Seagate (STX) Valuation Check as Nasdaq-100 Inclusion, AI Storage Demand and Dividend Hike Lift Expectations

Seagate Technology Holdings (STX) just clinched a spot in the Nasdaq 100, a shift that could pull in fresh index fund money while spotlighting its AI driven storage story and recently improved dividend.

See our latest analysis for Seagate Technology Holdings.

That Nasdaq 100 promotion caps an explosive run, with a year to date share price return above 220% and a three year total shareholder return above 500%, even after a sharp recent pullback as traders lock in AI driven gains.

If Seagate’s surge has you thinking about what else could benefit from AI and data growth, now is a good time to explore high growth tech and AI stocks.

With shares up more than 220% this year but still trading at a discount to some analyst and intrinsic estimates, is Seagate a rare AI hardware play still mispriced, or is the market already discounting years of future growth?

Most Popular Narrative: 4% Undervalued

With Seagate last closing at $277.65 against a narrative fair value near $289, the market is pricing in strength but not the full upside story yet.

The growing demand for mass capacity storage driven by the cloud CapEx investment cycle and data center build outs for AI transformation is likely to elevate Seagate's revenue streams. This increased demand aligns with ongoing cloud infrastructure expansion, suggesting positive impacts on earnings.

Curious how a storage veteran earns a premium valuation in an AI world? The narrative leans on faster growth, fatter margins, and a richer future earnings multiple. Want to see exactly how those assumptions combine to unlock that higher fair value?

Result: Fair Value of $289.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, trade policy shocks or a sharper than expected slowdown in AI infrastructure spending could quickly challenge today’s tight supply, pricing power, and valuation narrative.

Find out about the key risks to this Seagate Technology Holdings narrative.

Another View: Rich On Earnings Multiples

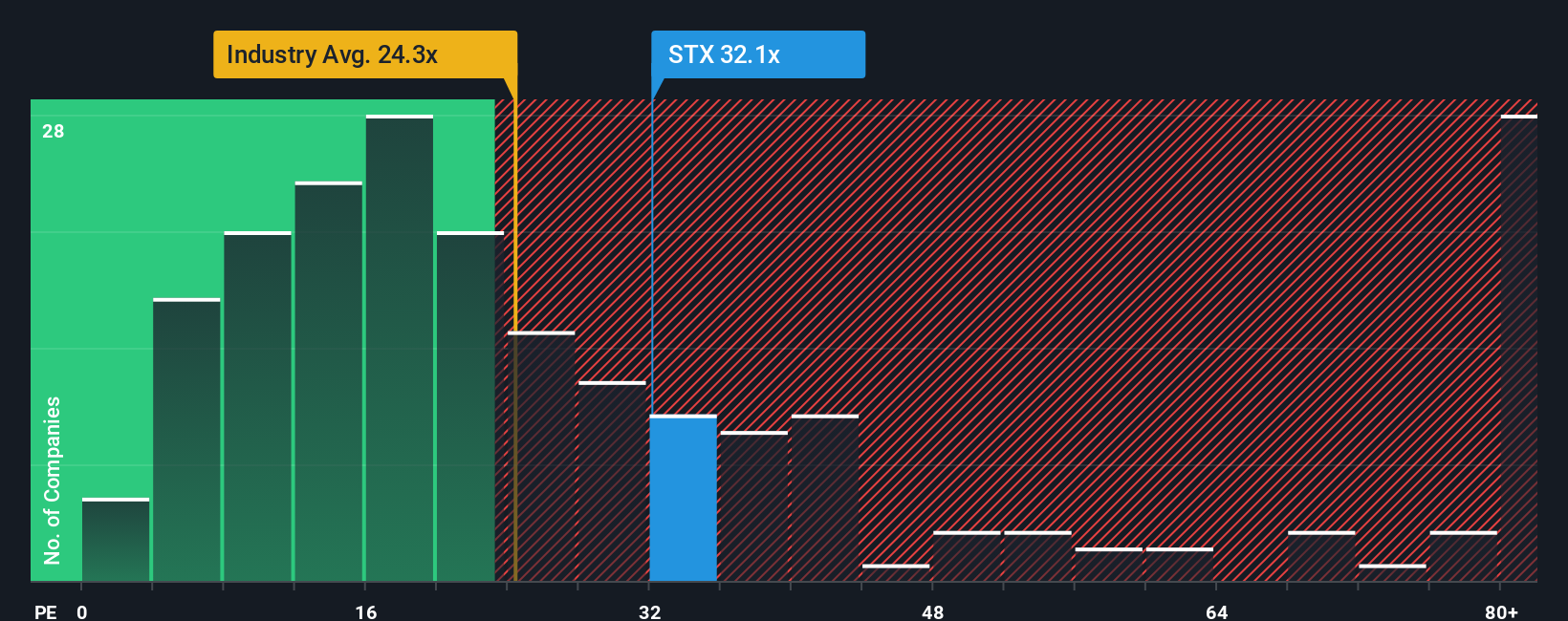

Fair value narratives say Seagate is roughly 4% undervalued, but its 35.3x price to earnings ratio is more than double peer averages near 16.4x and above the global tech average of 22.2x, even if only slightly below a 36.2x fair ratio. Is the market already paying tomorrow’s AI upside today?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Seagate Technology Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Seagate Technology Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Seagate when you can tap into a world of overlooked opportunities. Use the Simply Wall St Screener now to sharpen your edge.

- Capture potential turnaround stories early by scanning these 3639 penny stocks with strong financials that already back their small size with resilient financials.

- Ride the next wave of innovation by targeting these 25 AI penny stocks positioned at the intersection of accelerating software breakthroughs and scalable business models.

- Lock in a more predictable income stream by focusing on these 13 dividend stocks with yields > 3% that reward shareholders with yield above 3% and disciplined payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal