StoneX Group (SNEX): Valuation Check After Caliber Picks It for Digital Asset Treasury Platform

Caliber’s decision to tap StoneX Group (SNEX) as an institutional platform for its Digital Asset Treasury strategy puts a fresh spotlight on StoneX’s Prime offering and its role in institutional grade crypto infrastructure.

See our latest analysis for StoneX Group.

The partnership news lands while the share price sits at $95.73 after a modest pullback this week, but that comes on top of a strong year to date share price return of over 40 percent and a standout multi year total shareholder return profile that suggests momentum is still broadly building.

If this deal has you thinking about who else might be quietly compounding in the background, it could be a good moment to explore fast growing stocks with high insider ownership.

With shares up more than 50 percent over the past year and trading only a few percent below analyst targets, is StoneX still flying under the radar for value focused investors, or is the market already discounting years of future growth?

Price-to-Earnings of 16.9x: Is it justified?

Based on a price to earnings ratio of 16.9x and a last close of $95.73, StoneX screens modestly cheaper than broad US markets and sector peers, but not by a wide margin.

The price to earnings ratio compares the company’s share price with its earnings. This can be a useful shorthand for how much investors are willing to pay for each dollar of profit in a capital markets business like StoneX.

At 16.9x earnings, investors are paying slightly less than the wider US market multiple of 19x. StoneX’s profits have grown at a solid double digit pace over both the past year and past five years, with earnings also forecast to continue growing, albeit at a more moderate rate than the broader US market.

The picture becomes more nuanced when set against valuation benchmarks. While StoneX trades below the US Capital Markets industry average multiple of 25.5x, it is also a touch richer than the estimated fair price to earnings ratio of 16.1x, a level the market could gravitate toward if enthusiasm cools or growth expectations moderate.

Explore the SWS fair ratio for StoneX Group

Result: Price-to-Earnings of 16.9x (ABOUT RIGHT)

However, sustained multiple expansion still hinges on continued double digit earnings growth and stable trading conditions; any stumble could quickly compress StoneX’s valuation premium.

Find out about the key risks to this StoneX Group narrative.

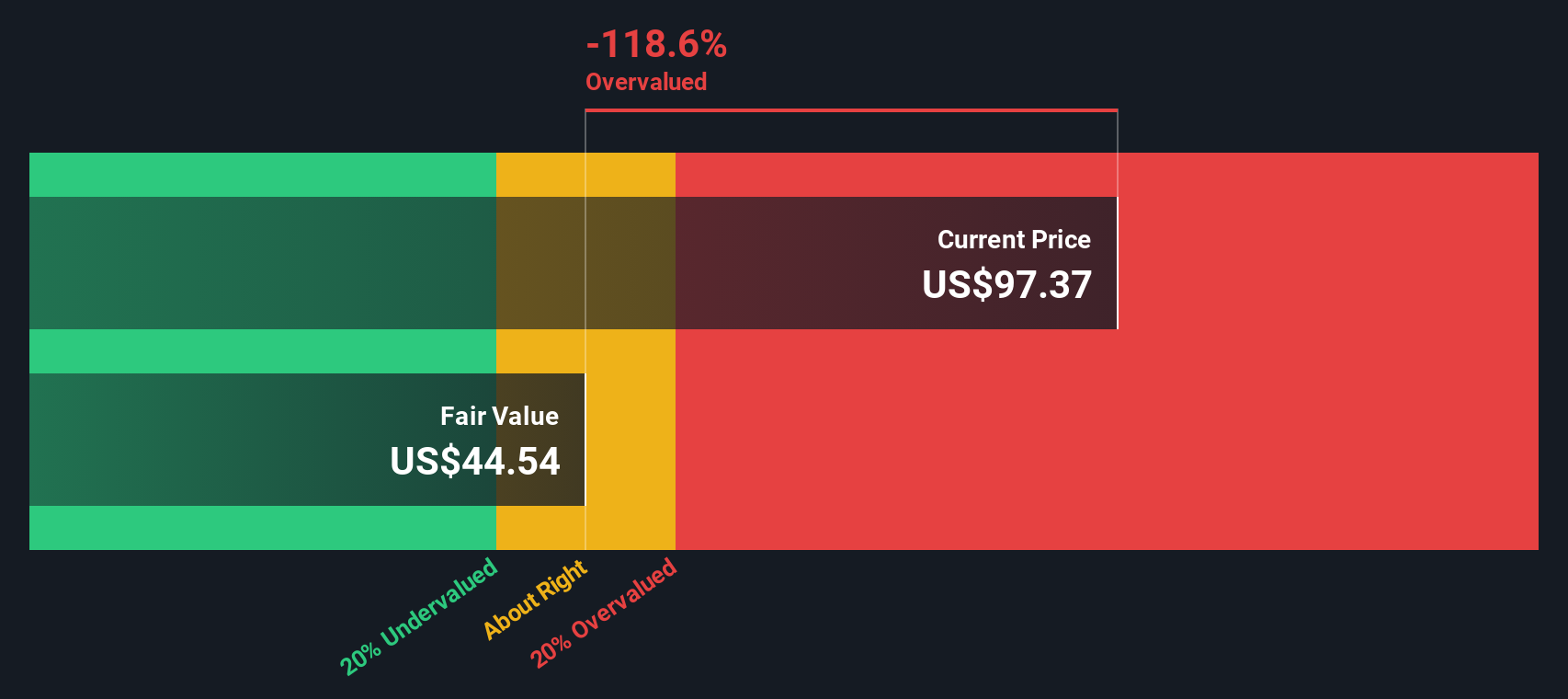

Another View: DCF Points to Overvaluation

While the earnings multiple looks broadly reasonable, our DCF model presents a starker picture, suggesting fair value closer to $43.70 versus today’s $95.73. That implies StoneX could be trading at more than double its modeled worth and raises the question: what is the market really paying up for?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out StoneX Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own StoneX Group Narrative

If you see things differently or want to stress test the assumptions yourself, you can build a personalized view of StoneX in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding StoneX Group.

Ready for your next investing move?

Before the market moves on without you, use the Simply Wall St screener to pinpoint fresh opportunities that match your strategy and keep your capital working.

- Target resilient income by scanning these 13 dividend stocks with yields > 3% that can help anchor your portfolio with reliable cash flows.

- Ride powerful structural trends by focusing on these 29 healthcare AI stocks at the intersection of medicine and machine intelligence.

- Capitalize on mispriced potential by zeroing in on these 908 undervalued stocks based on cash flows where current prices may understate future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal