Is Marathon Petroleum Still Attractively Priced After Its Big Buyback Push and Strong Run?

- If you are wondering whether Marathon Petroleum still offers good value after its big run, or if you might be turning up late to the party, this breakdown will help you decide whether the current price makes sense.

- Even after a recent pullback, with the share price down 8.8% over the last week and 11.0% over the past month, Marathon is still up 23.3% year to date and 381.5% over five years, which highlights how strong the longer term story has been.

- Recent headlines have focused on Marathon ramping up buybacks and capital returns to shareholders, alongside ongoing investments in refining and midstream infrastructure. This helps explain why the stock has remained a market favorite despite short term volatility. At the same time, shifting expectations for fuel demand and energy policy have been nudging sentiment around refiners as a group, adding some extra noise to those near term price swings.

- On our numbers, Marathon Petroleum scores a 4/6 valuation check, suggesting it looks undervalued on several key metrics. Next, we will walk through those methods in detail and also outline a more holistic way to judge value by the end of the article.

Approach 1: Marathon Petroleum Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and discounting them back into today’s dollars. For Marathon Petroleum, we start with last twelve months free cash flow of about $5.1 billion and then project how this could evolve over time.

Analysts expect free cash flow to remain robust, with forecasts such as roughly $6.8 billion in 2026 and $6.9 billion in 2028. Beyond those years, Simply Wall St extrapolates the trajectory, with modeled free cash flow rising to around $8.3 billion by 2035 as the business steadily expands.

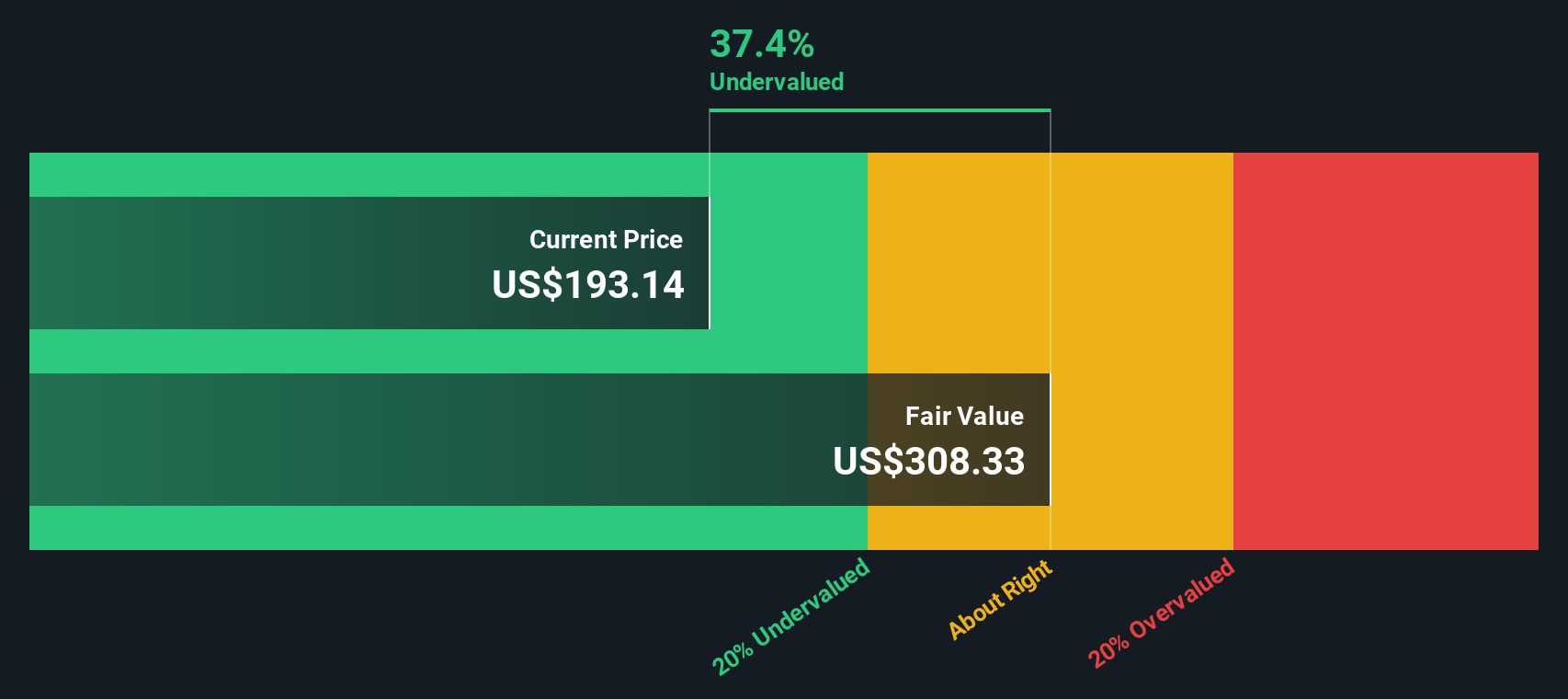

When all of these projected cash flows are discounted back using a 2 Stage Free Cash Flow to Equity approach, the estimated intrinsic value comes out at roughly $523 per share. Compared with the current market price, this suggests the stock is about 66.6% undervalued based on this DCF view.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Marathon Petroleum is undervalued by 66.6%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Marathon Petroleum Price vs Earnings

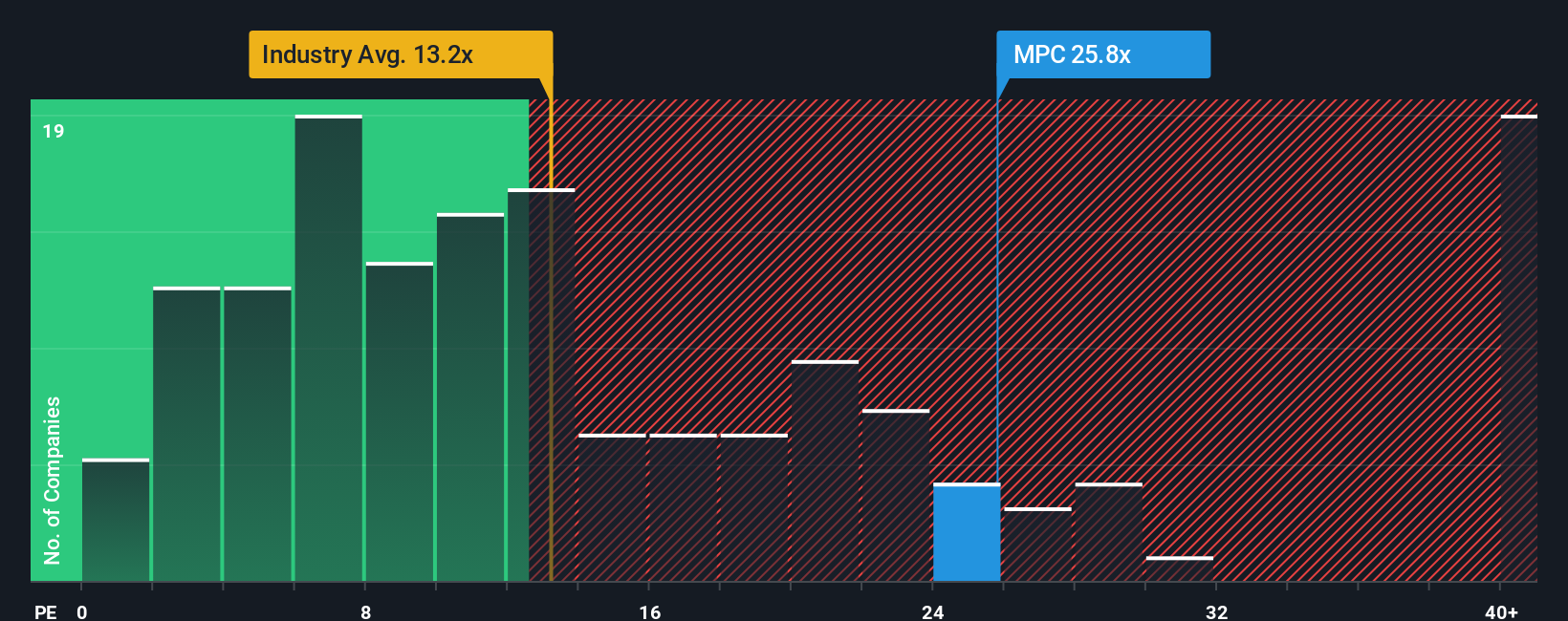

For profitable companies like Marathon Petroleum, the price to earnings (PE) ratio is a straightforward way to gauge how much investors are willing to pay for each dollar of current earnings. In general, faster expected growth and lower perceived risk justify a higher PE, while slower growth or higher risk usually means a lower, more conservative multiple.

Marathon currently trades on a PE of about 18.2x. That sits above the broader Oil and Gas industry average of roughly 13.1x, but below the peer group average of around 29.0x. This suggests the market views Marathon as higher quality than a typical refiner, but not as richly valued as the most popular names in the space.

Simply Wall St’s Fair Ratio for Marathon is 21.1x, a proprietary estimate of what a reasonable PE should be once you factor in the company’s earnings growth outlook, margins, risk profile, industry positioning and market cap. This is more informative than a simple peer or industry comparison because it adjusts for Marathon’s specific fundamentals rather than assuming all refiners deserve the same multiple. With the shares at 18.2x compared to a Fair Ratio of 21.1x, the stock screens as modestly undervalued on this lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Marathon Petroleum Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to link your view of Marathon Petroleum’s story to a concrete financial forecast and fair value by writing down what you believe will happen to its revenue, earnings and margins, then seeing how that translates into a Fair Value you can compare to today’s Price to inform your own decision. Narratives on Simply Wall St, available to millions of investors on the Community page, are dynamic, meaning they automatically update when new information like earnings releases, news or guidance changes come in, so your story and valuation stay in sync with reality. For Marathon, one investor might lean into the tight refining market, margin expansion and aggressive buybacks to justify a fair value above $200 per share, while another might focus on long term fossil fuel demand risk and policy pressure to anchor a much lower fair value closer to $140, and Narratives make those differing perspectives and their valuation impact completely transparent.

Do you think there's more to the story for Marathon Petroleum? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal