3 Reliable Dividend Stocks Yielding Up To 9.3%

As the U.S. stock market navigates a mixed landscape with rising unemployment and fluctuating indices, investors are increasingly seeking stability through dividend stocks. In such uncertain times, reliable dividend payers can offer consistent income streams, making them an attractive option for those looking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.59% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.18% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.85% | ★★★★★★ |

| Host Hotels & Resorts (HST) | 5.12% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.29% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.71% | ★★★★★★ |

| Ennis (EBF) | 5.51% | ★★★★★★ |

| Dillard's (DDS) | 4.82% | ★★★★★★ |

| Columbia Banking System (COLB) | 4.97% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.13% | ★★★★★★ |

Click here to see the full list of 111 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

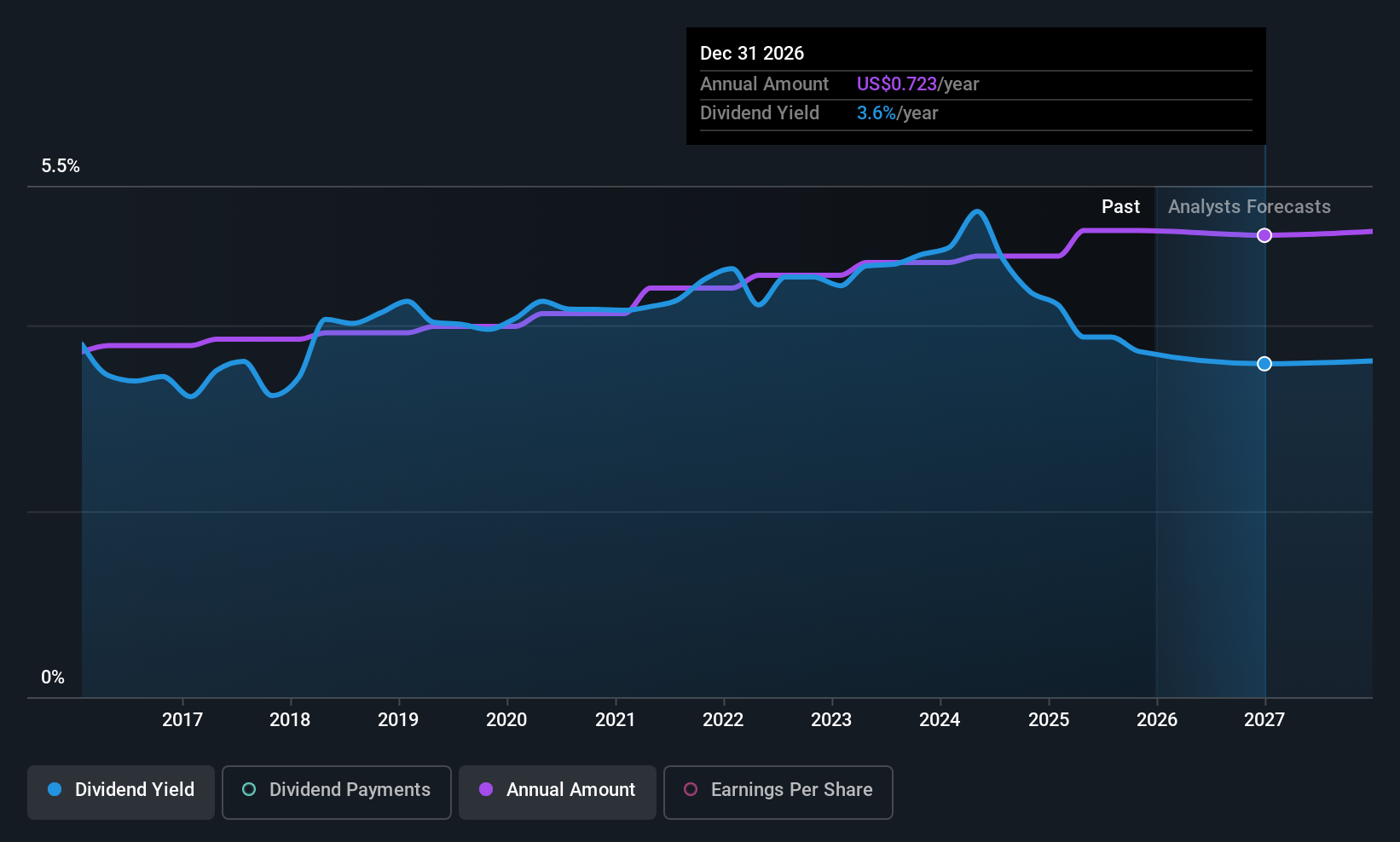

Donegal Group (DGIC.A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Donegal Group Inc. is an insurance holding company that offers commercial and personal lines of property and casualty coverages, with a market cap of $730.37 million.

Operations: Donegal Group Inc.'s revenue is derived from its investments ($53.12 million), personal lines of property and casualty coverages ($379.20 million), and commercial lines of property and casualty coverages ($551.73 million).

Dividend Yield: 3.5%

Donegal Group's dividend yield of 3.52% is lower than the top quartile of US dividend payers but remains attractive due to its stability and growth over the past decade. The dividends are well-covered, with a payout ratio of 29.5% and cash payout ratio of 30.2%, indicating sustainability. Despite recent earnings growth, future declines are forecasted. Recent financials show steady net income improvement, though revenue slightly decreased year-over-year for Q3 2025 at US$245.92 million.

- Click here to discover the nuances of Donegal Group with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Donegal Group's current price could be quite moderate.

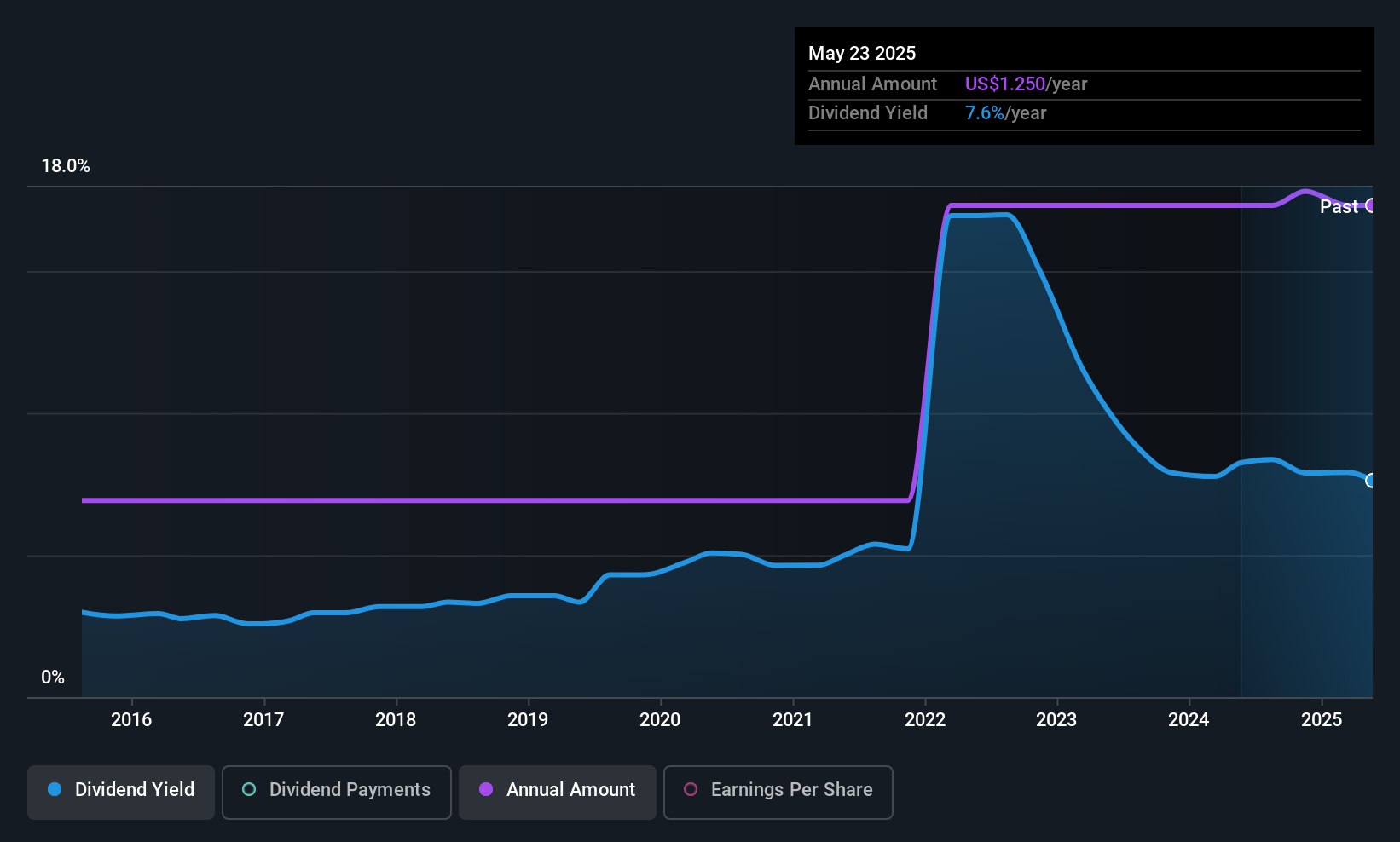

Spok Holdings (SPOK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Spok Holdings, Inc., through its subsidiary Spok, Inc., offers healthcare communication solutions across various regions including the United States, Europe, Canada, Australia, Asia, and the Middle East with a market cap of $274.99 million.

Operations: Spok Holdings, Inc. generates revenue primarily from its Clinical Communication and Collaboration Business, amounting to $139.74 million.

Dividend Yield: 9.3%

Spok Holdings offers a high dividend yield of 9.31%, placing it in the top 25% of US dividend payers, yet its sustainability is questionable due to coverage issues with earnings and cash flows. Despite stable and growing dividends over the past decade, a high payout ratio of 154.2% raises concerns. Recent financials show slight declines in Q3 revenue and net income year-over-year, though annual figures indicate some growth in earnings per share from continuing operations.

- Navigate through the intricacies of Spok Holdings with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Spok Holdings' current price could be inflated.

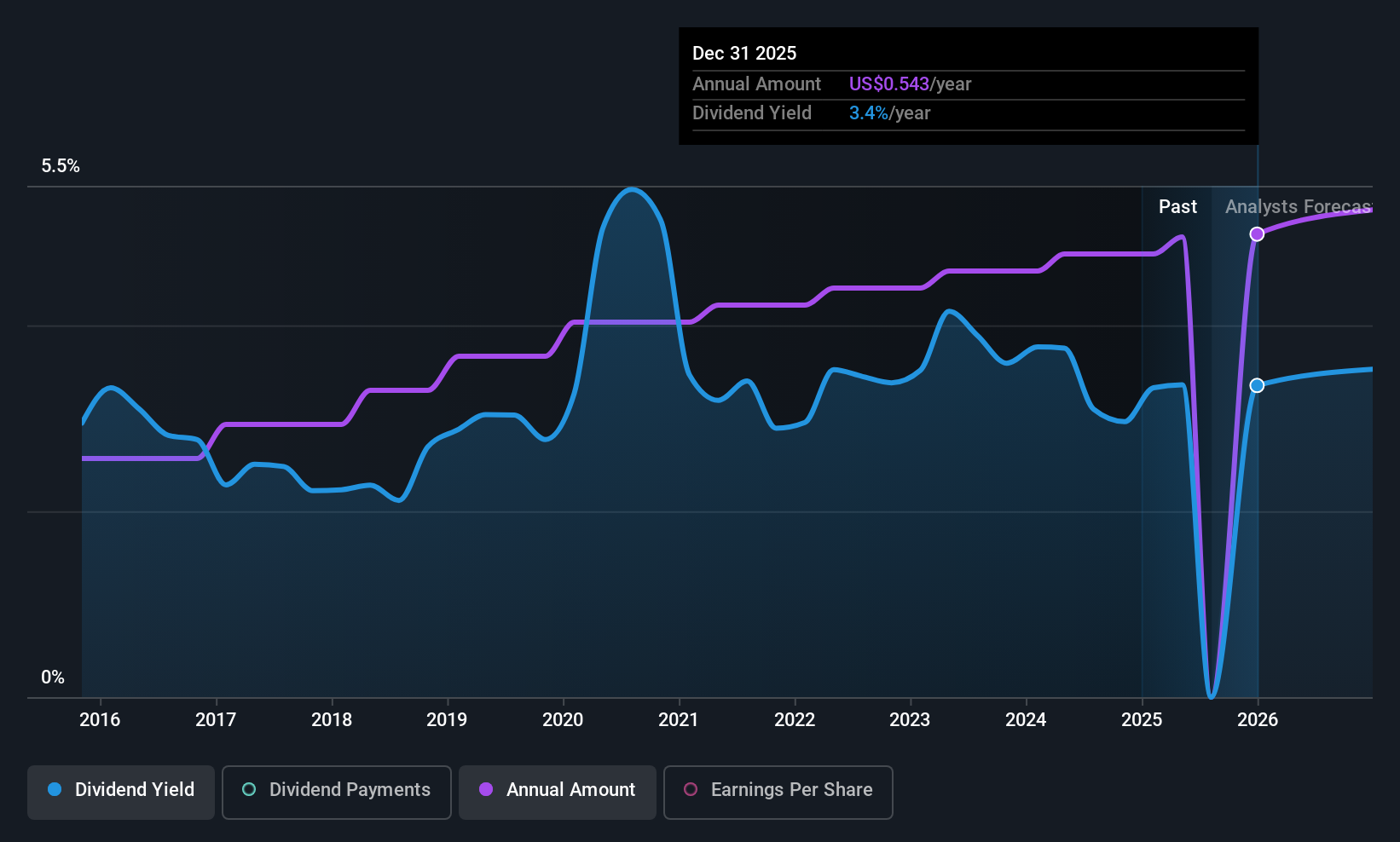

First Commonwealth Financial (FCF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Commonwealth Financial Corporation is a financial holding company offering a range of consumer and commercial banking products and services in the United States, with a market cap of approximately $1.77 billion.

Operations: First Commonwealth Financial Corporation generates revenue primarily through its banking segment, which accounted for $468.73 million.

Dividend Yield: 3.1%

First Commonwealth Financial maintains a stable dividend history with a 3.07% yield, supported by a low payout ratio of 38.4%, ensuring coverage by earnings. Recent financials show increased net interest income and net income for Q3 2025, enhancing its dividend reliability. The company announced a $25 million share repurchase program, signaling confidence in its financial health despite recent charge-offs. However, the yield remains below top-tier US dividend payers' averages.

- Take a closer look at First Commonwealth Financial's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that First Commonwealth Financial is trading behind its estimated value.

Key Takeaways

- Dive into all 111 of the Top US Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal