December 2025 Penny Stocks Worth Watching

As the U.S. stock market navigates a mixed landscape with rising unemployment and fluctuating indices, investors are closely watching for opportunities amid these shifts. Penny stocks, often associated with smaller or emerging companies, continue to capture interest due to their potential for growth at accessible price points. Despite being considered a relic of past market eras, these stocks can still offer value when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.82 | $488.62M | ✅ 3 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.08 | $198.38M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.08 | $526.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.21 | $1.32B | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.72 | $175.18M | ✅ 5 ⚠️ 0 View Analysis > |

| CI&T (CINT) | $4.72 | $623.12M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.45 | $351.35M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.89 | $6.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.82 | $89.72M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 342 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

MacroGenics (MGNX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MacroGenics, Inc. is a clinical-stage biopharmaceutical company focused on discovering, developing, manufacturing, and commercializing antibody-based cancer therapeutics in the United States with a market cap of $85.40 million.

Operations: The company's revenue of $127.63 million is derived from its efforts in developing and commercializing monoclonal antibody-based therapeutics.

Market Cap: $85.4M

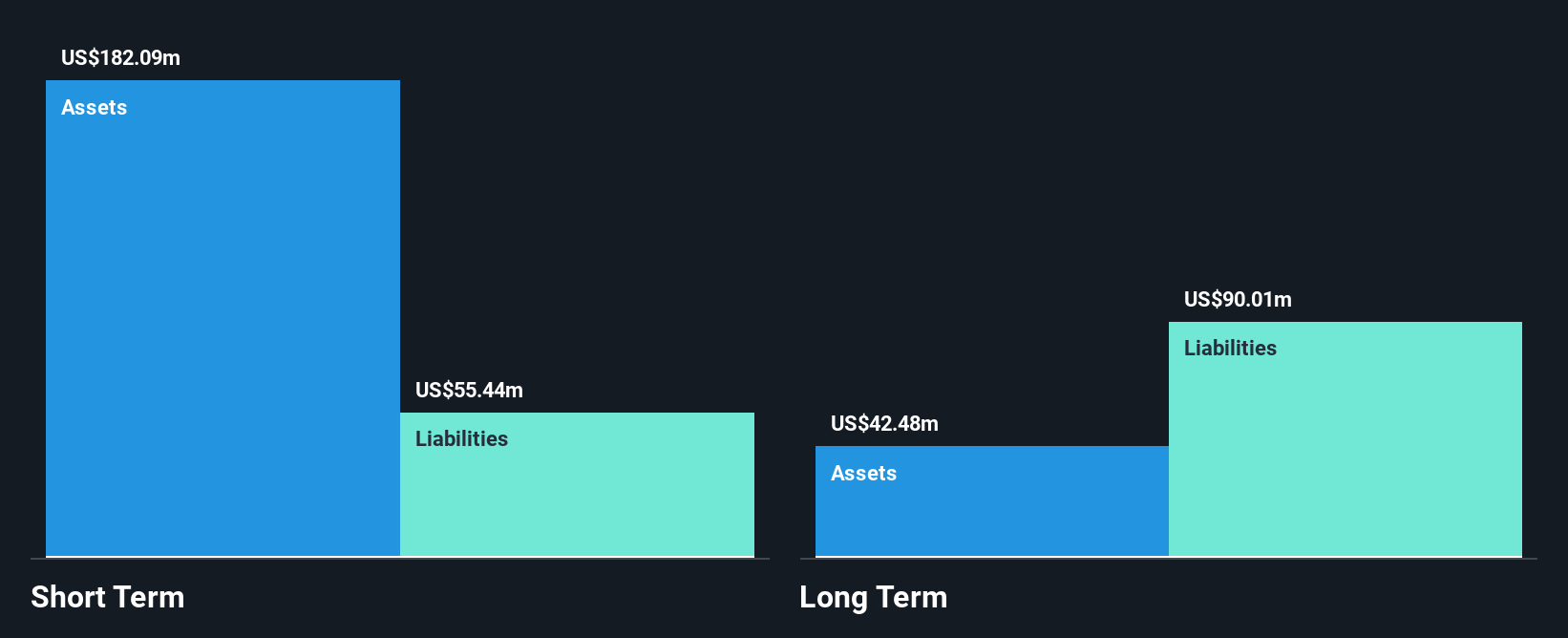

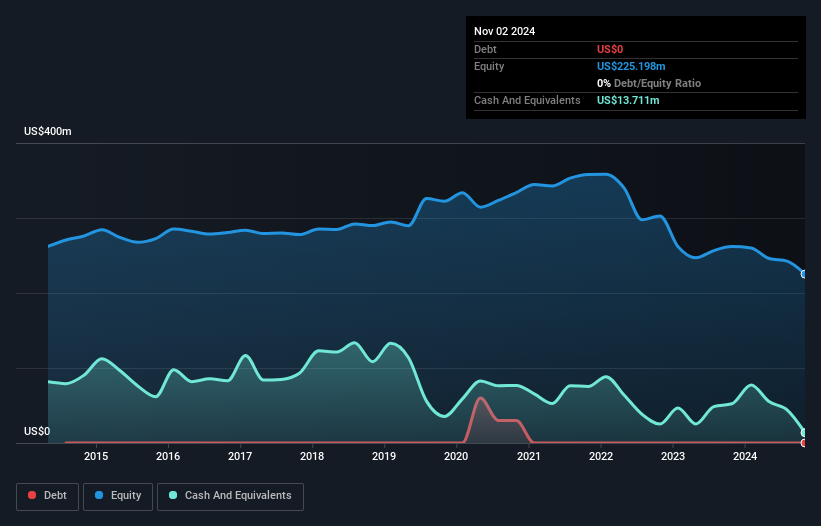

MacroGenics, Inc., with a market cap of US$85.40 million, operates in the biopharmaceutical sector and is currently unprofitable, evidenced by its negative return on equity. Despite this, it has managed to reduce losses by 25.5% annually over the past five years and maintains a stable cash runway for 1.2 years if current growth rates persist. The company is debt-free with short-term assets exceeding liabilities significantly but faces declining earnings forecasts over the next three years. Recent executive changes include the departure of Chief Medical Officer Dr. Stephen Eck, impacting clinical development oversight temporarily.

- Click here to discover the nuances of MacroGenics with our detailed analytical financial health report.

- Learn about MacroGenics' future growth trajectory here.

Vera Bradley (VRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vera Bradley, Inc. designs and manufactures women's handbags, luggage and travel items, fashion and home accessories, and gifts in the United States with a market cap of $61.08 million.

Operations: The company's revenue is derived from two primary segments: Direct, contributing $229.75 million, and Indirect, accounting for $41.38 million.

Market Cap: $61.08M

Vera Bradley, Inc., with a market cap of US$61.08 million, faces challenges as its recent earnings report shows declining sales and increased losses. The company's net loss for the nine months ended November 2025 was US$50.5 million, highlighting financial struggles despite having more cash than total debt and short-term assets exceeding liabilities. Recent strategic moves include appointing Ivan Brockman to the board, potentially bringing valuable investment banking expertise. Additionally, a collaboration with Anthropologie aims to boost brand visibility through a limited-edition collection but profitability remains elusive amidst high volatility and an inexperienced board.

- Get an in-depth perspective on Vera Bradley's performance by reading our balance sheet health report here.

- Evaluate Vera Bradley's prospects by accessing our earnings growth report.

Yatsen Holding (YSG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yatsen Holding Limited, along with its subsidiaries, develops and sells beauty products in the People’s Republic of China and has a market cap of approximately $394.82 million.

Operations: The company's revenue from the People's Republic of China amounts to CN¥4.07 billion.

Market Cap: $394.82M

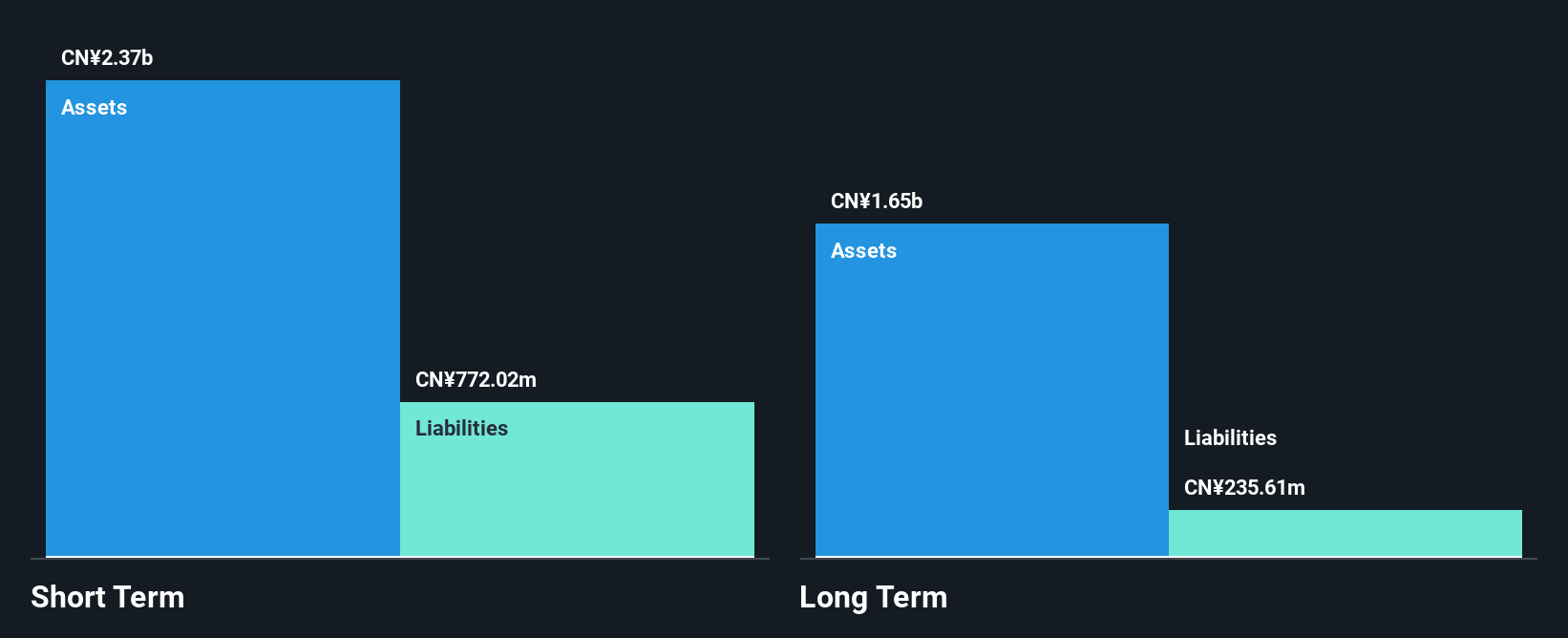

Yatsen Holding Limited, with a market cap of approximately US$394.82 million, is navigating the complexities of being unprofitable but has shown progress by reducing losses at a significant rate over five years. Despite high volatility, its seasoned management and board offer stability. The company recently provided revenue guidance for Q4 2025, projecting an increase between 15% to 30%, reflecting positive operational momentum. With no debt and strong short-term assets exceeding liabilities, Yatsen's financial position is relatively solid in the penny stock landscape despite ongoing challenges in achieving profitability.

- Take a closer look at Yatsen Holding's potential here in our financial health report.

- Review our growth performance report to gain insights into Yatsen Holding's future.

Taking Advantage

- Gain an insight into the universe of 342 US Penny Stocks by clicking here.

- Interested In Other Possibilities? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal