Deep Source Holdings (SEHK:990) Share Placement Prompts Fresh Look at Valuation and Growth Expectations

Deep Source Holdings (SEHK:990) has just lined up a placement of 515 million new shares at HK$0.69, a roughly 4% dilution that raises fresh equity while putting investor focus squarely on capital allocation.

See our latest analysis for Deep Source Holdings.

With the latest placement coming as the share price sits around HK$0.70, the strong year to date share price return of roughly 79% and hefty five year total shareholder return of about 488% suggest longer term momentum has been powerful, even if near term sentiment has cooled slightly.

If this capital raise has you reassessing where growth and insider conviction might line up next, it could be worth exploring fast growing stocks with high insider ownership.

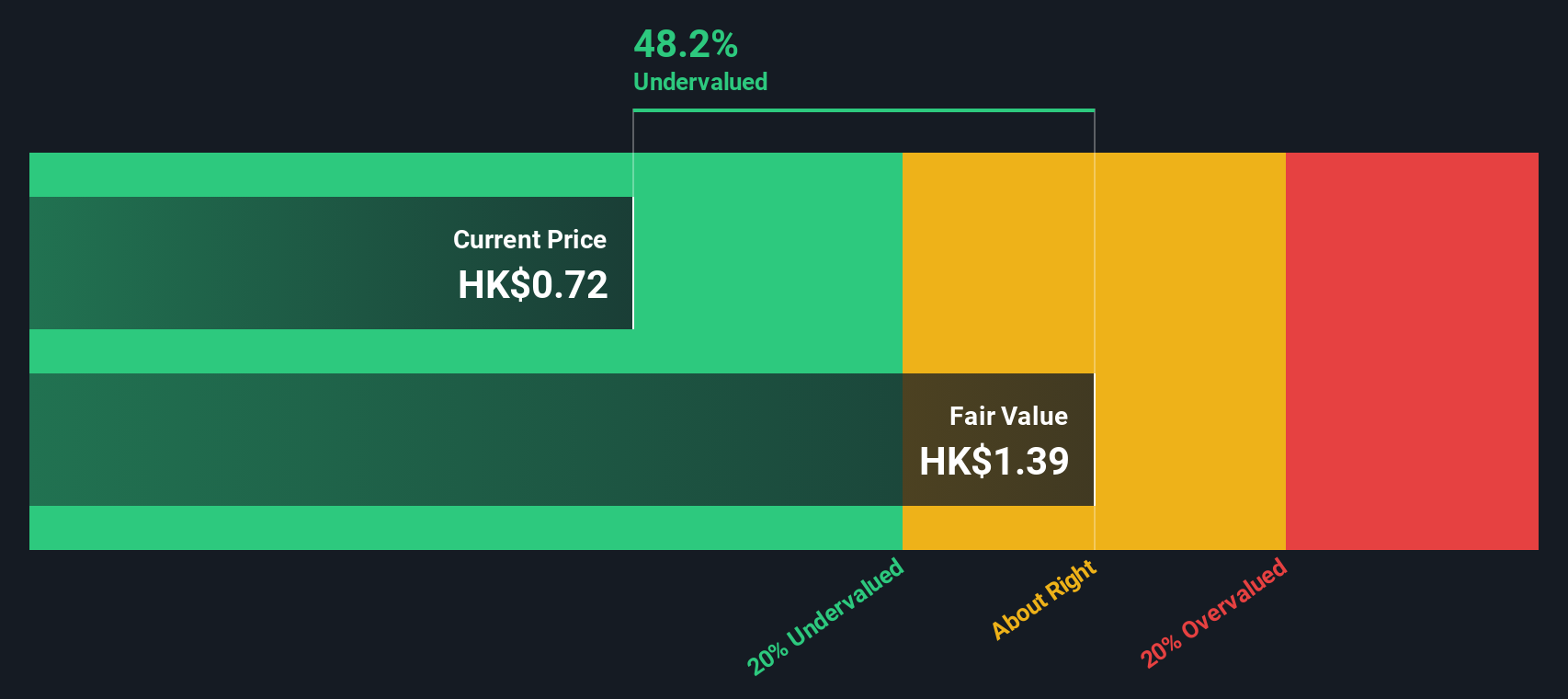

Given its near 50 percent estimated intrinsic discount but already spectacular multiyear returns, the key question now is whether Deep Source remains mispriced value or if the market is simply pricing in aggressive future growth.

Price-to-Earnings of 30.9x: Is it justified?

Deep Source Holdings last closed at HK$0.70, and on a price-to-earnings ratio of 30.9x it screens as expensive versus both peers and its own fundamentals.

The price to earnings multiple compares the current share price with the company’s earnings per share, effectively showing how much investors are paying for each unit of profit. For a diversified trade distribution and financial services group like Deep Source, this ratio is a quick way to gauge whether the market is assuming strong profit growth or paying up despite earnings pressure.

Here, the 30.9x price to earnings stands sharply above the Hong Kong Trade Distributors industry average of 10.7x and a peer average of 11x. As a result, the market is assigning Deep Source a premium of almost three times sector norms. This indicates that investors may be expecting a meaningful earnings recovery despite the company’s negative recent earnings growth and modest 5.4 percent return on equity.

Compared with the industry, this elevated multiple looks demanding, especially given earnings have declined both over the past year and across the last five years, rather than outpacing sector growth.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 30.9x (OVERVALUED)

However, a slowdown in bulk commodity demand or tighter financial regulation could still quickly undermine growth expectations embedded in Deep Source’s elevated valuation.

Find out about the key risks to this Deep Source Holdings narrative.

Another View: DCF Points to Deep Value

While the 30.9x earnings multiple looks stretched, our DCF model paints a different picture, suggesting fair value closer to HK$1.39 versus the current HK$0.70, or about a 49.5 percent discount. Is the market mispricing cyclical risk, or underestimating cash flow resilience?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Deep Source Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Deep Source Holdings Narrative

If you want to dig into the numbers yourself or challenge this view, you can build a fresh perspective in just a few minutes, Do it your way.

A great starting point for your Deep Source Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Do not stop at a single opportunity; use the Simply Wall St Screener now to uncover fresh ideas other investors will only notice once prices have moved.

- Capture mispriced potential by targeting these 908 undervalued stocks based on cash flows where cash flows point to value the market has yet to fully recognize.

- Capitalize on innovation tailwinds by scanning these 26 AI penny stocks for businesses reshaping entire industries with applied artificial intelligence.

- Lock in dependable income streams by filtering for these 13 dividend stocks with yields > 3% that can power long term total returns through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal