Is AIG’s New International Leadership Team Quietly Rewriting Its Global Commercial Playbook (AIG)?

- American International Group, Inc. recently announced that Adam Clifford will become CEO of International Commercial Insurance in January 2026, while Scott Leney will take over as Regional President for Asia Pacific in February 2026, alongside governance-focused amendments to the company’s by-laws.

- These leadership appointments, both drawing on deep international insurance experience, suggest AIG is sharpening its focus on global commercial lines while tightening shareholder-meeting and nomination rules through its revised by-laws.

- Next, we’ll examine how Clifford’s appointment to lead International Commercial Insurance could reshape AIG’s investment narrative around global growth and execution.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

American International Group Investment Narrative Recap

To own AIG, you need to believe in a leaner, more focused global insurer that can turn disciplined underwriting and expense control into steady earnings, despite litigation, climate and competitive pressures. The Clifford and Leney appointments reinforce AIG’s commitment to international commercial lines, but do not materially change the near term balance between the key catalyst of operational execution and the ongoing risk of catastrophe and claims volatility.

Among the recent announcements, the refreshed by laws stand out alongside these leadership moves, because they reshape how shareholder meetings, director nominations and special meeting requests are handled. For investors watching AIG’s execution on global growth, these governance changes sit in the background, while underwriting discipline, international leadership depth and the cost and complexity of AIG’s technology transformation remain more central to the near term story.

Yet beneath AIG’s push on global commercial growth, investors should be aware of the mounting exposure to climate driven catastrophe risk...

Read the full narrative on American International Group (it's free!)

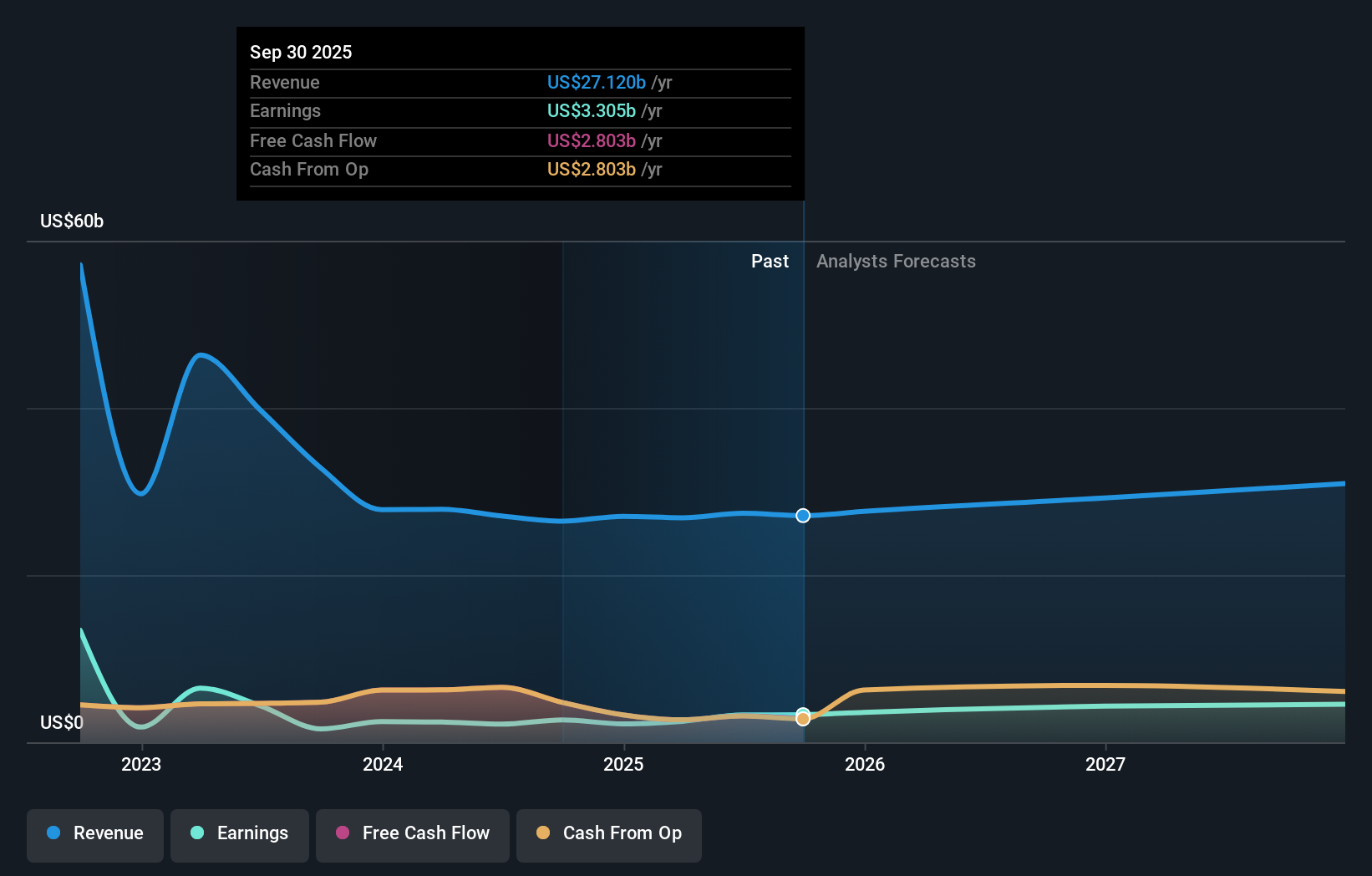

American International Group's narrative projects $31.3 billion revenue and $3.8 billion earnings by 2028. This requires 4.5% yearly revenue growth and a $0.5 billion earnings increase from $3.3 billion today.

Uncover how American International Group's forecasts yield a $88.28 fair value, in line with its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community currently place AIG’s fair value anywhere between about US$88 and an extreme outlier above US$100,000 per share. Against that backdrop of widely different views, AIG’s push to improve underwriting discipline and expense efficiency remains central to how its long term performance could unfold.

Explore 6 other fair value estimates on American International Group - why the stock might be worth just $88.28!

Build Your Own American International Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American International Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free American International Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American International Group's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal