Assessing Charles Schwab’s (SCHW) Valuation After Its Steady Year-to-Date Share Price Rebound

Charles Schwab (SCHW) keeps grinding higher, with shares up about 5% over the past month and more than 30% this year, as investors reassess the long term earnings power of its interest sensitive business.

See our latest analysis for Charles Schwab.

The move has been steady rather than flashy, but Schwab’s solid year to date share price return and strong five year total shareholder return suggest momentum is rebuilding as investors grow more comfortable with its interest rate exposure and earnings trajectory.

If Schwab’s renewed strength has you thinking about what else might be setting up for a sustained run, it could be worth scanning fast growing stocks with high insider ownership as a next step.

With shares hovering below analyst targets and earnings back on a growth path, investors now face a key question: is Schwab still trading at a discount to its long term potential, or is the market already pricing in the next leg of growth?

Most Popular Narrative Narrative: 13.6% Undervalued

With Charles Schwab last closing at $96.61 against a narrative fair value near $111.78, the story leans toward upside if the projections hold.

Schwab's industry-leading scale, continued penetration with independent advisors via its custody platform, and launch of new offerings (such as retail alternatives and digital asset products) are expected to enhance recurring fee-based revenues and cement competitive positioning, supporting earnings resilience and long-term profitability.

Want to see what powers that valuation gap? The narrative leans on ambitious revenue growth, higher margins, and a future earnings multiple that assumes durable compounding. Curious which levers do the heavy lifting in that model? Explore the details to see how those moving parts compare.

Result: Fair Value of $111.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could be challenged if a lower rate backdrop erodes net interest income or if digital first rivals accelerate account growth at Schwab’s expense.

Find out about the key risks to this Charles Schwab narrative.

Another Lens on Value

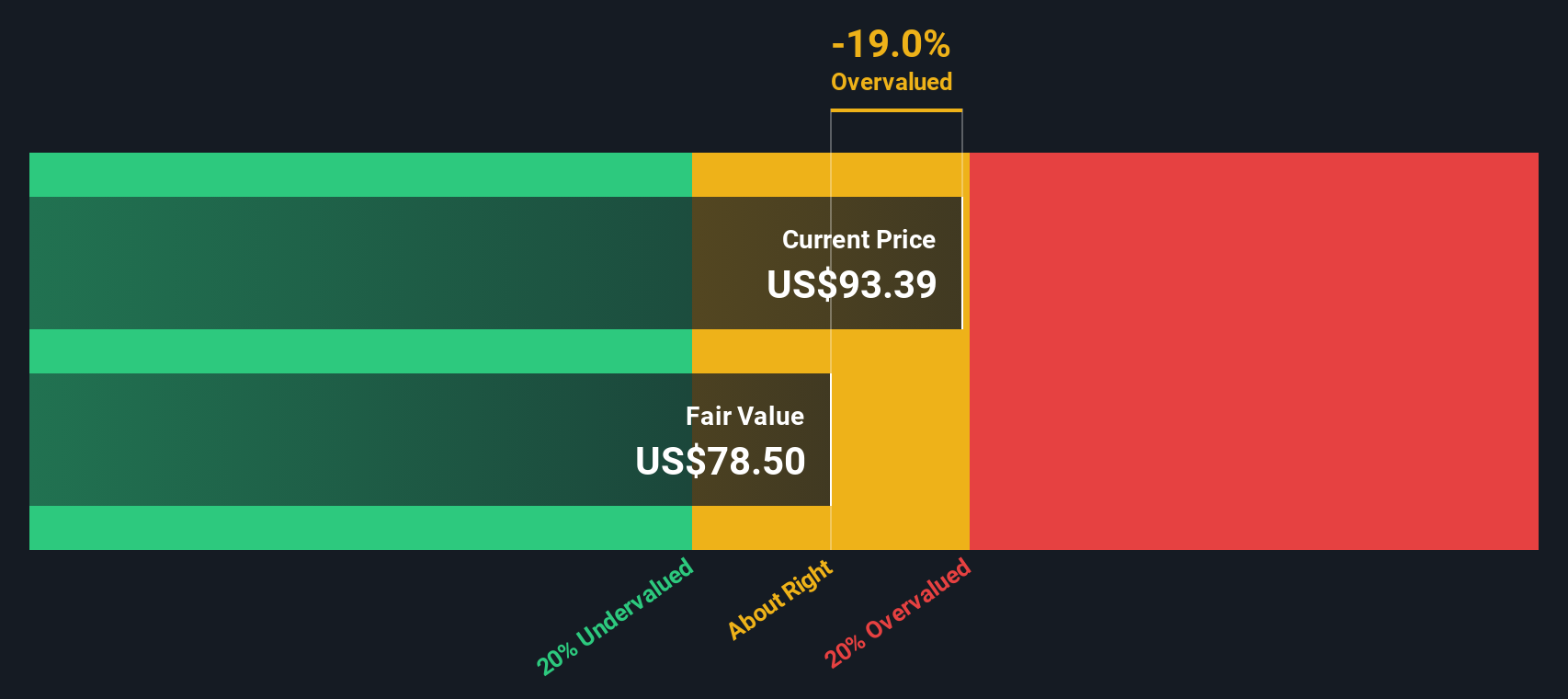

Our SWS DCF model tells a different story, with a fair value near $92.01 versus today’s $96.61, implying Schwab screens a little expensive on cash flow grounds even as the narrative points to upside. Which side of that spread feels more realistic to you?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Charles Schwab for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Charles Schwab Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes. Do it your way

A great starting point for your Charles Schwab research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop at one compelling idea. Use the Simply Wall Street Screener to quickly surface fresh opportunities before the crowd moves on.

- Target potential multi-baggers early by scanning these 3640 penny stocks with strong financials that pair tiny market caps with surprisingly solid fundamentals.

- Ride structural tailwinds in automation and machine learning by focusing on these 26 AI penny stocks positioned at the heart of AI adoption.

- Review these 13 dividend stocks with yields > 3% that may offer regular cash returns while you hold.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal