Golconda Gold Ltd. (CVE:GG) Surges 32% Yet Its Low P/S Is No Reason For Excitement

Golconda Gold Ltd. (CVE:GG) shareholders have had their patience rewarded with a 32% share price jump in the last month. This latest share price bounce rounds out a remarkable 913% gain over the last twelve months.

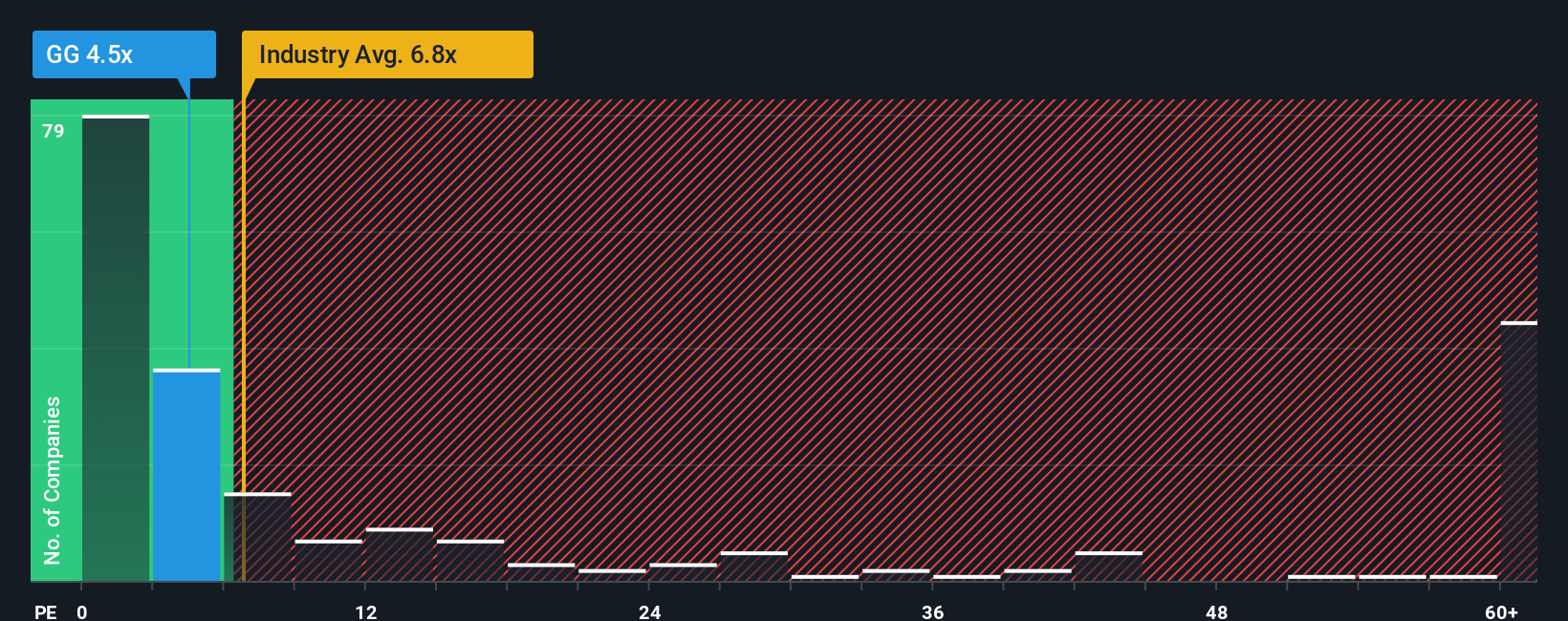

Even after such a large jump in price, Golconda Gold's price-to-sales (or "P/S") ratio of 4.5x might still make it look like a buy right now compared to the Metals and Mining industry in Canada, where around half of the companies have P/S ratios above 6.8x and even P/S above 44x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Golconda Gold

How Golconda Gold Has Been Performing

Golconda Gold certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Golconda Gold will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Golconda Gold?

The only time you'd be truly comfortable seeing a P/S as low as Golconda Gold's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 139% last year. Pleasingly, revenue has also lifted 103% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 51% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why Golconda Gold's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Golconda Gold's P/S

Golconda Gold's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

In line with expectations, Golconda Gold maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Golconda Gold with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal