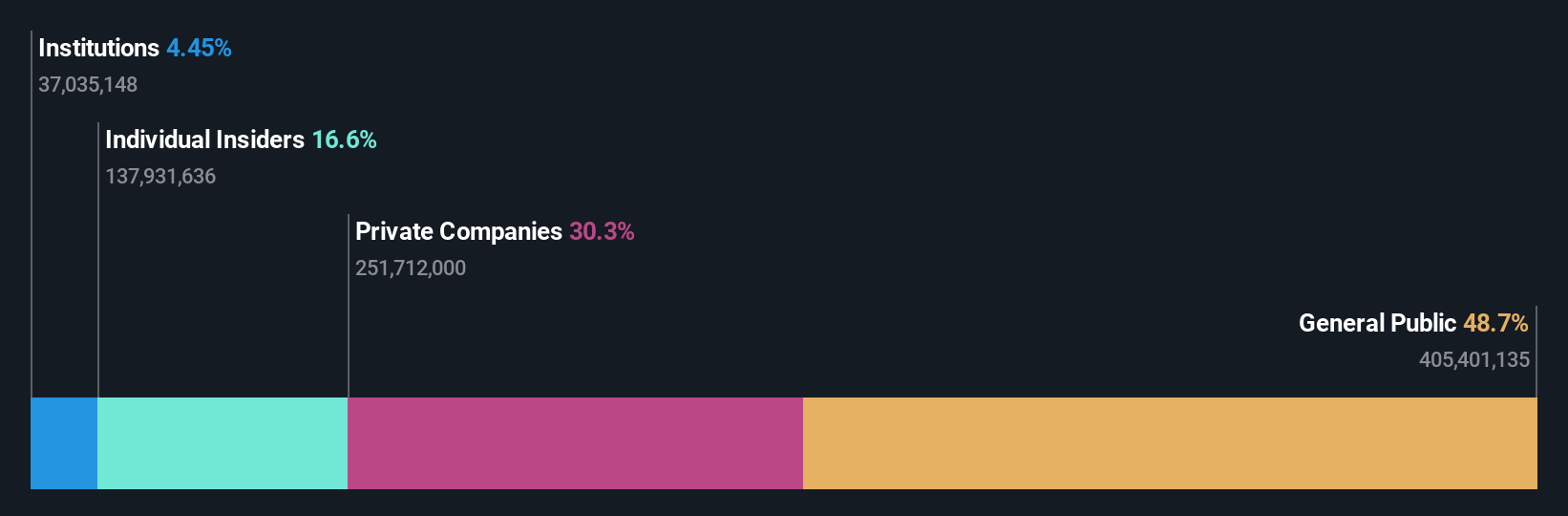

Jiangsu JieJie Microelectronics (SZSE:300623)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu JieJie Microelectronics Co., Ltd. (SZSE:300623) operates in the semiconductor industry, focusing on the design and manufacturing of power devices, with a market cap of CN¥22.90 billion.

Operations: The company's revenue primarily comes from its Electronic Components segment, which generated CN¥3.30 billion.

Insider Ownership: 16.6%

Jiangsu JieJie Microelectronics has demonstrated revenue growth, with sales reaching CNY 2.50 billion for the first nine months of 2025, up from CNY 2.01 billion a year ago. Despite a slight decline in earnings per share, its projected annual profit growth remains robust at over 20%. The company's price-to-earnings ratio is favorable compared to industry averages, although return on equity forecasts are modest. Recent bylaw changes could impact governance but no significant insider trading activity was noted recently.

- Navigate through the intricacies of Jiangsu JieJie Microelectronics with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Jiangsu JieJie Microelectronics is trading beyond its estimated value.

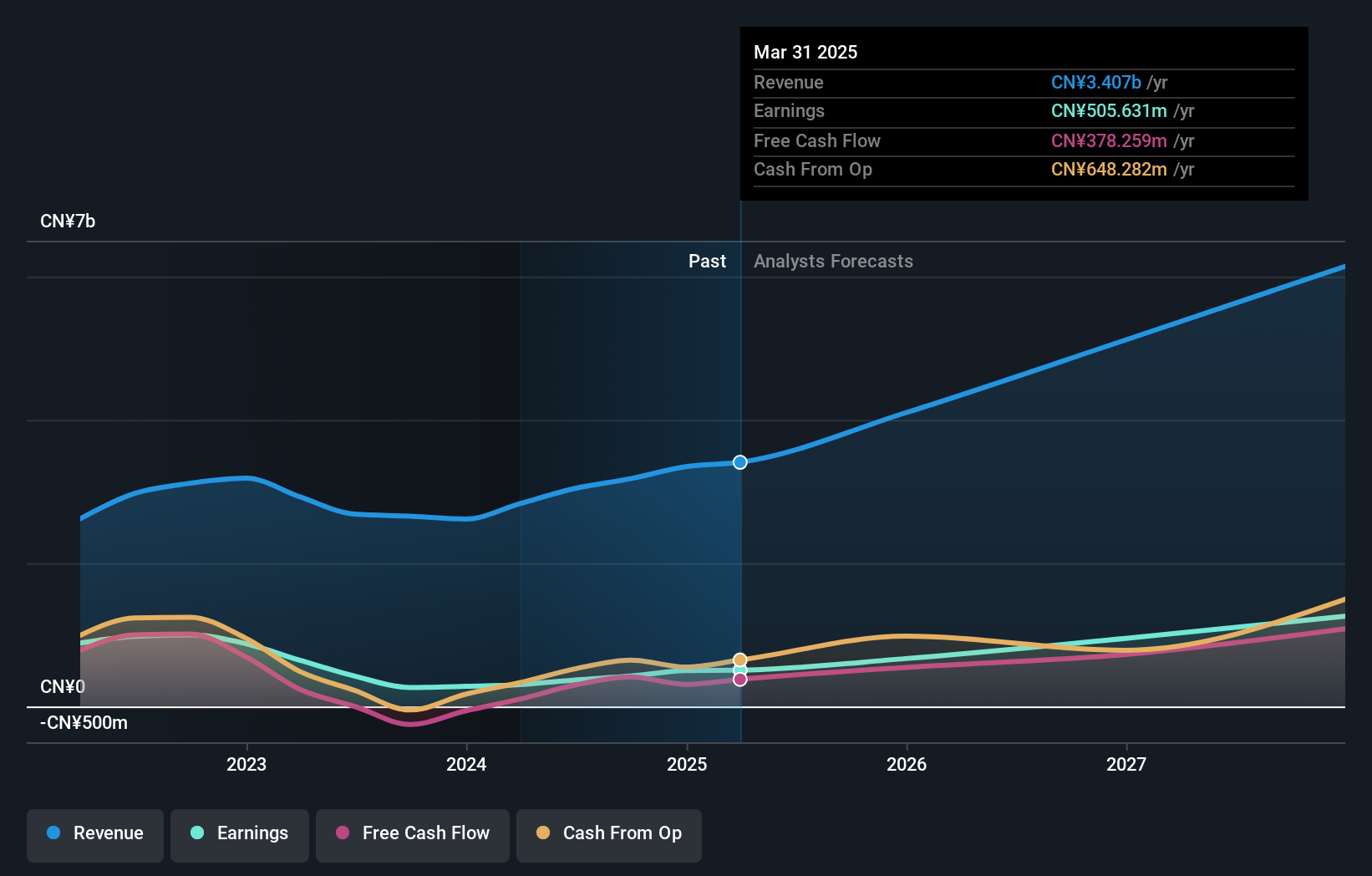

SG Micro (SZSE:300661)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SG Micro Corp designs, markets, and sells analog integrated circuits across Mainland China, Hong Kong, Taiwan, and internationally with a market cap of CN¥41.08 billion.

Operations: The company's revenue is primarily derived from the integrated circuit industry, amounting to CN¥3.70 billion.

Insider Ownership: 31.7%

SG Micro's earnings grew by 31.9% over the past year, with revenue reaching CNY 2.80 billion for the first nine months of 2025, up from CNY 2.44 billion a year ago. Earnings are forecast to grow significantly at over 34% annually, outpacing both industry and market averages. The price-to-earnings ratio is slightly below the semiconductor industry average, indicating relative value despite modest return on equity forecasts and no recent insider trading activity noted.

- Delve into the full analysis future growth report here for a deeper understanding of SG Micro.

- The valuation report we've compiled suggests that SG Micro's current price could be inflated.

Taking Advantage

- Gain an insight into the universe of 633 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Interested In Other Possibilities? Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal