Is Aon Still Attractively Priced After Its 76.1% Five Year Share Price Surge?

- Wondering if Aon at around $352 a share is still worth buying, or if the easy money has already been made? Let us unpack what the current price really implies about future value.

- Over the last week Aon is up about 3.5%, but it is almost flat over 1 year with just a 0.7% gain and a modest 0.6% rise over 30 days, leaving year to date returns slightly negative at -0.8% despite a strong 76.1% run over 5 years.

- Recently, the market has been reacting to Aon's ongoing strategic push in risk, health and reinsurance advisory, as it doubles down on data driven solutions for corporate clients. Investors are weighing how these moves, along with a more uncertain macro and insurance pricing environment, may shift Aon's long term growth and risk profile.

- On our framework Aon scores a 2/6 valuation check score. This suggests it looks undervalued on only a couple of metrics. We will walk through DCF, multiples and other methods next, then finish by looking at an even better way to judge whether the market is mispricing the business.

Aon scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Aon Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate above the minimum return shareholders require on their equity, then capitalizes those excess profits into an intrinsic value per share.

For Aon, the starting point is a Book Value of $36.89 per share and an estimated Stable EPS of $757.88 per share, based on the median return on equity from the past 5 years. With a Cost of Equity of $3.38 per share, the model estimates an Excess Return of $754.50 per share, which suggests that Aon is generating earnings far above what investors demand for the risk they are taking.

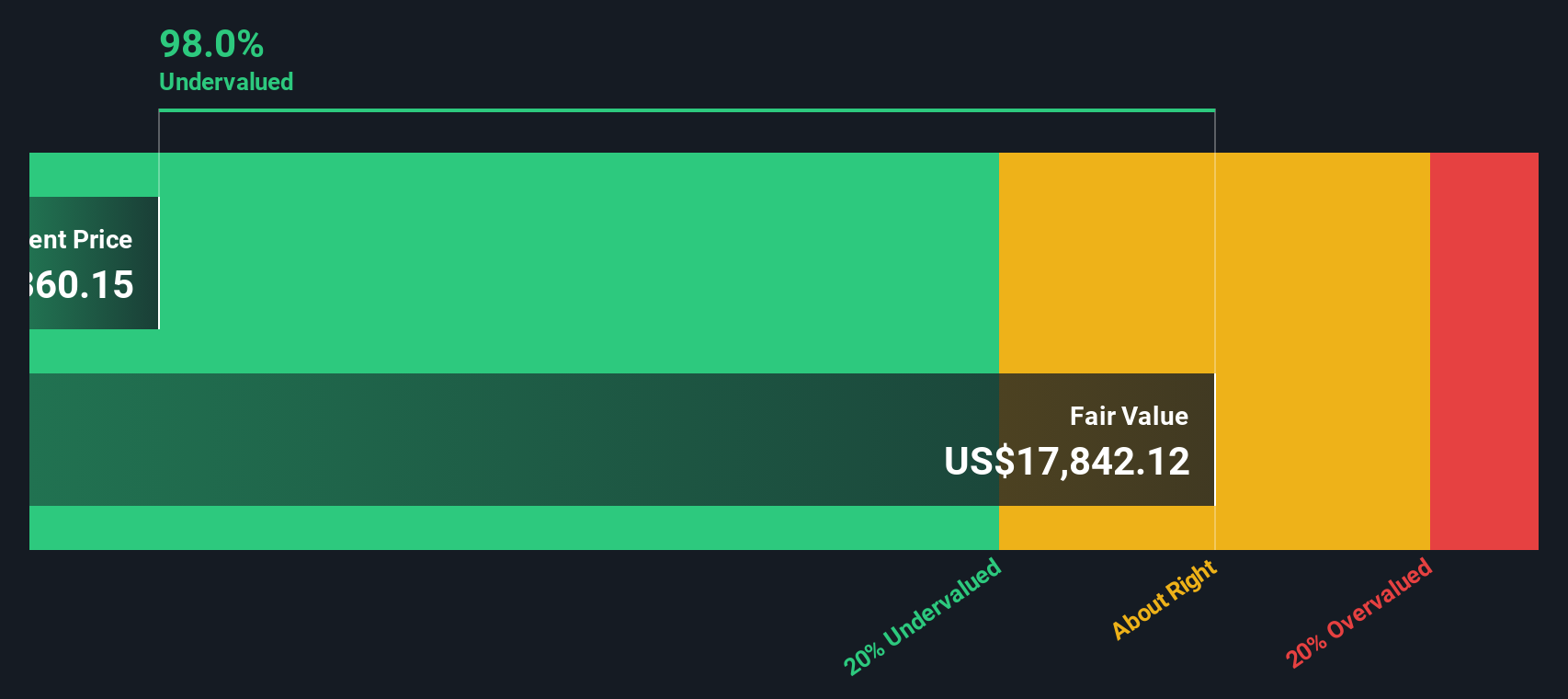

The Stable Book Value is projected to rise to $46.07 per share, using weighted future book value estimates from three analysts. Combining these inputs, the Excess Returns model implies an intrinsic value that is roughly 98.1% above the current share price, which points to a significant valuation gap.

On this basis, Aon screens as materially undervalued relative to the earnings power its balance sheet can support.

Result: UNDERVALUED

Our Excess Returns analysis suggests Aon is undervalued by 98.1%. Track this in your watchlist or portfolio, or discover 913 more undervalued stocks based on cash flows.

Approach 2: Aon Price vs Earnings

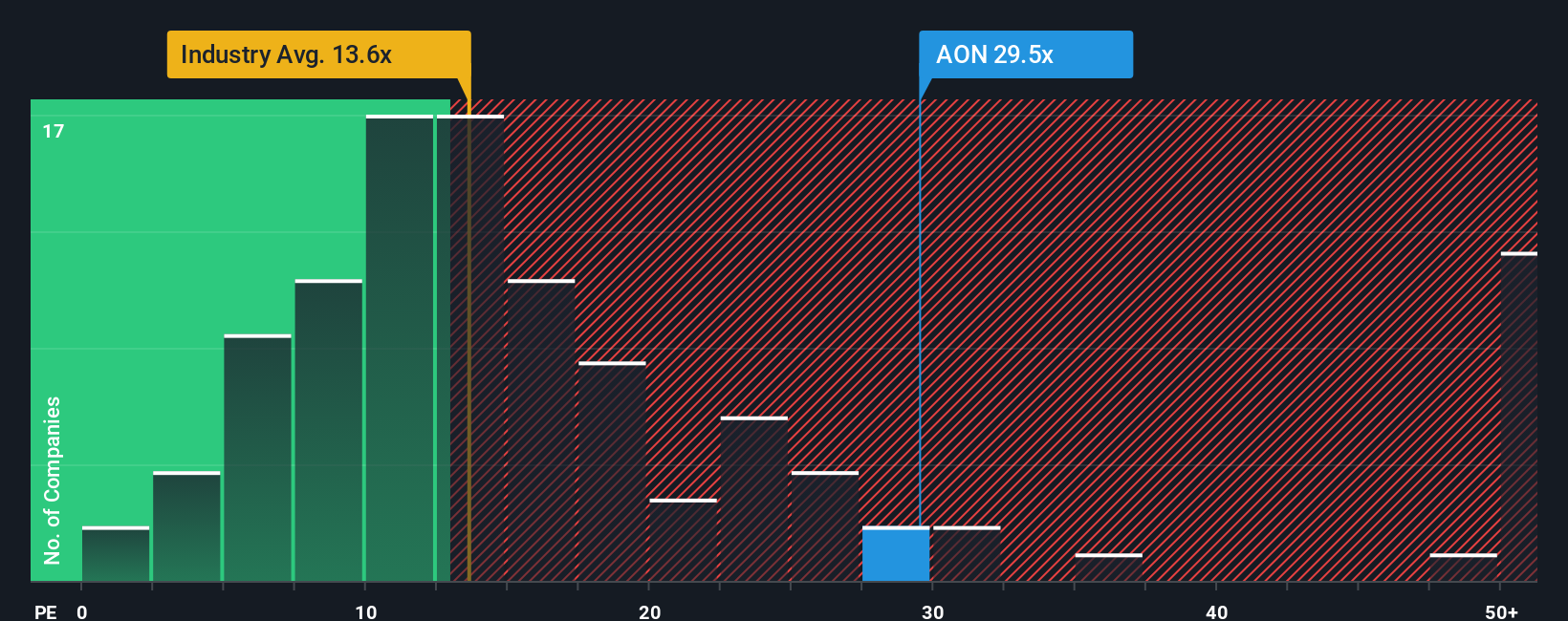

For a profitable, established business like Aon, the price to earnings (PE) ratio is a practical way to gauge valuation because it directly links what investors pay to the profits the company is generating today. In general, faster and more reliable earnings growth, combined with lower risk, justify a higher PE, while slower growth or higher uncertainty should come with a lower, more conservative multiple.

Aon currently trades on a PE of about 27.8x, which is well above both the Insurance industry average of roughly 13.4x and the peer group average of around 26.3x. To move beyond these broad comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what a reasonable PE should be after accounting for Aon’s specific earnings growth outlook, profitability, risk profile, industry and market cap. This tailored Fair Ratio for Aon is 15.7x, suggesting the current market multiple embeds richer expectations than our model supports. On this basis, even allowing for Aon’s quality and scale, the shares appear priced above what its fundamentals justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1454 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Aon Narrative

Earlier we mentioned that there is an even better way to understand valuation, and on Simply Wall St that is done through Narratives. These let you turn your view of Aon’s business, such as how fast its AI enabled risk solutions will grow, what margins it can sustain and what multiple it deserves, into a simple, shareable story that links those assumptions to a full financial forecast, a Fair Value estimate and a clear buy or sell signal based on the gap between Fair Value and today’s Price. Everything is hosted on the Community page where millions of investors compare perspectives, see dynamically updated values as fresh news or earnings arrive, and weigh, for example, a more bullish Narrative that leans toward the upper end of current targets around $451 against a more cautious one anchored closer to $349 that stresses macro and sector risks.

Do you think there's more to the story for Aon? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal