BYD (SEHK:1211) Valuation Check as Thai Price Cuts Signal Strategic Push and Demand Uncertainty

BYD (SEHK:1211) just fired a clear warning shot in Thailand, slashing Seal sedan prices by up to 38% and promising compensation for early buyers if cuts continue. This move is putting volumes, margins and sentiment in sharp focus.

See our latest analysis for BYD.

Investors have been recalibrating expectations around these aggressive tactics, with the share price now at HK$93.9 and a 90 day share price return of minus 17.27% contrasting with a still solid 3 year total shareholder return of 44.13%. This suggests momentum has cooled even as the longer term story remains intact.

If this EV pricing battle has your attention, it might be a good time to compare BYD with other auto manufacturers that could benefit from similar shifts in demand and competition.

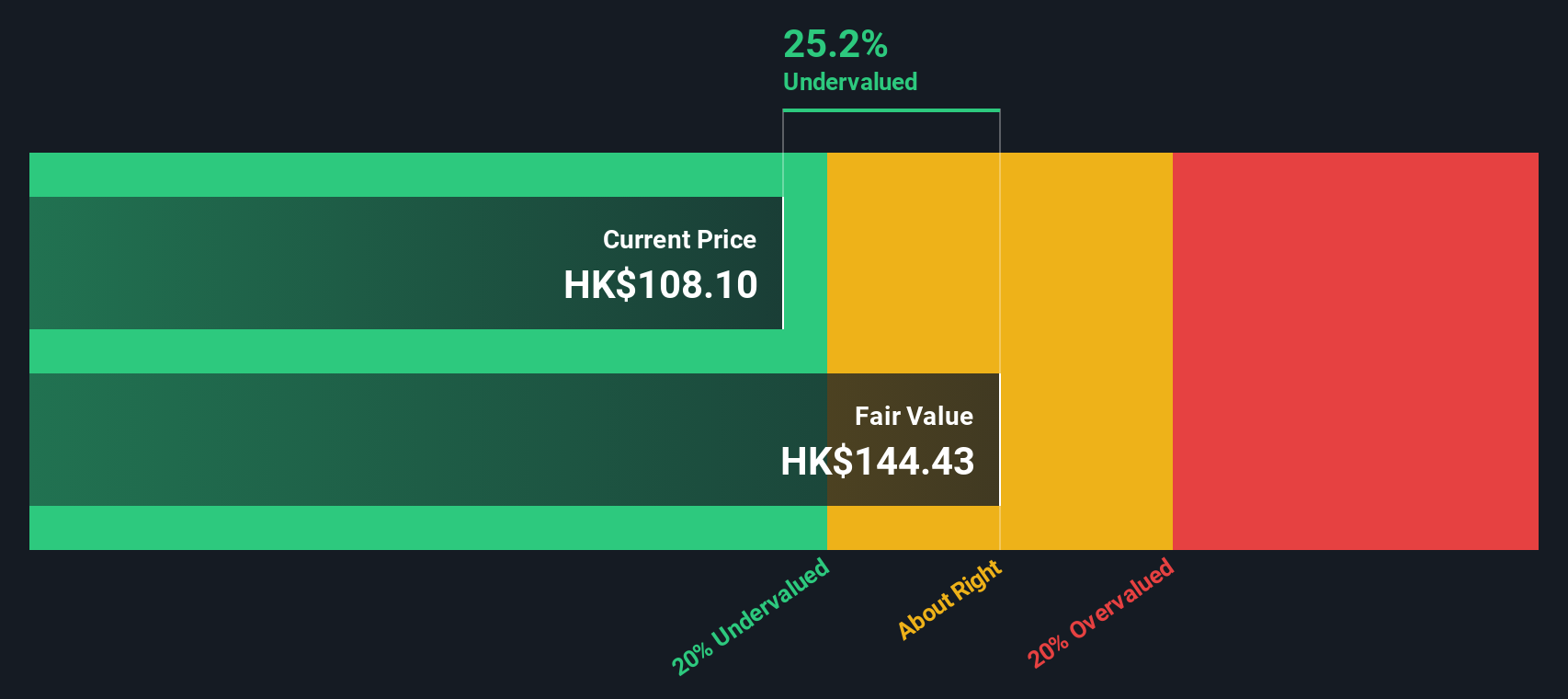

With valuation metrics pointing to a discount versus analyst targets but recent price cuts and margin pressure clouding the outlook, is BYD a mispriced growth leader or already fairly valued with future expansion fully baked in?

Price-to-Earnings of 20.2x: Is it justified?

On a price-to-earnings basis, BYD trades at 20.2x earnings, leaving the stock looking expensive versus peers despite the recent pullback to HK$93.9.

The price-to-earnings multiple compares what investors pay today with the company’s current earnings power, a key yardstick for profitable auto manufacturers. At 20.2x, the market is assigning a premium that implies confidence in BYD’s growth durability and margin resilience.

By comparison, our fair price-to-earnings ratio of 14.6x suggests the current premium goes too far, and that the market could eventually gravitate toward a lower earnings multiple as expectations normalise. BYD also screens as more expensive than both the Asian auto industry average of 18.9x and a much cheaper peer group average of 8.6x, underscoring how rich its valuation looks on this metric.

Explore the SWS fair ratio for BYD

Result: Price-to-Earnings of 20.2x (OVERVALUED)

However, intensifying EV price wars, along with any slowdown in revenue or earnings growth, could quickly challenge the premium valuation investors currently assign to BYD.

Find out about the key risks to this BYD narrative.

Another View: DCF Points to Undervaluation

Our DCF model paints a different picture, with BYD trading about 15.6% below its estimated fair value of HK$111.31 at the current HK$93.9 price. While earnings multiples flag valuation risk, the cash flow view hints at upside if growth and margins hold up.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BYD for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BYD Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalised view in just a few minutes, Do it your way.

A great starting point for your BYD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop with a single opportunity. Your next big win could be hiding in plain sight among other focused stock ideas tailored to different strategies and risk profiles.

- Capture potential early stage breakouts by reviewing these 3640 penny stocks with strong financials that already show solid balance sheets and improving fundamentals.

- Ride the structural shift toward automation and smart platforms by targeting these 26 AI penny stocks positioned at the heart of the artificial intelligence boom.

- Lock in attractive cash flow returns by screening these 13 dividend stocks with yields > 3% that combine reliable payouts with room for steady capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal