Twist Bioscience (TWST): Evaluating Valuation After New Research‑Grade Plasmid DNA Preps Launch

Twist Bioscience (TWST) just rolled out research grade Plasmid DNA Preps aimed squarely at pre clinical pharma and biotech workflows, a targeted move that could deepen its role in nucleic acid therapeutics discovery.

See our latest analysis for Twist Bioscience.

The launch of plasmid DNA preps and Twist’s upcoming presence at the Antibody Engineering and Therapeutics conference come as momentum starts to rebuild, with a 30 day share price return of 23.6 percent but a still negative one year total shareholder return.

If this kind of specialist biotech story interests you, it is worth seeing what else is out there in healthcare stocks to spot other potential growth names early.

Yet with shares still down sharply over one and five years but rallying in recent months, are investors looking at a misunderstood synthetic biology player that is trading below its potential, or a name where future growth is already fully priced in?

Most Popular Narrative Narrative: 10% Undervalued

With Twist Bioscience closing at $32.13 against a narrative fair value of about $35.63, the story leans toward upside if key execution milestones land.

Significant improvements in gross margin (now above 50%) through volume leverage, process improvements, and increased vertical integration signal ongoing margin expansion and a clear near-term path toward adjusted EBITDA breakeven, indicating robust future earnings potential.

Curious how steady double digit growth, a future profit margin transformation, and an ambitious earnings multiple all combine to justify that valuation? The full narrative breaks down the exact revenue ramp, margin lift, and share count assumptions behind this optimistic price target, and shows how far expectations stretch beyond today’s losses.

Result: Fair Value of $35.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the path to profitability still hinges on sustaining recent margin gains and avoiding setbacks from customer concentration in its NGS business.

Find out about the key risks to this Twist Bioscience narrative.

Another Angle on Valuation

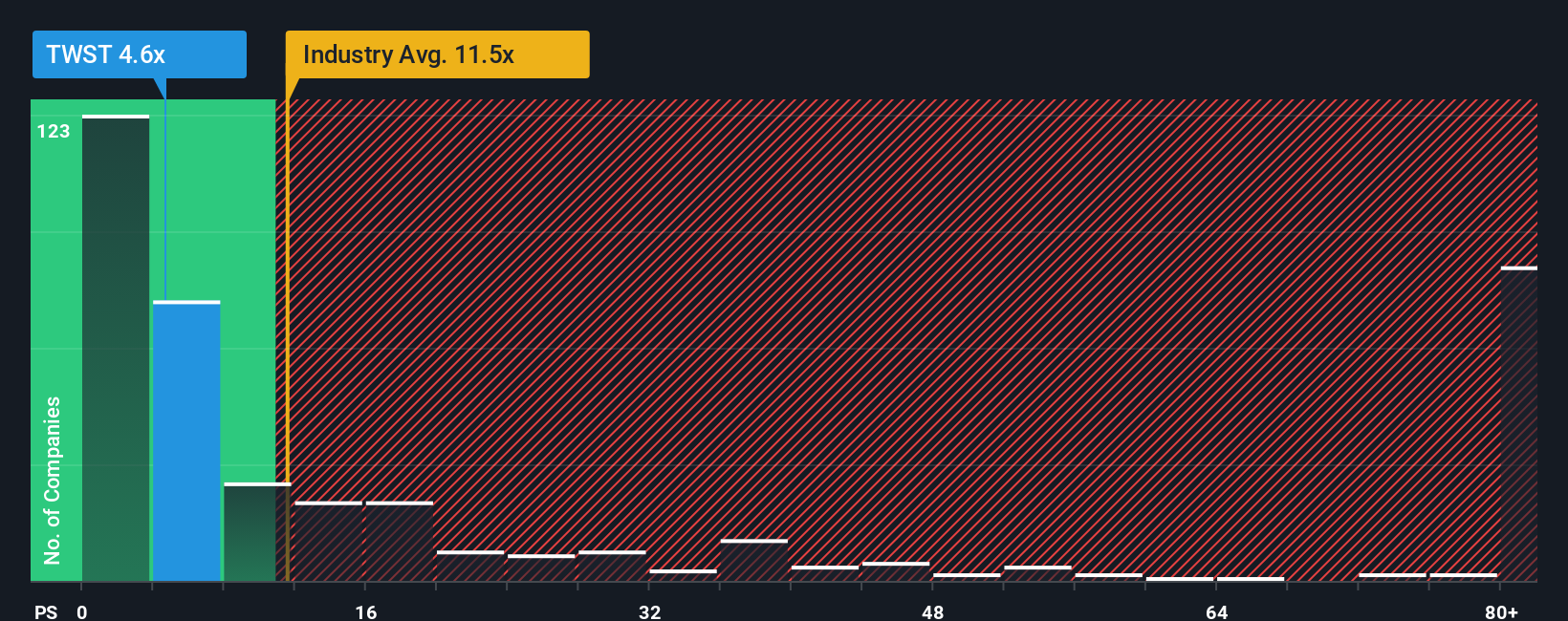

On sales based metrics Twist looks less forgiving. Its current Price to Sales of about 5.2 times sits well below US biotech peers at roughly 12.3 times, but meaningfully above a fair ratio of around 4 times, suggesting limited margin for error if growth underdelivers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Twist Bioscience Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Twist Bioscience research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Turn today’s insight into tomorrow’s gains by acting now, not later, and tap into data backed ideas other investors may overlook with the Simply Wall St Screener.

- Capture mispriced opportunities early by scanning these 908 undervalued stocks based on cash flows that the market has yet to fully appreciate.

- Ride powerful structural trends by targeting these 26 AI penny stocks at the heart of the next technology wave.

- Lock in potential income streams by focusing on these 13 dividend stocks with yields > 3% that can help support long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal