Penumbra (PEN): Assessing Valuation After a Recent Double-Digit Share Price Climb

Penumbra (PEN) has quietly climbed about 11% over the past month and roughly 21% in the past 3 months, drawing fresh attention to whether the current price still leaves upside for long term investors.

See our latest analysis for Penumbra.

That recent 11.2% one month share price return and 20.99% three month share price return builds on a solid backdrop, with a 27.0% one year total shareholder return suggesting momentum is still leaning in Penumbra’s favor at around $309 per share.

If Penumbra’s run has caught your eye, this could be a good moment to see what else is working in healthcare and compare it against healthcare stocks.

Yet with the stock already up sharply and trading only slightly below analyst targets, the key question is whether Penumbra still trades at a discount to its long term potential or whether markets have already priced in future growth.

Most Popular Narrative: 0.2% Undervalued

With Penumbra last closing at $309.26 against a narrative fair value of about $309.94, the story hinges less on mispricing and more on execution.

The analysts have a consensus price target of $303.333 for Penumbra based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $350.0, and the most bearish reporting a price target of just $186.0.

Curious how steady double digit growth, rising margins, and a punchy future earnings multiple can still converge on today’s price? The underlying math may surprise you.

Result: Fair Value of $309.94 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in pivotal trials like STORM-PE, or intensifying competition squeezing pricing and margins, could quickly weaken the seemingly balanced outlook.

Find out about the key risks to this Penumbra narrative.

Another Angle on Valuation

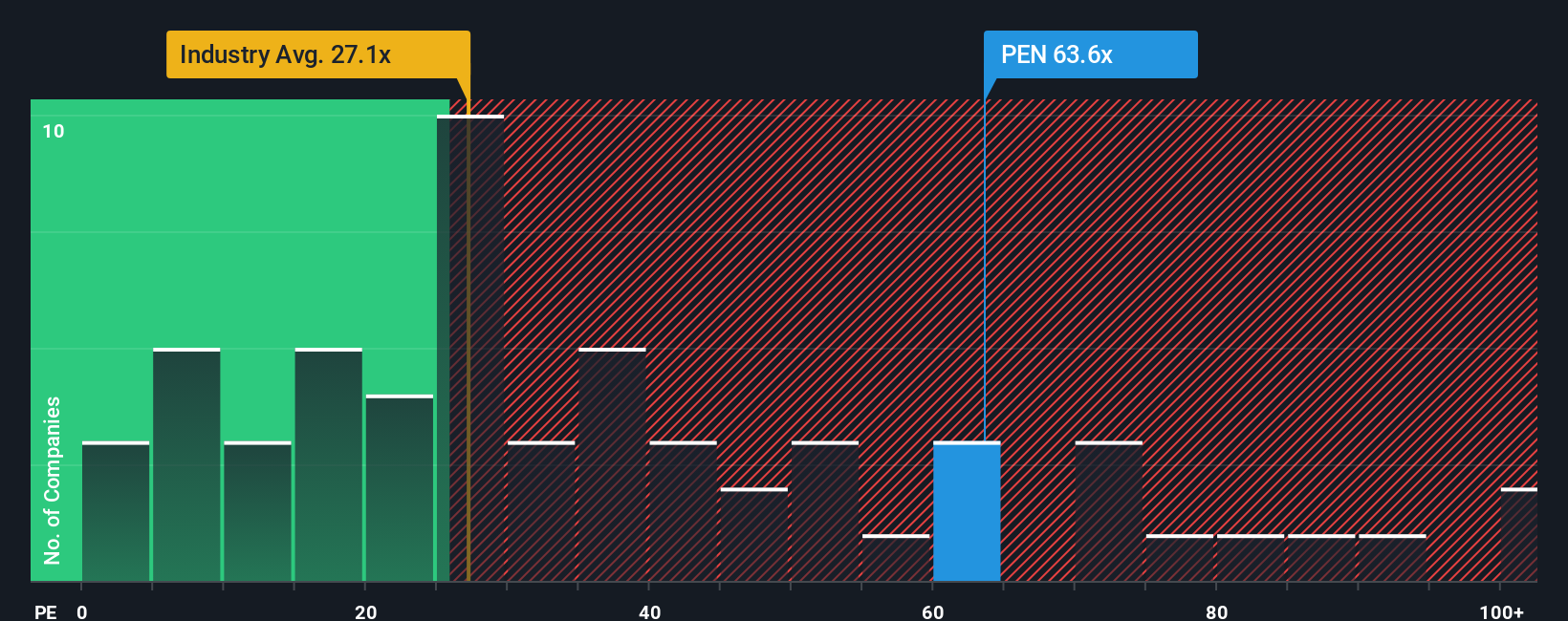

Most narratives call Penumbra roughly fairly priced, but on earnings the picture looks stretched. The stock trades at about 73.8 times earnings versus 30 times for the US Medical Equipment industry, 40.4 times for peers, and a 29.5 times fair ratio, leaving little room for disappointment.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Penumbra Narrative

If you see the story differently or prefer to rely on your own research, you can build a complete view in just minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Penumbra.

Ready for more high conviction ideas?

Penumbra might be on your radar now, but you will leave money on the table if you ignore other powerful ideas emerging from our screeners.

- Capture potential mispricing by running through these 909 undervalued stocks based on cash flows that look poised for a rerating as cash flows compound.

- Ride structural tailwinds by targeting these 26 AI penny stocks at the heart of the next wave of intelligent automation.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that could keep paying you while markets stay uncertain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal