Netflix (NFLX) Valuation Check After a 16.9% One-Month Share Price Pullback

Netflix (NFLX) has quietly slipped over the past month, even as its underlying business continues to generate solid growth in revenue and earnings. That disconnect is where the investment story gets interesting.

See our latest analysis for Netflix.

Over the past year Netflix’s share price has swung from strong gains to a sharp 1 month pullback of 16.9%, even as its 3 year total shareholder return of 218.4% shows that long term momentum remains very much intact.

If Netflix’s shift into games and global content has you rethinking the streaming landscape, it might be a good time to explore other high growth tech and AI stocks that could be shaping the next wave of digital entertainment.

With shares still up over the longer term yet trading well below analyst targets, investors now face a key question: is Netflix’s recent dip a sign it is undervalued, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 29.5% Undervalued

With Netflix’s fair value estimate sitting well above the last close of $94.79, the leading narrative sees the recent pullback as an opportunity rather than a warning.

Netflix's continued operational efficiency improvements, such as AI-powered production tools that accelerate VFX workflows and reduce content creation costs, provide a pathway to structurally higher long-term operating margins and faster EPS growth even as content and competitive pressures mount.

Curious how rising margins, accelerating earnings, and a premium future multiple can still point to upside from here? The full narrative explains the specific growth runway, profitability shift, and valuation bridge behind that bullish fair value view.

Result: Fair Value of $134.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition and potential regulatory hurdles could limit Netflix’s pricing power and margin expansion, challenging the long term undervaluation case.

Find out about the key risks to this Netflix narrative.

Another Take On Value

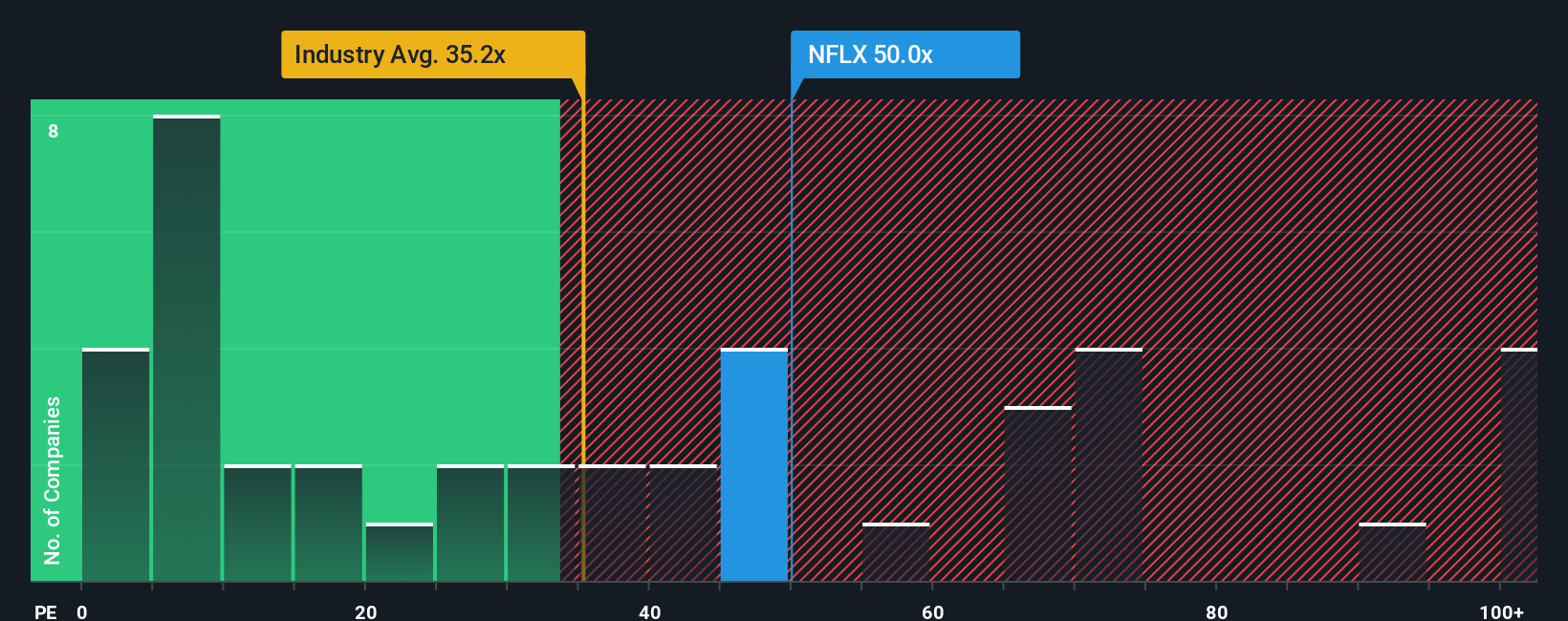

While the narrative leans on future earnings power, today’s price tells a tougher story. Netflix trades at 41.5 times earnings versus 19.5 times for the US Entertainment industry and a fair ratio of 33.2, suggesting investors are paying up and shrinking the margin of safety. Is that premium really secure?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Netflix Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom Netflix thesis in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Netflix.

Ready for more investment ideas?

Before Netflix’s story moves on without you, put Simply Wall Street’s Screener to work and uncover fresh opportunities that could reshape your portfolio’s next decade.

- Supercharge your growth hunt by reviewing these 25 AI penny stocks that are capturing value from the rapid shift toward automation and intelligent software.

- Lock in potential value by targeting these 908 undervalued stocks based on cash flows where market pessimism may have overshot the fundamentals, leaving upside on the table.

- Strengthen your income stream with these 13 dividend stocks with yields > 3% that can complement capital gains with cash returns over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal