Delta Air Lines, Inc. (NYSE:DAL) Shares Fly 25% But Investors Aren't Buying For Growth

Delta Air Lines, Inc. (NYSE:DAL) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Looking further back, the 18% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

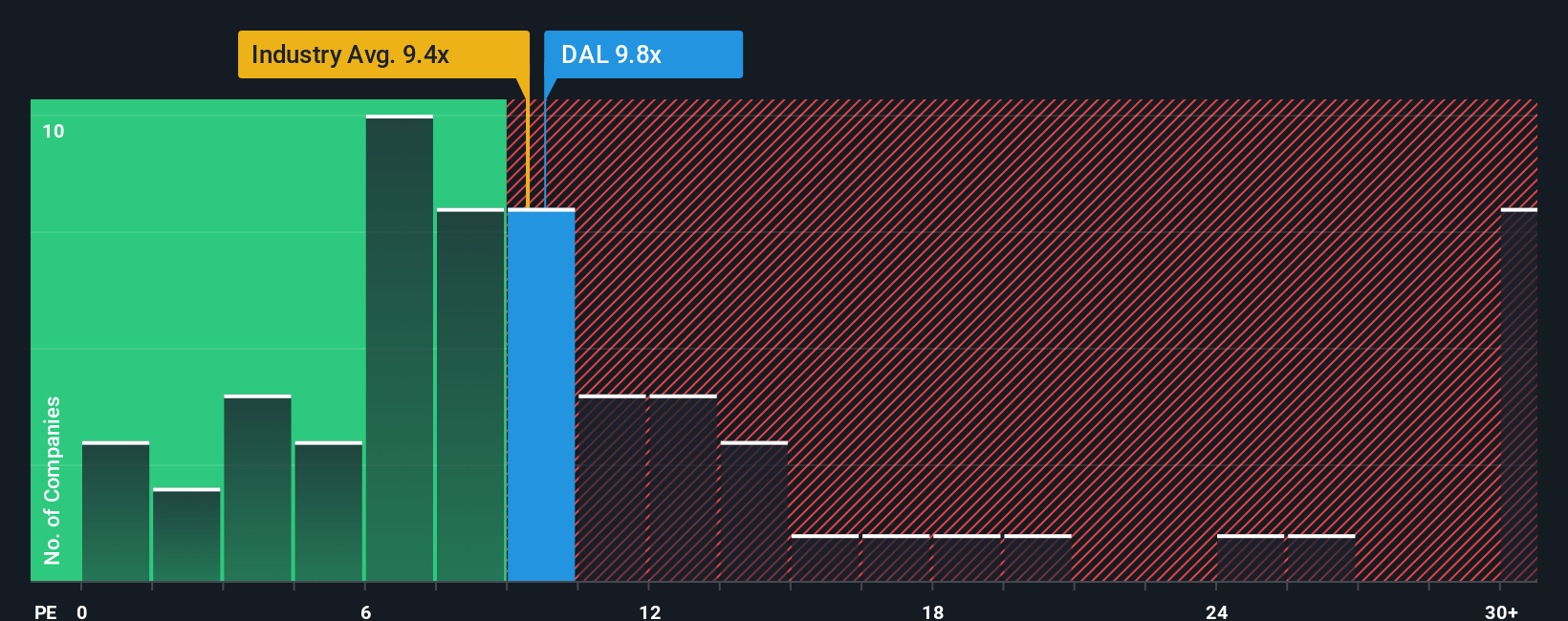

Even after such a large jump in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 20x, you may still consider Delta Air Lines as an attractive investment with its 9.8x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Delta Air Lines hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Delta Air Lines

Is There Any Growth For Delta Air Lines?

In order to justify its P/E ratio, Delta Air Lines would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 1.6%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 5,517% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 3.8% per year over the next three years. With the market predicted to deliver 11% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Delta Air Lines' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Delta Air Lines' P/E?

The latest share price surge wasn't enough to lift Delta Air Lines' P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Delta Air Lines maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Delta Air Lines is showing 2 warning signs in our investment analysis, and 1 of those is concerning.

If you're unsure about the strength of Delta Air Lines' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal