Why Inspire Medical Systems (INSP) Is Down 15.6% After Medicare Fee Hike And New Lawsuits

- In recent days, Inspire Medical Systems has faced renewed attention as regulators finalized a substantial future increase in Medicare facility fees for its sleep apnea procedure, while multiple law firms advanced securities class actions tied to the rollout of its Inspire V device.

- This combination of richer long-term reimbursement and heightened legal and execution scrutiny creates a complex risk–reward backdrop for investors assessing Inspire’s path forward.

- Now we’ll explore how the planned Medicare facility fee increase for Inspire’s procedure could reshape the company’s investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Inspire Medical Systems Investment Narrative Recap

To own Inspire Medical Systems, you need to believe its implantable sleep apnea therapy remains clinically compelling and can grow despite execution hiccups and competition from GLP-1 drugs. The CMS decision to lift Medicare facility fees from 2026 looks supportive for the key near term catalyst of procedure volume recovery, while the biggest near term risk remains the messy Inspire V rollout and the mounting securities lawsuits that keep attention on management’s execution and disclosures.

Against this backdrop, the CMS rule that could raise Medicare facility fees for Inspire’s procedure by about 50% in 2026 stands out as especially relevant. It directly addresses prior reimbursement uncertainty and could help offset pressure from slower Inspire V adoption, although it does not resolve legal claims around billing software, inventory handling or the risk that GLP-1 driven weight loss alters the long term pool of eligible patients.

Yet investors also need to be aware that, alongside richer future Medicare economics, multiple securities class actions now allege that Inspire’s Inspire V launch...

Read the full narrative on Inspire Medical Systems (it's free!)

Inspire Medical Systems' narrative projects $1.3 billion revenue and $103.6 million earnings by 2028.

Uncover how Inspire Medical Systems' forecasts yield a $128.19 fair value, a 8% upside to its current price.

Exploring Other Perspectives

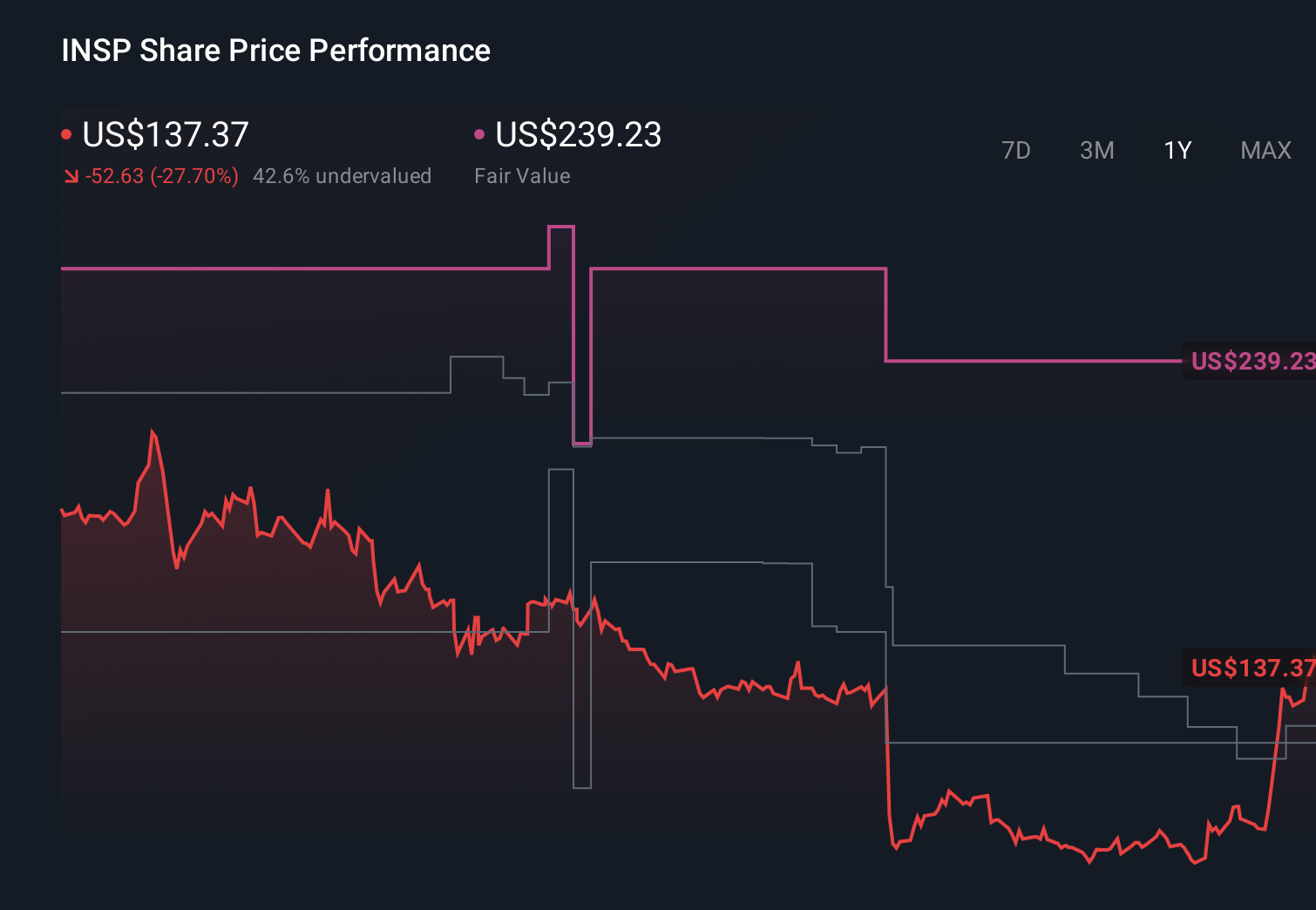

Nine Simply Wall St Community fair value estimates for Inspire span roughly US$41 to US$271, showing how far apart individual views can be. As you weigh those opinions, the key execution risk around the Inspire V rollout and related legal scrutiny could influence how confidently the business converts richer future Medicare reimbursement into sustained growth.

Explore 9 other fair value estimates on Inspire Medical Systems - why the stock might be worth over 2x more than the current price!

Build Your Own Inspire Medical Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inspire Medical Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Inspire Medical Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inspire Medical Systems' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal