3 Growth Stocks With Strong Insider Confidence

As the U.S. stock market rebounds with major indexes like the Dow Jones and S&P 500 poised to break losing streaks thanks to cooler-than-expected inflation data, investor sentiment is cautiously optimistic. In such a climate, growth stocks with high insider ownership can be particularly appealing, as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.9% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Karman Holdings (KRMN) | 17.3% | 78.5% |

| Credo Technology Group Holding (CRDO) | 10.4% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.4% | 27.1% |

Underneath we present a selection of stocks filtered out by our screen.

SANUWAVE Health (SNWV)

Simply Wall St Growth Rating: ★★★★★☆

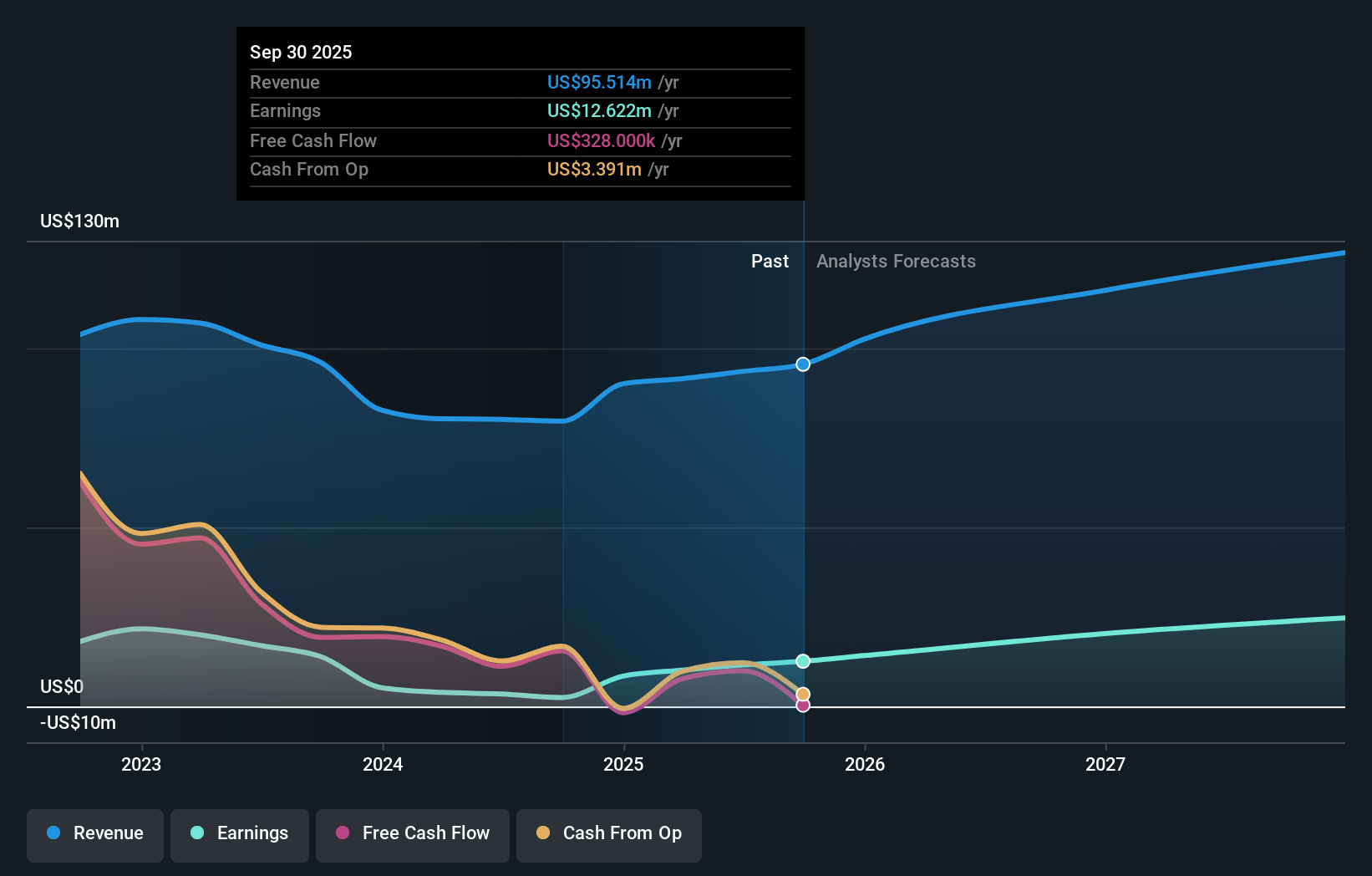

Overview: SANUWAVE Health, Inc. is a medical device company operating in the United States and internationally with a market cap of $274.35 million.

Operations: The company's revenue primarily comes from the design and sale of medical devices, totaling $41.28 million.

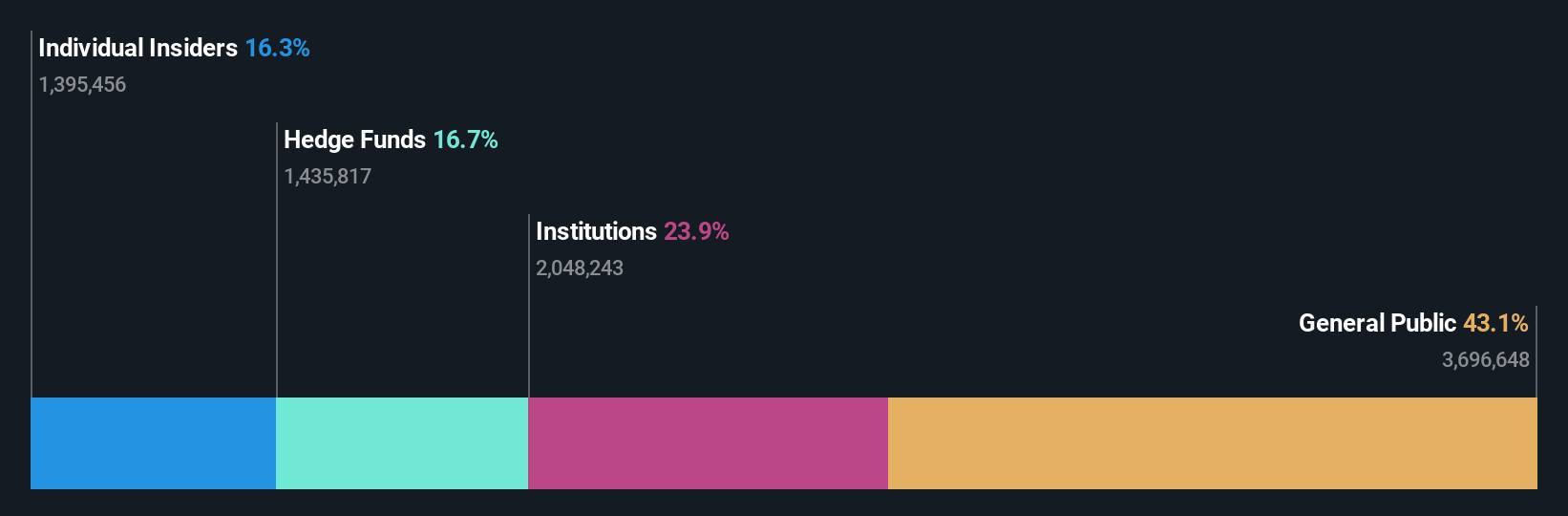

Insider Ownership: 16.3%

Earnings Growth Forecast: 86.4% p.a.

SANUWAVE Health, a growth company with high insider ownership, is expected to become profitable in the next three years. The company's revenue growth forecast of 28.2% per year surpasses the US market average. Despite recent volatility and significant insider selling, SANUWAVE's earnings are projected to grow significantly at 86.39% annually. Recent developments include expanding its UltraMIST product line through Healogics iSupply and securing a new $23 million credit facility from J.P. Morgan for strategic financial management.

- Click here and access our complete growth analysis report to understand the dynamics of SANUWAVE Health.

- Our expertly prepared valuation report SANUWAVE Health implies its share price may be too high.

First Western Financial (MYFW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: First Western Financial, Inc. is a financial holding company offering wealth advisory, private banking, personal trust, investment management, mortgage lending, and institutional asset management services to individual and corporate clients with a market cap of $250.45 million.

Operations: The company's revenue is primarily derived from wealth management services, totaling $90.23 million, and mortgage services, contributing $5.29 million.

Insider Ownership: 15%

Earnings Growth Forecast: 28.8% p.a.

First Western Financial's earnings are forecast to grow significantly at 28.8% annually, outpacing the US market average. Despite slower revenue growth expectations of 12.2% per year, it still exceeds the market rate. Recent executive changes include appointing Alex McDougall as Regional President in Arizona, highlighting strategic regional investment amid broader industry pullbacks. The company reported strong Q3 results with net income rising to US$3.19 million from US$2.13 million year-over-year and completed a share buyback worth US$0.3 million.

- Delve into the full analysis future growth report here for a deeper understanding of First Western Financial.

- Our comprehensive valuation report raises the possibility that First Western Financial is priced higher than what may be justified by its financials.

Northpointe Bancshares (NPB)

Simply Wall St Growth Rating: ★★★★☆☆

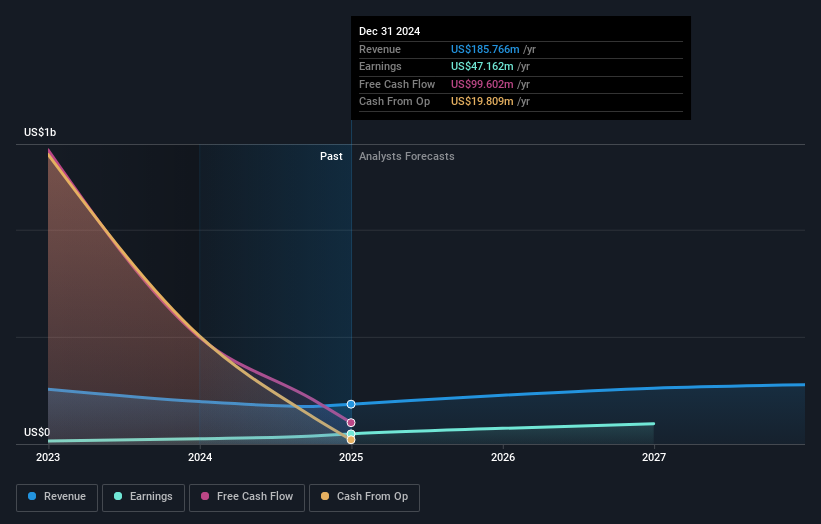

Overview: Northpointe Bancshares, Inc. is the bank holding company for Northpointe Bank, offering a range of banking products and services in the United States, with a market cap of $593.13 million.

Operations: Northpointe Bancshares generates revenue through its Retail Banking segment, which accounts for $157.25 million, and its Mortgage Warehouse (MPP) segment, contributing $60.70 million.

Insider Ownership: 35.8%

Earnings Growth Forecast: 21.7% p.a.

Northpointe Bancshares is poised for growth with earnings projected to rise significantly at 21.65% annually, surpassing the US market average. Trading below its estimated fair value and offering good relative value compared to peers, it reflects strong investment potential. Recent debt financing of US$70 million will aid in redeeming higher-cost preferred stock, optimizing capital structure. Despite a low allowance for bad loans, the company's return on equity forecast remains modest at 13.9%.

- Take a closer look at Northpointe Bancshares' potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Northpointe Bancshares' share price might be too pessimistic.

Seize The Opportunity

- Explore the 206 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Searching for a Fresh Perspective? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal