Nuvau Minerals And 2 Other Promising Penny Stocks On The TSX

The Canadian market has recently seen a boost, with equities reaching new highs in response to dovish signals from the Bank of Canada and supportive interest rate policies. For investors interested in exploring smaller or newer companies, penny stocks—though an older term—remain a relevant area for potential growth. These stocks, when backed by solid financial health, can offer unique opportunities for value and growth that might be overlooked by larger firms.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.12 | CA$54.1M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.30 | CA$251.96M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.23 | CA$121.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.47 | CA$3.93M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$51.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.33 | CA$851.58M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.20 | CA$23.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.93 | CA$150.14M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.00 | CA$184.52M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 390 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Nuvau Minerals (TSXV:NMC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nuvau Minerals Inc. focuses on acquiring, evaluating, and exploring mining properties in Canada, with a market cap of CA$38.32 million.

Operations: Nuvau Minerals Inc. has not reported any revenue segments.

Market Cap: CA$38.32M

Nuvau Minerals Inc., with a market cap of CA$38.32 million, is pre-revenue and currently unprofitable, having reported a net loss of CA$3.1 million for Q3 2025. The company has no long-term liabilities and remains debt-free, but its cash runway is less than a year if free cash flow trends continue. Short-term assets (CA$4.7M) exceed short-term liabilities (CA$3.1M), indicating some financial stability despite lacking experienced management and board members with an average tenure of just one year each. Shareholders have not faced significant dilution over the past year, maintaining equity value amidst volatility concerns.

- Unlock comprehensive insights into our analysis of Nuvau Minerals stock in this financial health report.

- Gain insights into Nuvau Minerals' past trends and performance with our report on the company's historical track record.

Questor Technology (TSXV:QST)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Questor Technology Inc. is an environmental emissions reduction technology company that designs, manufactures, and services clean combustion systems in Canada and the United States, with a market cap of CA$13.28 million.

Operations: Questor Technology generates revenue primarily from Equipment Sales and Equipment Rentals, totaling CA$7.84 million.

Market Cap: CA$13.28M

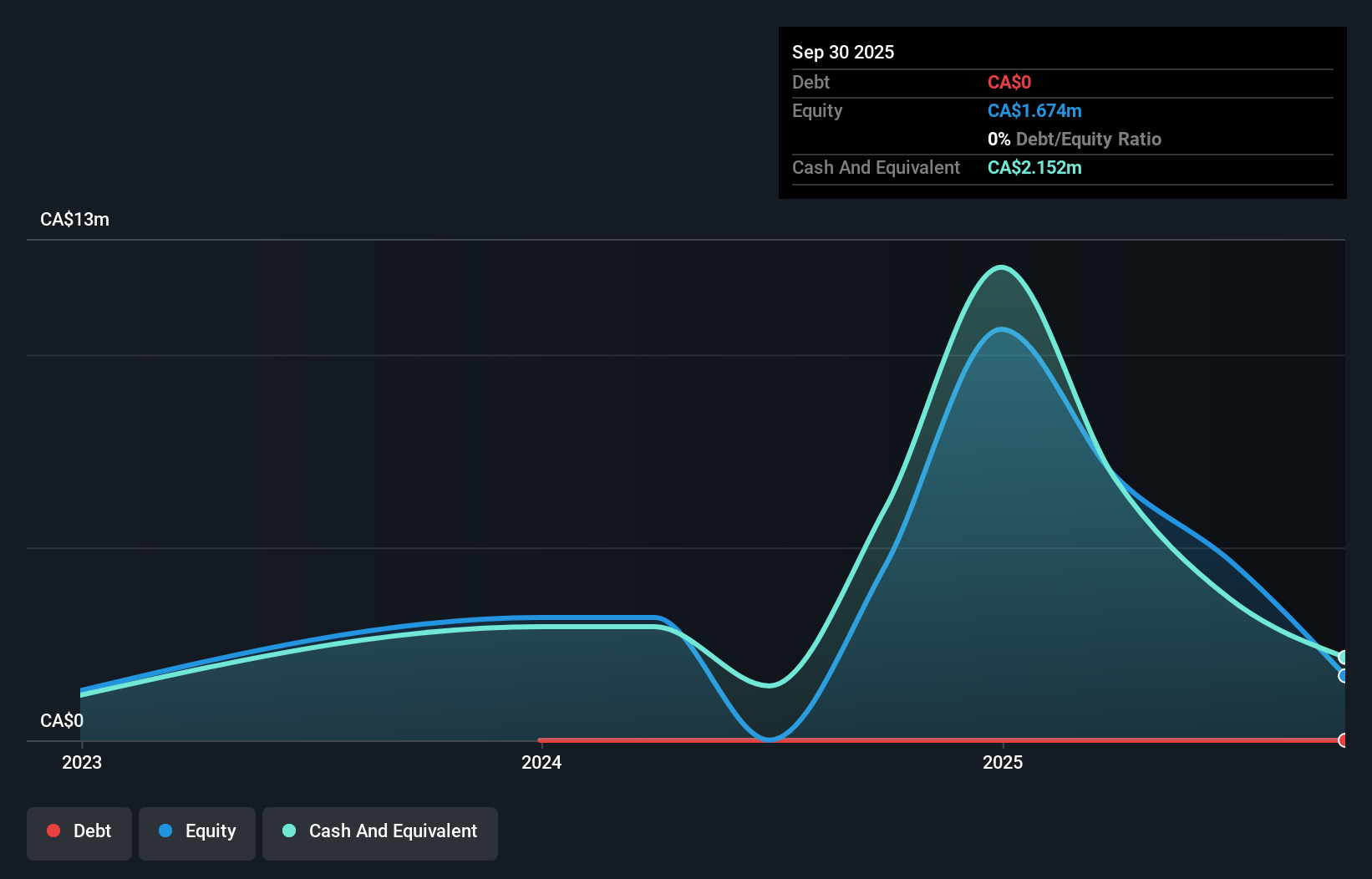

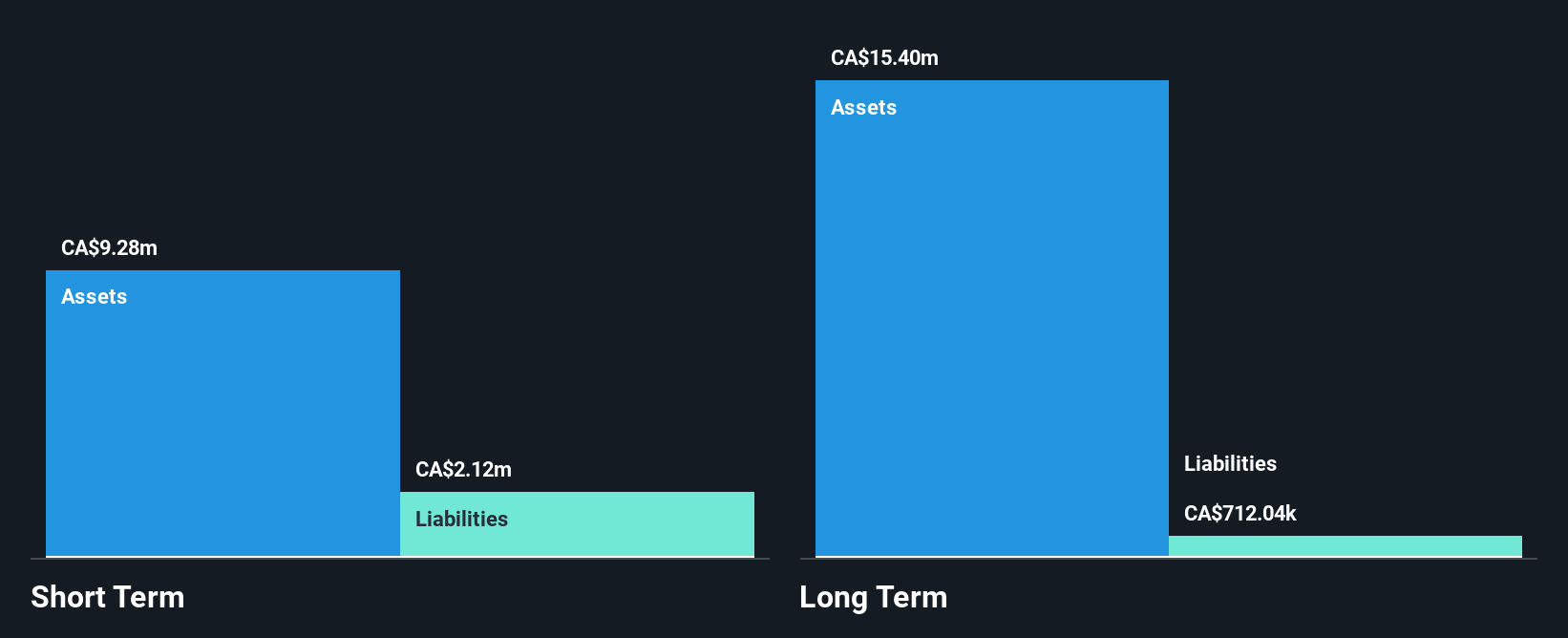

Questor Technology Inc., with a market cap of CA$13.28 million, faces challenges as it remains unprofitable despite revenue growth to CA$6.07 million for the first nine months of 2025. The company has secured a significant $9 million contract in Mexico, enhancing its global market presence and supporting environmental goals. Financially, Questor's short-term assets exceed liabilities, and it has more cash than debt, indicating stability amidst losses. However, management and board inexperience could impact strategic execution as earnings are forecasted to grow significantly but remain negative due to increased net losses over recent years.

- Get an in-depth perspective on Questor Technology's performance by reading our balance sheet health report here.

- Examine Questor Technology's earnings growth report to understand how analysts expect it to perform.

Thermal Energy International (TSXV:TMG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thermal Energy International Inc. develops, engineers, and supplies pollution control, heat recovery systems, and condensate return solutions across North America, Europe, and internationally with a market cap of CA$21.34 million.

Operations: The company generates revenue from its operations in Ottawa and Bristol, with CA$14.25 million and CA$13.92 million respectively.

Market Cap: CA$21.34M

Thermal Energy International Inc., with a market cap of CA$21.34 million, is navigating its unprofitable status by leveraging positive free cash flow and maintaining a cash runway exceeding three years. Recent orders, including a CA$1.6 million deal for heat recovery units in the Arctic and two projects worth CA$1.5 million from a nutrition company, underscore its operational momentum despite fluctuating quarterly sales figures. The company's seasoned management and board provide strategic stability as it continues to reduce debt significantly over five years while trading below estimated fair value, positioning it attractively relative to peers in the industry.

- Dive into the specifics of Thermal Energy International here with our thorough balance sheet health report.

- Assess Thermal Energy International's future earnings estimates with our detailed growth reports.

Where To Now?

- Take a closer look at our TSX Penny Stocks list of 390 companies by clicking here.

- Contemplating Other Strategies? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal