West China Cement (SEHK:2233): Valuation Check After 2026 Notes Tender Offer and Debt Profile Tidy-Up

West China Cement (SEHK:2233) has just wrapped up payment for its recent tender offer on the 2026 Notes, trimming its outstanding principal to USD 200 million and subtly reshaping its debt profile.

See our latest analysis for West China Cement.

That tidy up of the 2026 Notes sits against a stock that has cooled a little in the very short term, with a recent 1 month share price return of minus 3.99 percent. However, West China Cement still trades at HK$2.89, and its year to date share price return of 82.91 percent plus a 3 year total shareholder return of 262.95 percent suggest momentum has been firmly building as investors re rate its growth and risk profile.

If this kind of balance sheet clean up has you thinking more broadly about opportunities, it might be worth exploring fast growing stocks with high insider ownership for other fast growing, high conviction ideas.

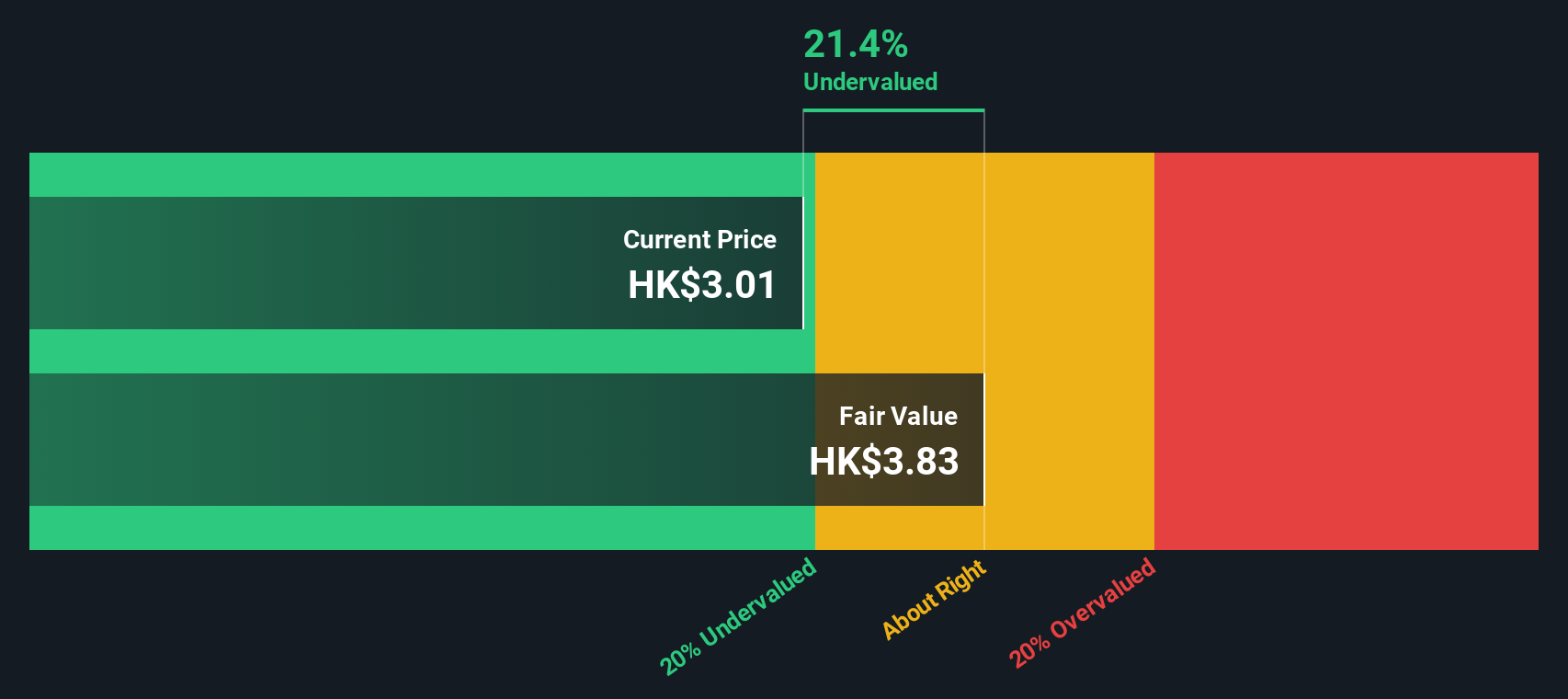

Yet with the shares trading just below analyst targets and a sizeable intrinsic value discount still implied, investors now face a key question: is West China Cement genuinely undervalued, or is the market already baking in its next leg of growth?

Price-to-Earnings of 14.5x: Is it justified?

On a 14.5x price-to-earnings multiple versus West China Cement's last close at HK$2.89, the shares screen as undervalued against both peers and intrinsic value estimates.

The price-to-earnings ratio compares what investors pay today with the company’s current earnings, a key yardstick for mature, cash generative cyclicals such as cement producers. For West China Cement, this multiple sits below the peer average of 19.3x and only slightly under the wider Asian Basic Materials average of 14.7x.

This discount suggests the market is not fully pricing in the company’s earnings outlook, high quality profit base and forecast annual profit growth north of 30 percent. Relative to an estimated fair price-to-earnings ratio of 16.9x from our fair value work, it also implies room for the market multiple to expand if execution stays on track.

Compared with peers trading at 19.3x, West China Cement’s 14.5x looks conservative, and versus the 16.9x fair ratio, the current valuation appears distinctly on the low side.

Explore the SWS fair ratio for West China Cement

Result: Price-to-Earnings of 14.5x (UNDERVALUED)

However, sustained demand weakness in key African projects, or execution missteps on expansion plans, could pressure margins and cap the rerating investors are anticipating.

Find out about the key risks to this West China Cement narrative.

Another View: What Does Our DCF Say?

While earnings multiples point to a modest discount, our DCF model is more bullish. It suggests West China Cement is trading around 24 percent below fair value at roughly HK$3.82 per share. If the cash flows play out as forecast, is the current price leaving too much on the table?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out West China Cement for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own West China Cement Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your West China Cement research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single opportunity when the market offers so many angles. Use the Simply Wall St Screener to uncover what others are missing today.

- Capture potential mispricings by hunting for quality companies trading below their estimated worth through these 908 undervalued stocks based on cash flows that could offer attractive upside.

- Position yourself for the next wave of innovation by targeting early stage innovators with strong momentum using these 26 AI penny stocks before they become mainstream.

- Strengthen your income stream by focusing on companies with consistent cash returns via these 13 dividend stocks with yields > 3% that can support long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal