3 Asian Dividend Stocks With Up To 3.9% Yield

As global markets navigate a period of interest rate adjustments and economic uncertainties, Asian equities have been drawing attention for their potential stability and income generation. In this context, dividend stocks in Asia offer an attractive proposition, providing investors with regular income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.78% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.20% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.94% | ★★★★★★ |

| NCD (TSE:4783) | 4.04% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.59% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.70% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.35% | ★★★★★★ |

Click here to see the full list of 1039 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

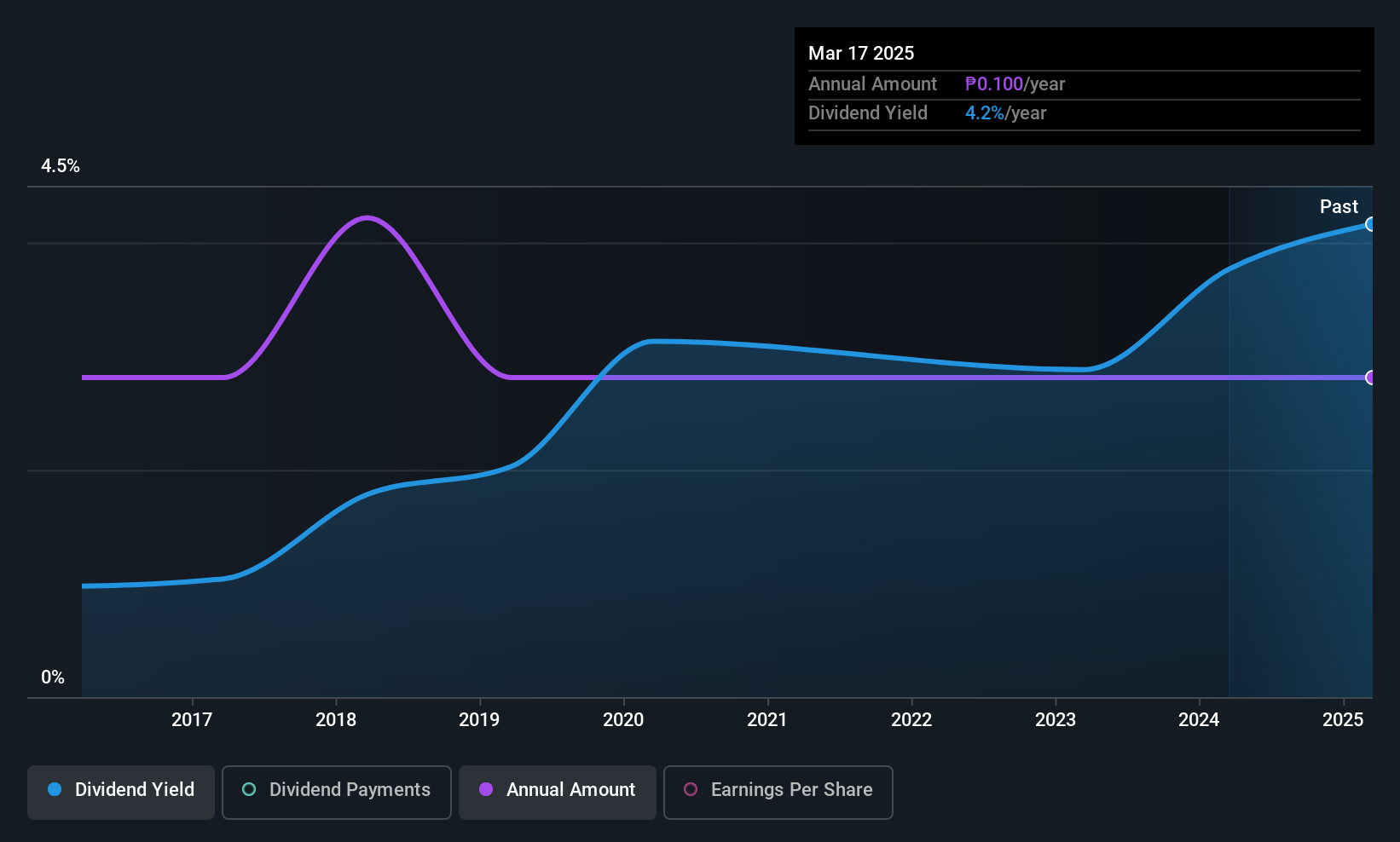

Petron (PSE:PCOR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Petron Corporation operates as an oil refining and marketing company in the Philippines with a market cap of ₱22.37 billion.

Operations: Petron Corporation generates revenue primarily through its petroleum segment, which accounts for ₱1.19 billion, with additional contributions from leasing at ₱1.23 billion and marketing at ₱860 million.

Dividend Yield: 4%

Petron Corporation's recent earnings report shows significant growth, with net income for the third quarter rising to PHP 4.12 billion from PHP 954 million a year ago. Despite this, its dividend track record remains unstable and unreliable over the past decade. The dividends are well-covered by earnings and cash flows, boasting a low payout ratio of 21.7% and cash payout ratio of 2.2%. However, its dividend yield is lower than top-tier payers in the Philippine market at 3.98%.

- Unlock comprehensive insights into our analysis of Petron stock in this dividend report.

- Our valuation report here indicates Petron may be undervalued.

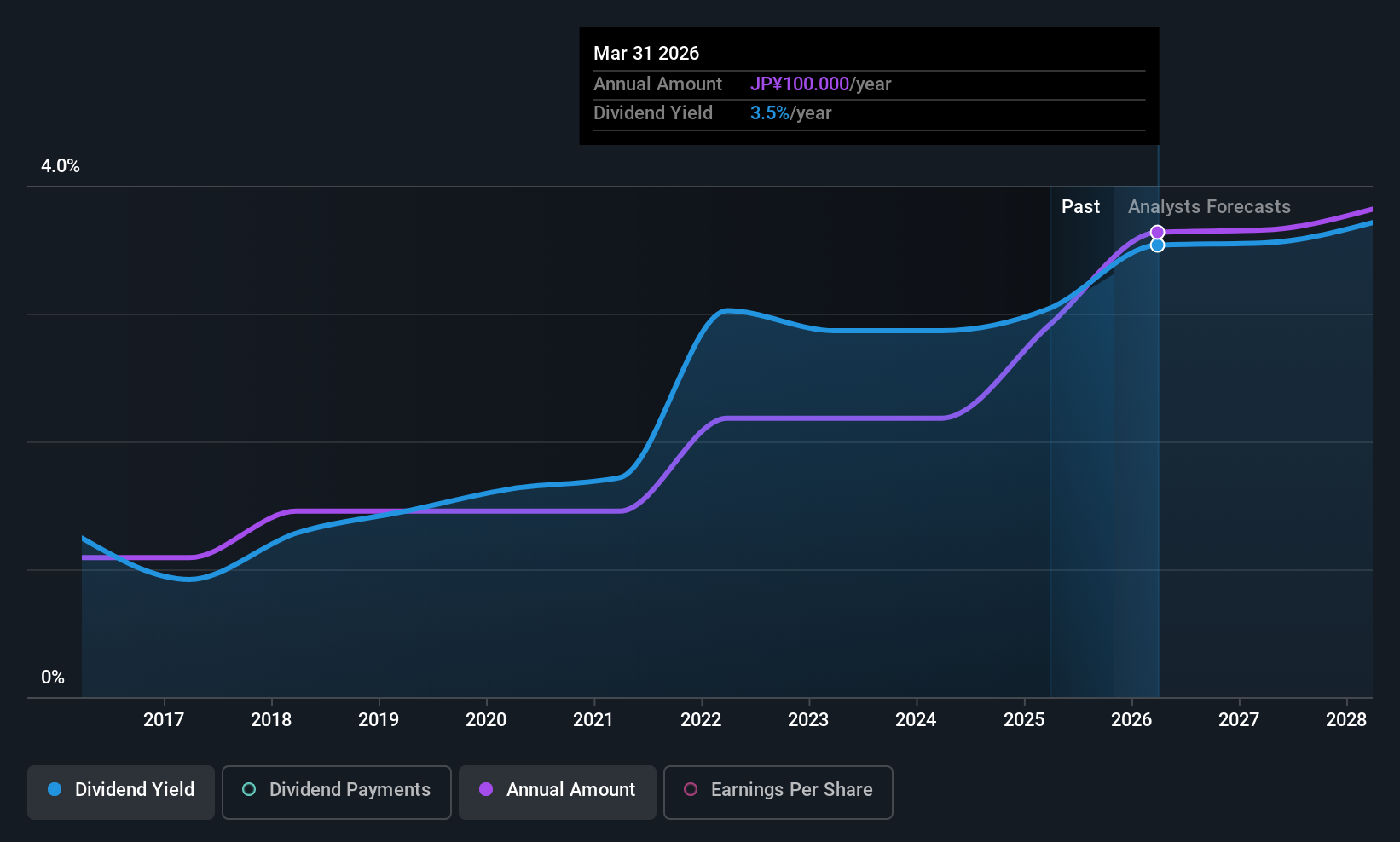

MEGMILK SNOW BRANDLtd (TSE:2270)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MEGMILK SNOW BRAND Co., Ltd. is a company that manufactures and sells milk, milk products, and other food products both in Japan and internationally, with a market cap of ¥201.89 billion.

Operations: MEGMILK SNOW BRAND Co., Ltd.'s revenue segments include Dairy Products at ¥279.45 billion and Beverages and Desserts at ¥261.88 billion, along with Feed and Seeds contributing ¥48.73 billion.

Dividend Yield: 3.1%

MEGMILK SNOW BRAND Ltd. maintains a stable dividend history with consistent increases over the past decade, supported by a low payout ratio of 32.8%. However, the dividend yield of 3.05% is below Japan's top-tier payers and not covered by free cash flows, raising sustainability concerns. Recent downsizing at its Okoppe Plant resulted in an impairment loss of ¥2.1 billion and revised earnings guidance reflects challenges in sales volume despite price adjustments to manage costs.

- Dive into the specifics of MEGMILK SNOW BRANDLtd here with our thorough dividend report.

- According our valuation report, there's an indication that MEGMILK SNOW BRANDLtd's share price might be on the expensive side.

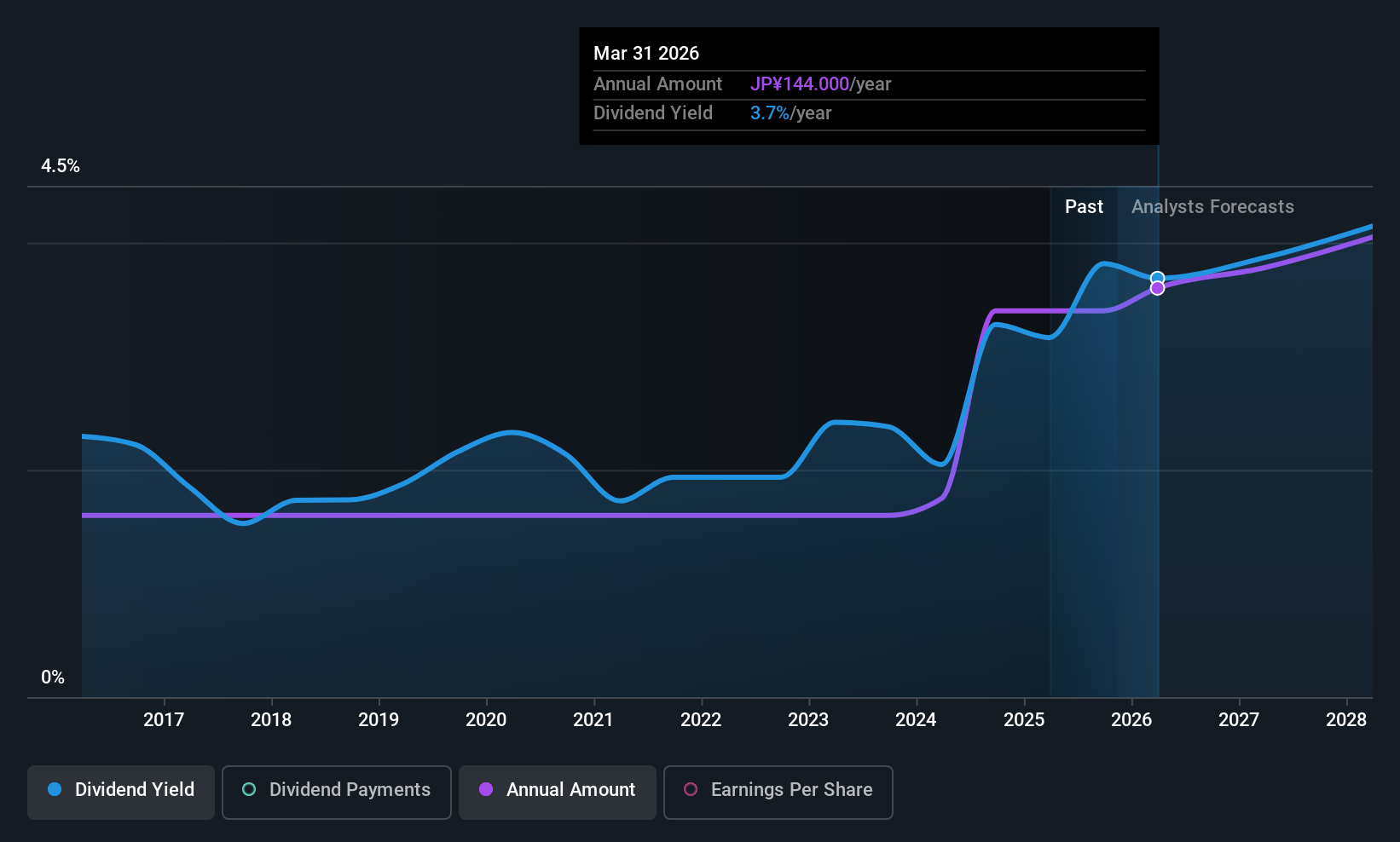

Tsumura (TSE:4540)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tsumura & Co. is involved in the production and sale of Kampo extract intermediates and granular Kampo formulations both in Japan and internationally, with a market cap of ¥302.77 billion.

Operations: Tsumura & Co.'s revenue primarily comes from its Pharmaceutical Products segment, totaling ¥181.92 billion.

Dividend Yield: 3.7%

Tsumura's dividend appeal is highlighted by a reliable and stable history, with recent increases reflecting improved earnings forecasts. Despite its dividends not being covered by free cash flows, the payout ratio remains low at 37.4%, suggesting earnings coverage. The company's competitive price-to-earnings ratio of 11x and a dividend yield of 3.73% place it among Japan's top-tier payers. Recent guidance revisions indicate positive growth prospects due to strategic acquisitions and cost management efforts.

- Get an in-depth perspective on Tsumura's performance by reading our dividend report here.

- According our valuation report, there's an indication that Tsumura's share price might be on the cheaper side.

Seize The Opportunity

- Click through to start exploring the rest of the 1036 Top Asian Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal