The Bull Case For First Horizon (FHN) Could Change Following Analyst Shifts And New Charlotte Leader

- In recent days, First Horizon Bank announced that experienced banker Justin Rutledge has joined as Charlotte Market President, while the parent company scheduled its fourth-quarter and full-year 2025 results release and investor call for January 15, 2026.

- Alongside these management and disclosure updates, a series of analyst rating changes and refreshed views on the stock have sharpened how the market assesses First Horizon’s prospects.

- We’ll now examine how the recent analyst sentiment shift, alongside the Charlotte leadership hire, may influence First Horizon’s investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

First Horizon Investment Narrative Recap

To own First Horizon, you need to be comfortable with a regional bank that is growing within a still-uncertain macro backdrop, where credit quality and net interest margins remain key swing factors. The Charlotte Market President hire and the scheduled January 15, 2026 earnings call do not materially change the near term catalyst, which remains how the bank balances growth with credit risk, or the primary risk from rising provision expenses and pressure on loan yields.

The most relevant recent development here is the cluster of analyst rating changes, including JP Morgan lifting its price target while maintaining a Neutral view and an average brokerage stance of Outperform across 19 firms. This refreshed external sentiment frames how investors might interpret upcoming earnings commentary on provisions, net charge offs and fee income trends, all of which sit at the heart of both the current catalyst and the credit quality risk story.

Yet while optimism around ratings and leadership changes can be encouraging, investors should still pay close attention to the rising provision expense and...

Read the full narrative on First Horizon (it's free!)

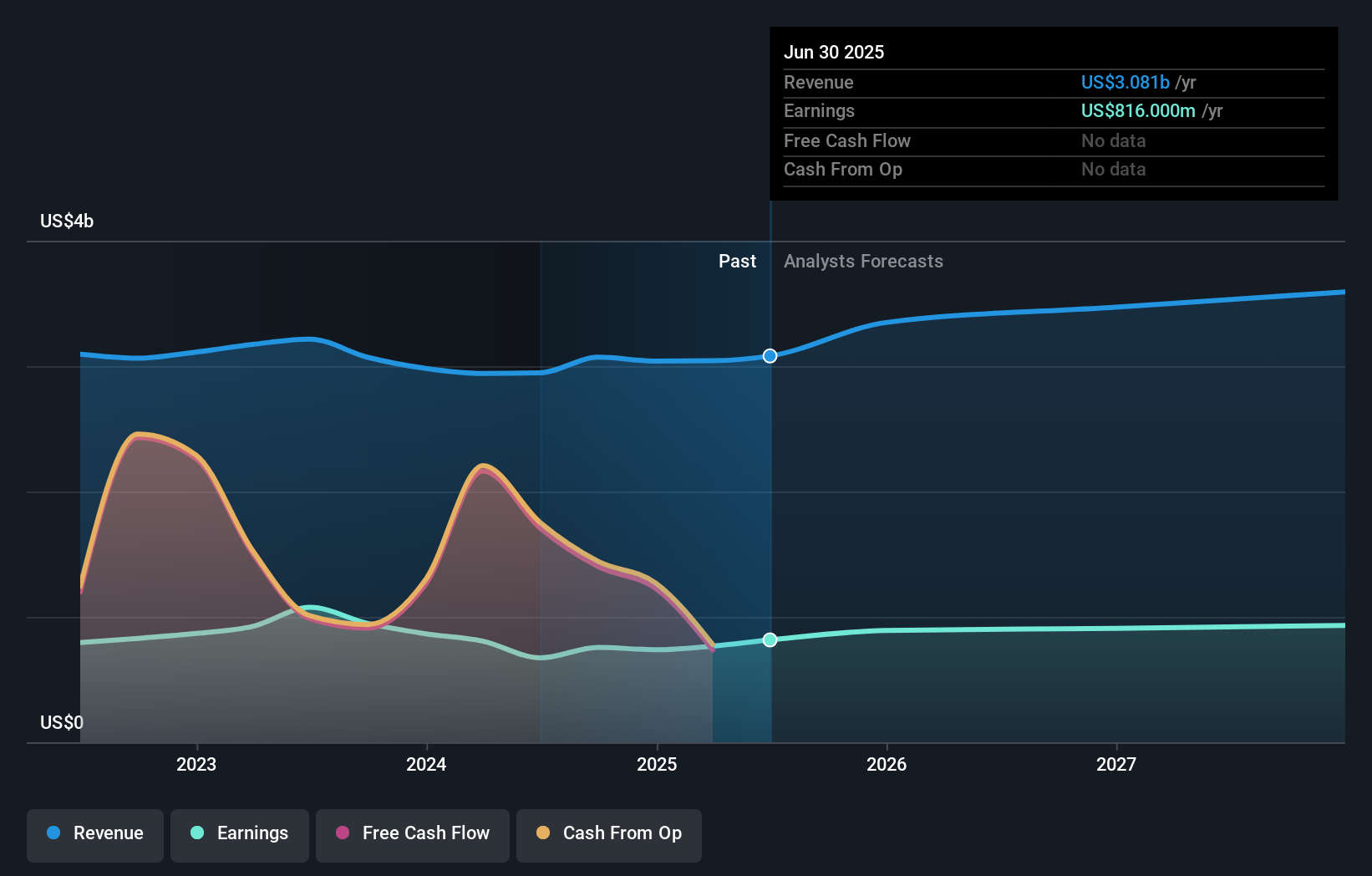

First Horizon's narrative projects $3.7 billion revenue and $965.0 million earnings by 2028. This requires 6.7% yearly revenue growth and an earnings increase of about $149 million from $816.0 million today.

Uncover how First Horizon's forecasts yield a $25.25 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate First Horizon’s fair value between US$25.25 and US$29.59, reflecting a wide spread of personal views. Set against concerns about higher provision expenses and credit quality, this range underlines how differently investors can weigh the same risks and why it helps to compare several perspectives.

Explore 3 other fair value estimates on First Horizon - why the stock might be worth as much as 24% more than the current price!

Build Your Own First Horizon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Horizon research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free First Horizon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Horizon's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal