Is Thermo Fisher Still Attractively Priced After Its 2025 Share Price Gains?

- Wondering if Thermo Fisher Scientific is still worth buying at these levels, or if the market has already priced in the upside? This breakdown will help you see where the real value might be hiding.

- The stock is up 7.7% year to date and 9.3% over the last year, even after a recent pullback of around 2.8% over the past week and 2.3% over the last month. This suggests sentiment is positive but not euphoric.

- Recently, investors have been reacting to Thermo Fisher's ongoing role in high growth areas like bioprocessing, diagnostics, and advanced lab tools, where demand is supported by long term healthcare and research trends. Strategic investments and acquisitions in these segments have reinforced the narrative that this is a core picks and shovels player for life sciences, even as short term macro worries occasionally spark volatility.

- On our framework, Thermo Fisher scores a 3 out of 6 on undervaluation checks, which points to a stock that is neither a screaming bargain nor wildly overpriced, at least on the surface. Next, we will unpack how different valuation approaches see Thermo Fisher, and why there might be an even smarter way to think about its true worth by the end of this article.

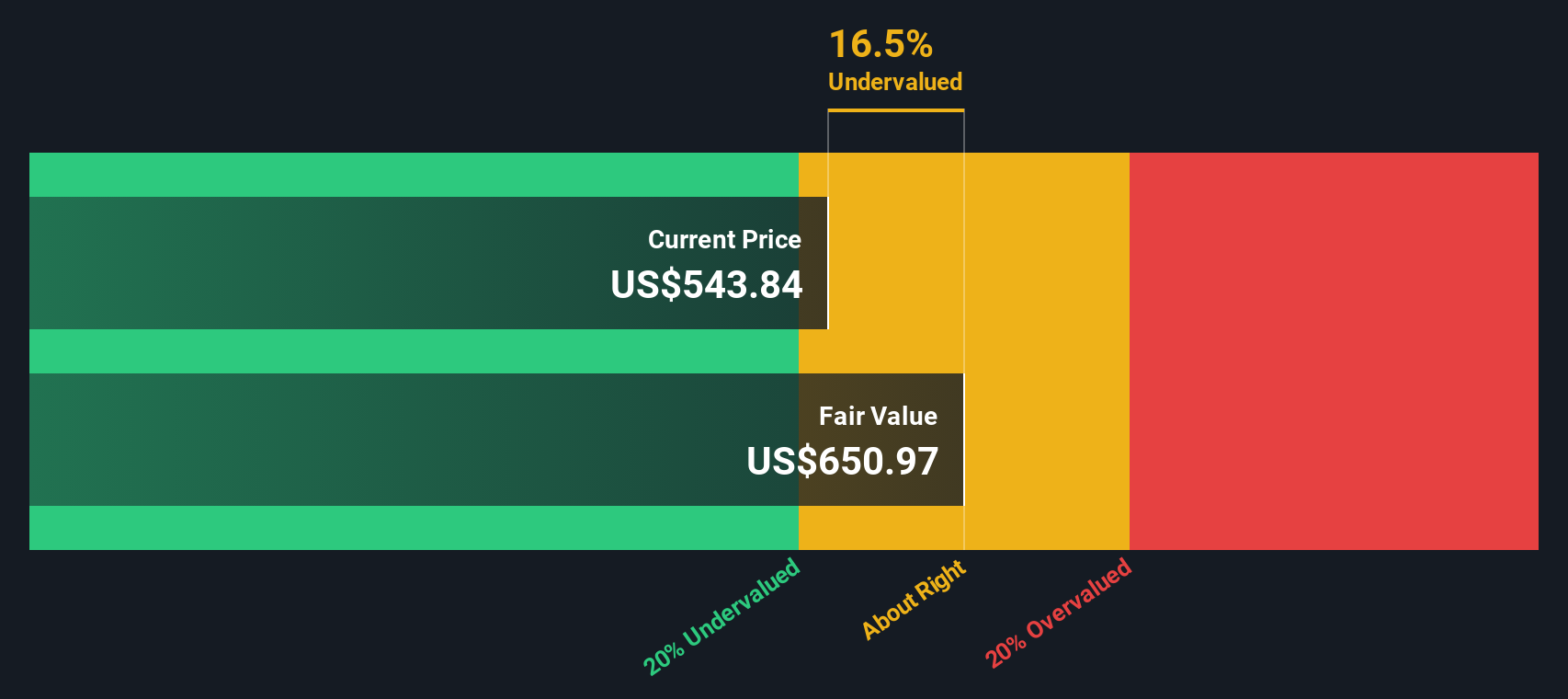

Approach 1: Thermo Fisher Scientific Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today. For Thermo Fisher Scientific, the model uses a 2 stage Free Cash Flow to Equity approach, based on $6.1 Billion of last twelve months free cash flow and analyst driven projections that extend into the next decade.

Analysts and extrapolations point to free cash flow rising to roughly $15.3 Billion by 2035, with intermediate forecasts such as about $8.6 Billion in 2026 and $11.3 Billion in 2029, all in $. Simply Wall St discounts each of these future figures back to today using its required return assumptions to arrive at an estimated intrinsic value of roughly $606.65 per share.

Compared with the current market price, this implies Thermo Fisher is trading at around a 7.3% discount to its DCF based fair value, suggesting the shares are modestly undervalued rather than a deep bargain.

Result: ABOUT RIGHT

Thermo Fisher Scientific is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

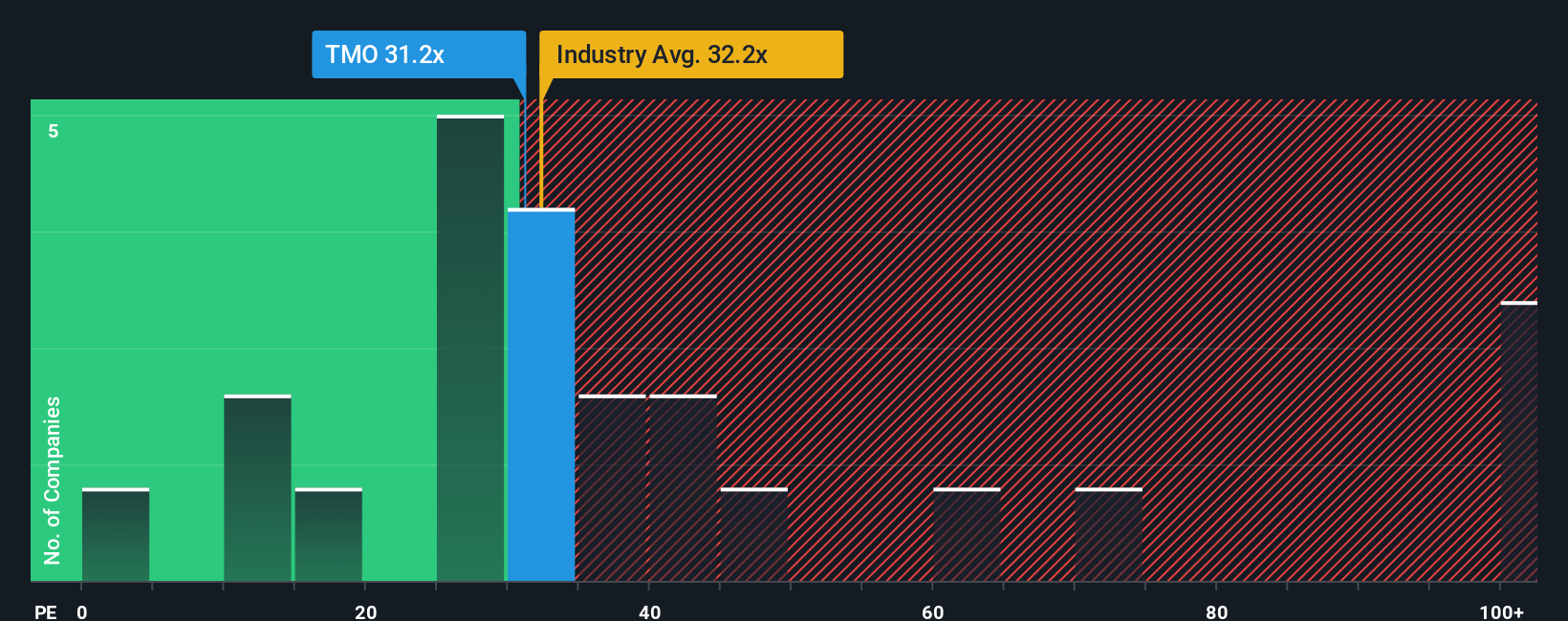

Approach 2: Thermo Fisher Scientific Price vs Earnings

For a profitable, established business like Thermo Fisher Scientific, the Price to Earnings (PE) ratio is a natural way to gauge valuation because it directly compares what investors pay with what the company actually earns. In general, faster earnings growth and lower perceived risk justify a higher PE, while slower growth or more uncertainty should translate into a lower, more conservative multiple.

Thermo Fisher currently trades on a PE of 32.2x, which sits slightly below both the Life Sciences industry average of about 35.2x and the peer average of roughly 34.5x. Simply Wall St also calculates a proprietary Fair Ratio of 30.8x, an estimate of what Thermo Fisher’s PE should be once you factor in its earnings growth profile, margins, risk characteristics, industry positioning, and market cap. This Fair Ratio is more tailored than a simple peer or industry comparison because it adjusts for the company’s specific strengths and risks rather than assuming all Life Sciences stocks deserve the same multiple.

With the actual PE of 32.2x only modestly above the 30.8x Fair Ratio, the shares look reasonably valued on earnings.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Thermo Fisher Scientific Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, a simple, story driven framework on Simply Wall St’s Community page. With Narratives, you combine your view of a company’s future, your assumptions for revenue, earnings and margins, and your fair value estimate into a single, living storyline. This links what Thermo Fisher Scientific does today to a financial forecast and then to a buy or sell decision based on how that Fair Value compares with the current Price. It updates automatically when new news or earnings arrive, so that two investors can reasonably disagree, with one Narrative leaning cautious at around $540 per share and another more optimistic at roughly $626 per share, yet both using the same intuitive tool to decide whether Thermo Fisher is attractively priced or fully valued at any given moment.

For Thermo Fisher Scientific, however, we will make it really easy for you with previews of two leading Thermo Fisher Scientific Narratives:

🐂 Thermo Fisher Scientific Bull Case

Fair value: $626 per share

Implied undervaluation: 10.1% below this fair value

Forecast revenue growth: 5.22% per year

- Sees Thermo Fisher as a life science tools leader with expansion in pharma manufacturing, advanced analytical instruments, and end to end customer solutions driving recurring growth.

- Assumes margin expansion from disciplined cost control, AI driven efficiency, and strategic M&A, supporting earnings growth and a premium but reasonable PE multiple by 2028.

- Flags risks from funding uncertainty, China headwinds, and leadership transition, but still supports a fair value meaningfully above the current share price.

🐻 Thermo Fisher Scientific Bear Case

Fair value: $540 per share

Implied overvaluation: 4.2% above this fair value

Forecast revenue growth: 7.0% per year

- Recognizes strong structural demand in life sciences, diagnostics, and contract services, supported by AI adoption, emerging markets, and a history of effective acquisitions.

- Views Thermo Fisher as broadly fairly valued with only moderate upside, assuming mid to high single digit revenue growth, margin improvement toward the high teens, and a future PE around the high 20s.

- Highlights key reasons to be cautious, including potential slowdowns in R&D spending, regulatory and M&A execution risks, and sensitivity to biotech funding cycles that could pressure growth and valuation.

Whether you lean toward the more optimistic or more cautious storyline, these two Narratives show how different but reasonable assumptions on growth, margins, and risk can lead to distinct fair value estimates and, ultimately, different decisions on Thermo Fisher Scientific at today’s price.

Do you think there's more to the story for Thermo Fisher Scientific? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal