Asian Stocks Estimated To Be Trading Below Fair Value In December 2025

As global markets navigate a period of fluctuating interest rates and economic uncertainties, Asian stocks have drawn attention for their potential value amid these shifts. In this context, identifying undervalued stocks becomes crucial as investors seek opportunities that may offer resilience and growth in the evolving market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Jiemei Electronic And Technology (SZSE:002859) | CN¥30.52 | CN¥59.85 | 49% |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥154.80 | CN¥304.27 | 49.1% |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.93 | CN¥25.33 | 48.9% |

| Tianqi Lithium (SZSE:002466) | CN¥52.10 | CN¥102.06 | 49% |

| LOIVELtd (TSE:352A) | ¥811.00 | ¥1596.04 | 49.2% |

| JINS HOLDINGS (TSE:3046) | ¥5620.00 | ¥10986.85 | 48.8% |

| Global Security Experts (TSE:4417) | ¥2880.00 | ¥5744.07 | 49.9% |

| Daiichi Sankyo Company (TSE:4568) | ¥3341.00 | ¥6544.37 | 48.9% |

| Andes Technology (TWSE:6533) | NT$243.50 | NT$484.94 | 49.8% |

| ActRO (KOSDAQ:A290740) | ₩12550.00 | ₩25085.06 | 50% |

Let's explore several standout options from the results in the screener.

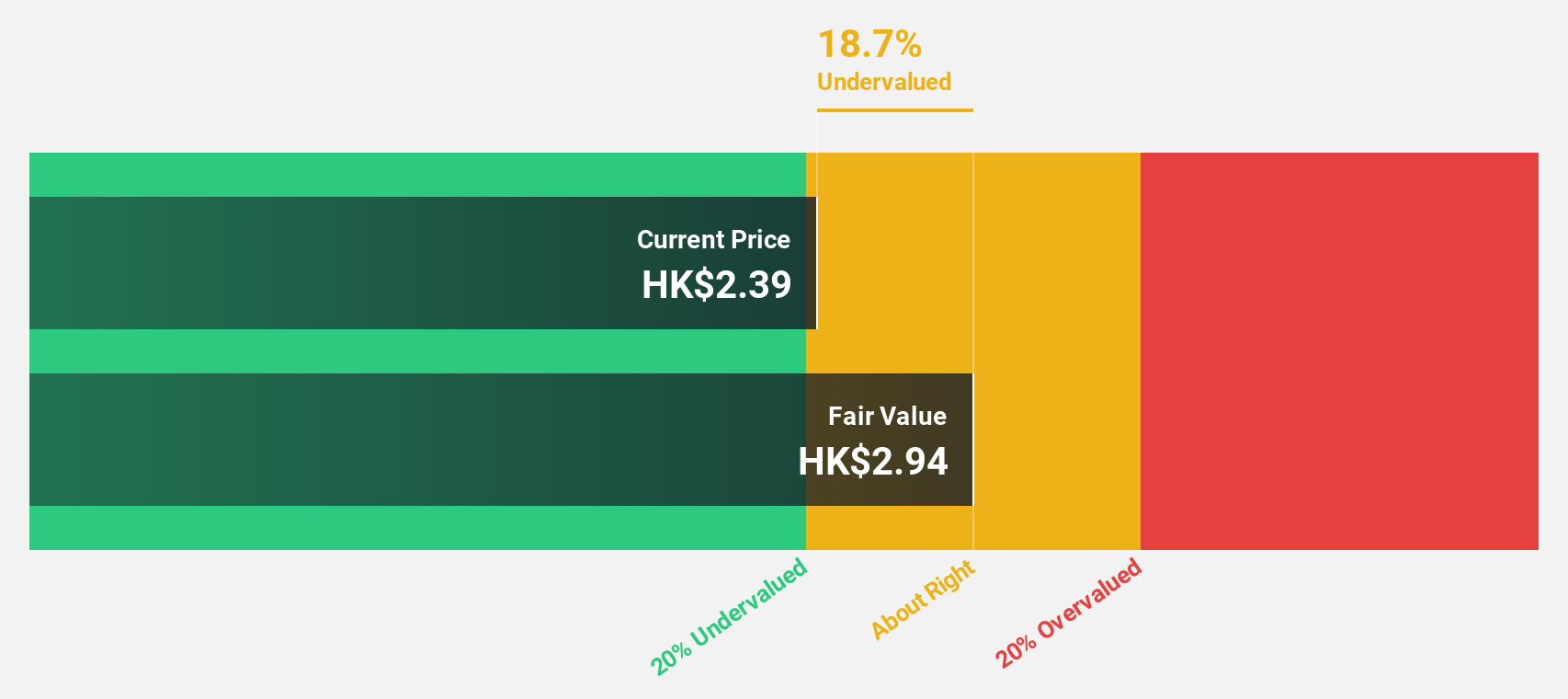

Metallurgical Corporation of China (SEHK:1618)

Overview: Metallurgical Corporation of China Ltd., along with its subsidiaries, operates in the engineering contracting sector in China and has a market capitalization of approximately HK$65.38 billion.

Operations: Metallurgical Corporation of China Ltd. generates its revenue primarily from its engineering contracting business in China.

Estimated Discount To Fair Value: 36.5%

Metallurgical Corporation of China appears undervalued based on cash flows, trading at 36.5% below its estimated fair value of HK$2.97. Despite a decline in contract values and net income, the company shows potential with forecasted earnings growth of over 30% annually, outpacing the Hong Kong market's average. However, challenges persist with low profit margins and volatile share prices impacting stability. Recent overseas contract gains highlight strategic expansion efforts amidst domestic setbacks.

- Upon reviewing our latest growth report, Metallurgical Corporation of China's projected financial performance appears quite optimistic.

- Take a closer look at Metallurgical Corporation of China's balance sheet health here in our report.

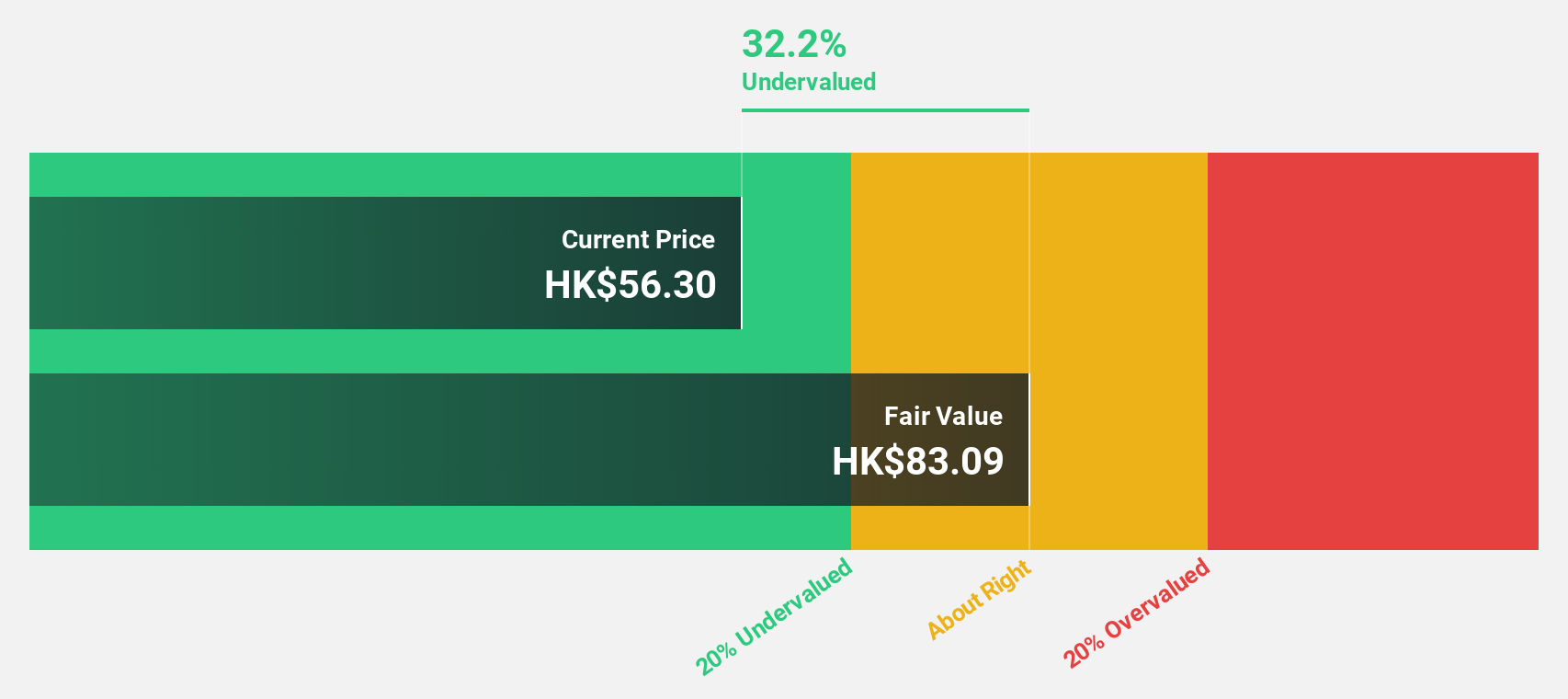

Beijing Fourth Paradigm Technology (SEHK:6682)

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in China, with a market capitalization of HK$21.90 billion.

Operations: The company's revenue segments comprise CN¥505.70 million from Sagegpt Aigs Services, CN¥4.57 billion from the 4ParadigmSage AI Platform, and CN¥940.30 million from Shift Intelligent Solutions.

Estimated Discount To Fair Value: 31.7%

Beijing Fourth Paradigm Technology is trading at HK$42.2, significantly below its estimated fair value of HK$61.8, indicating undervaluation based on cash flows. The company is expected to become profitable within three years and outpace the Hong Kong market with a 26.7% revenue growth forecast annually. Recent strategic collaboration with Solowin Holdings in RegTech aims to enhance its technological capabilities, potentially boosting future cash flow generation despite low forecasted return on equity of 7.3%.

- Our comprehensive growth report raises the possibility that Beijing Fourth Paradigm Technology is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Beijing Fourth Paradigm Technology.

DFI Retail Group Holdings (SGX:D01)

Overview: DFI Retail Group Holdings Limited operates as a retailer across several Asian markets, including Hong Kong, Mainland China, and Singapore, with a market cap of $5.50 billion.

Operations: The company's revenue segments consist of Food ($3.10 billion), Convenience ($2.34 billion), Home Furnishings ($680.30 million), and Health and Beauty ($2.54 billion).

Estimated Discount To Fair Value: 38.7%

DFI Retail Group Holdings is trading at US$4.06, well below its estimated fair value of US$6.63, highlighting its undervaluation based on cash flows. Despite a forecasted annual revenue decline of 0.7%, earnings are expected to grow significantly by 79.49% per year, surpassing market averages and becoming profitable within three years. However, the dividend yield of 2.59% isn't adequately covered by earnings, and recent leadership changes might influence strategic direction and performance stability.

- The analysis detailed in our DFI Retail Group Holdings growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of DFI Retail Group Holdings stock in this financial health report.

Next Steps

- Click through to start exploring the rest of the 273 Undervalued Asian Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal