Is It Too Late to Consider ResMed After Weight Loss Drug Concerns and DCF Outlook?

- Wondering if ResMed at around $245 a share is still good value or if the easy money has already been made? Let us unpack what the current price actually implies about the company.

- Over the last year ResMed has delivered a 7.8% return, with the stock up 7.6% year to date but only 0.5% over the past month and down 2.2% in the last week. This pattern suggests investors are still calibrating their view of its long term growth and risks.

- Recent headlines have focused on ResMed’s role in the fast evolving sleep apnea and respiratory care market, including continued adoption of cloud connected devices and software solutions that deepen its moat against rivals. At the same time, renewed attention on weight loss drugs as a potential long term headwind for sleep apnea volumes has kept debate alive about what the business is really worth.

- On our framework ResMed scores a 4/6 valuation score, meaning it screens as undervalued on most but not all of our checks. This makes it a useful case study to compare different valuation approaches and, later on, explore a more complete way to think about what this business might truly be worth.

Approach 1: ResMed Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to the present.

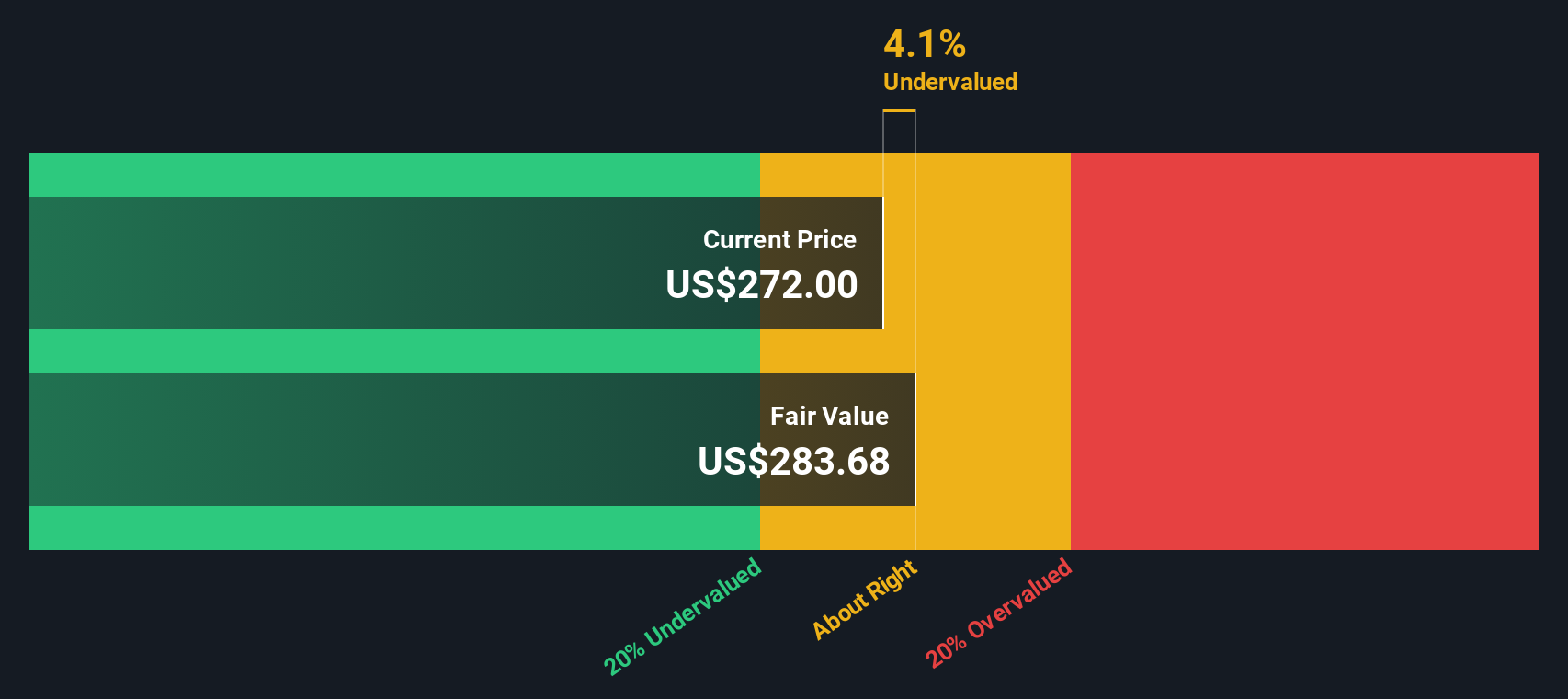

For ResMed, the model uses a 2 stage Free Cash Flow to Equity approach. The company generated trailing twelve month free cash flow of about $1.75 billion, and analysts expect this to grow steadily, with projected free cash flow of roughly $2.25 billion by 2035. The first few years of forecasts come from analyst estimates, while the later years are extrapolated using more modest growth assumptions to avoid overestimating the long term opportunity.

When all of these future cash flows are discounted back, the intrinsic value comes out at about $259 per share. Compared with the current share price around $245, the DCF suggests the stock is trading at roughly a 5.0% discount to its estimated fair value, indicating it is slightly undervalued but not a deep discount.

Result: ABOUT RIGHT

ResMed is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

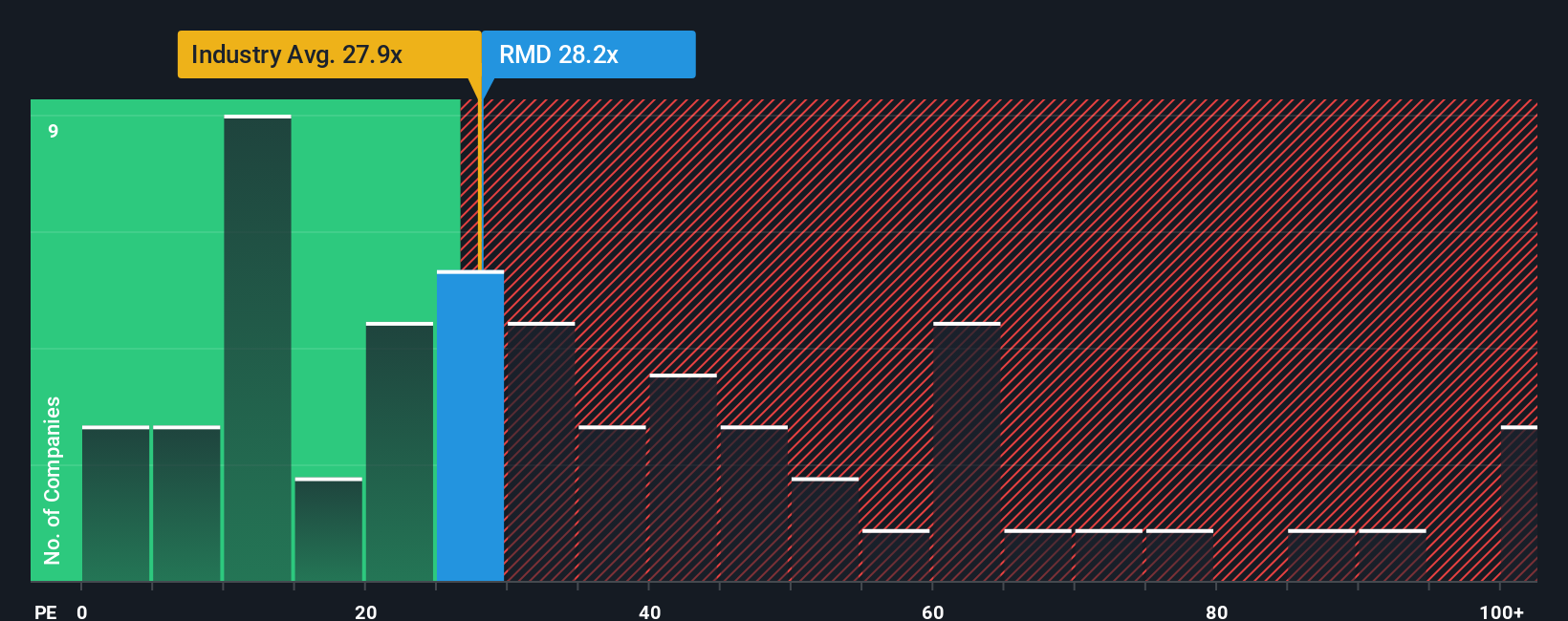

Approach 2: ResMed Price vs Earnings

For profitable businesses like ResMed, the price to earnings, or PE, ratio is a useful way to gauge what investors are willing to pay for each dollar of current profits. A higher PE typically reflects expectations of stronger future growth or lower perceived risk, while a lower PE can signal either slower growth ahead or greater uncertainty.

ResMed currently trades on a PE of about 24.9x. That is below both the Medical Equipment industry average of roughly 30.0x and the peer group average of about 31.3x, suggesting the market is assigning the stock a discount relative to many similar companies. However, simple comparisons like this can miss important nuances in profitability, growth outlook and risk.

To address that, Simply Wall St calculates a Fair Ratio, the PE that would be justified given ResMed’s specific earnings growth profile, margins, industry, market cap and risk factors. For ResMed, that Fair Ratio is around 27.4x, which sits above the current 24.9x. This suggests the shares are trading below the level implied by its fundamentals, even after accounting for sector and company specific risks.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ResMed Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework where you connect your view of a company’s story to specific assumptions about its future revenue, earnings and margins, and then translate that into a fair value you can compare with today’s price.

On Simply Wall St’s Community page, Narratives let you write down why you think ResMed will win or struggle, link that story to a forecast, and instantly see the fair value that falls out of those assumptions. This can make it easier to decide whether to buy, hold or sell based on the gap between Fair Value and the current Price.

Narratives on the platform are updated dynamically as new information such as earnings, news or guidance arrives. Your fair value is not a static spreadsheet but a living view of the business. For example, a bullish investor who believes ResMed deserves something closer to $325 and a more cautious investor who only sees value around $215 can both track how fresh data either supports or challenges their story over time.

Do you think there's more to the story for ResMed? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal