Is Merck KGaA Offering an Opportunity After Recent Share Price Rebound?

- If you are wondering whether Merck KGaA is quietly becoming a bargain or just a classic value trap, you are in the right place to unpack what the market might be missing.

- Despite being down 15.3% year to date and 12.6% over the last year, the stock has bounced about 6.4% in the past month while barely moving over the last week, which suggests sentiment could be starting to shift.

- That recent move comes as investors refocus on Merck KGaA's diversified exposure to life science tools, healthcare and high performance materials. These are areas the market often rotates back into when it starts caring more about quality and defensiveness. At the same time, regulatory tailwinds for innovative therapies and steady demand for lab consumables are keeping the long term growth story on the radar for institutional buyers.

- On our checks, Merck KGaA currently scores a 6/6 valuation score, meaning it screens as undervalued across every one of the six metrics we test. Next we will break down what that actually means in practice before finishing with an even more powerful way to think about valuation.

Find out why Merck KGaA's -12.6% return over the last year is lagging behind its peers.

Approach 1: Merck KGaA Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in € terms.

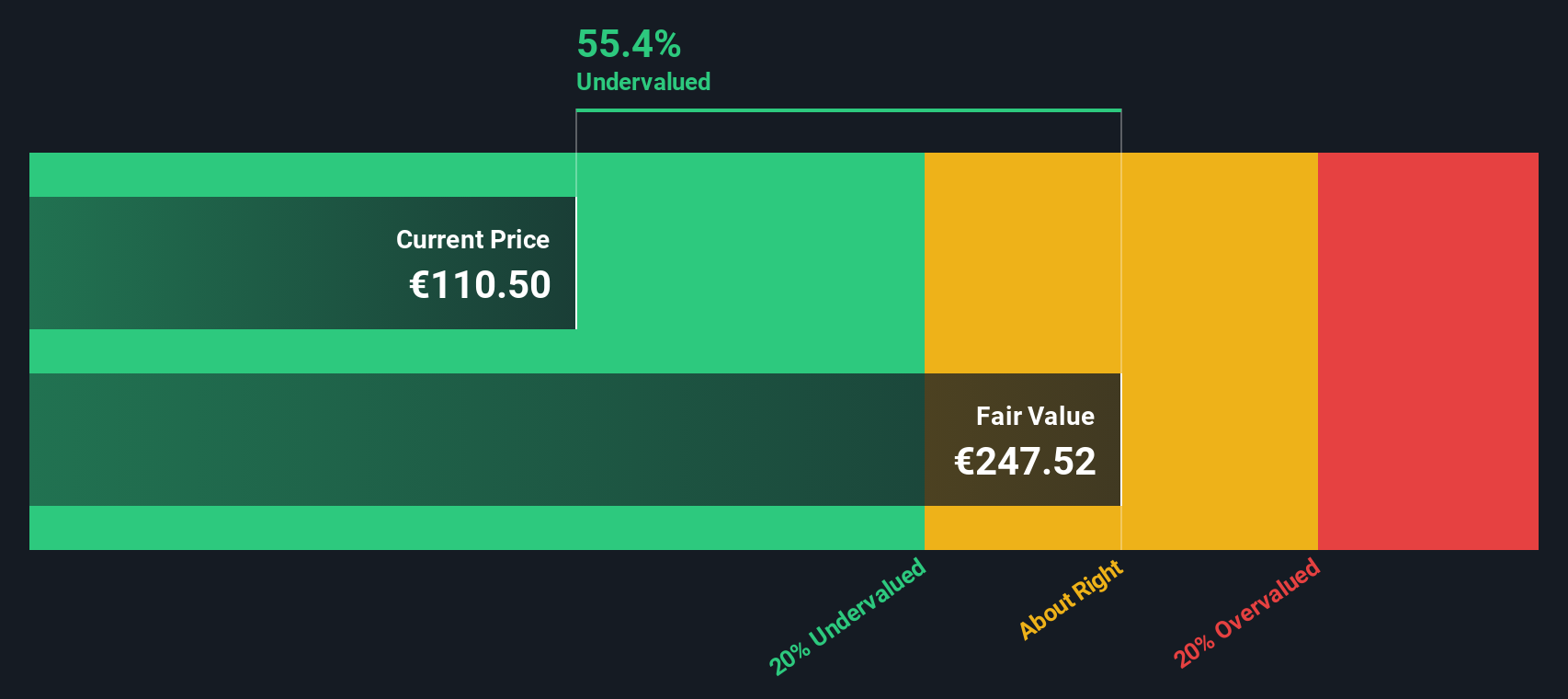

For Merck KGaA, the model starts with last twelve months free cash flow of about €1.9 billion and uses a 2 stage Free Cash Flow to Equity approach. Analyst estimates drive the next few years, with free cash flow expected to rise to roughly €4.0 billion by 2029. Beyond that, Simply Wall St extrapolates a gradual slowdown in growth, with projected free cash flow reaching around €5.2 billion by 2035 as the business matures.

When all these future cash flows are discounted back to today, the estimate of intrinsic value is roughly €294 per share. Compared with the current share price, this suggests the stock is about 59.6% undervalued on a cash flow basis, according to this model.

Result: UNDERVALUED (model-based estimate)

Our Discounted Cash Flow (DCF) analysis suggests Merck KGaA is undervalued by 59.6%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

Approach 2: Merck KGaA Price vs Earnings

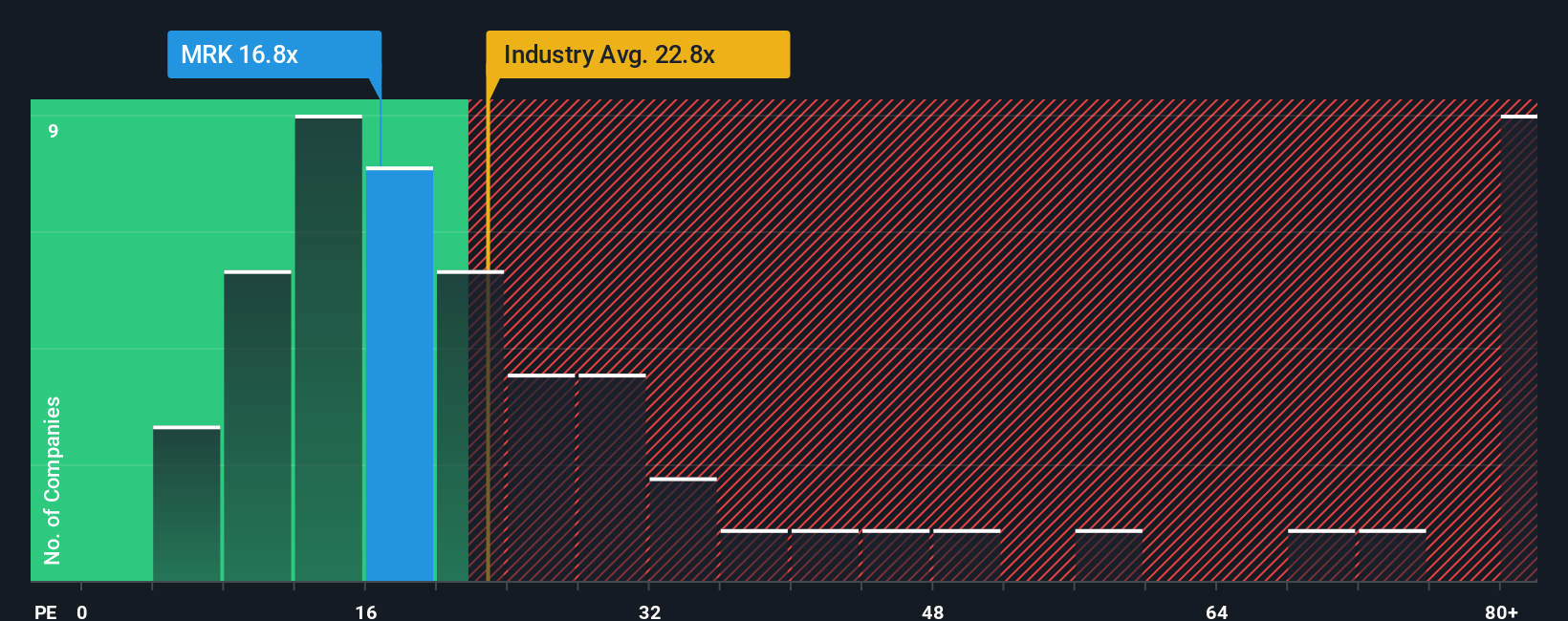

For established, profitable companies like Merck KGaA, the price to earnings (PE) ratio is a practical way to gauge whether investors are paying a reasonable price for each euro of current profits. In general, faster and more reliable earnings growth, coupled with lower perceived risk, justifies a higher PE, while slower growth or higher uncertainty should translate into a lower, more conservative multiple.

Merck KGaA currently trades on a PE of about 17.5x, which sits below the Pharmaceuticals industry average of roughly 22.3x and far beneath the peer group average of about 76.0x. This suggests the stock screens as relatively inexpensive on simple comparisons. However, Simply Wall St also calculates a proprietary Fair Ratio of 25.9x, which is the PE level that would typically be expected given Merck KGaA's earnings growth profile, profit margins, risk factors, industry context and market capitalization. Because this Fair Ratio is tailored to the company, it is a more nuanced yardstick than broad industry or peer averages.

Set against that Fair Ratio of 25.9x, Merck KGaA's current 17.5x multiple points to the shares trading at a meaningful discount rather than being fully priced.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1454 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Merck KGaA Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, an easy tool on Simply Wall St's Community page that lets you turn your view of Merck KGaA into a simple story linked to a financial forecast. You set assumptions for future revenue, earnings and margins. The platform converts that story into a Fair Value, continually updates it when new news or earnings arrive, and shows how that Fair Value compares to today’s price. One investor might build a bullish Merck KGaA Narrative around AI enabled drug discovery, margin expansion and a Fair Value near €191 per share. Another could create a more cautious Narrative focused on patent risks, slower growth and a Fair Value closer to €100, both grounded in numbers but guided by their own perspectives.

Do you think there's more to the story for Merck KGaA? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal