EnerSys (ENS): Assessing Valuation After a 52% Year‑to‑Date Rally and Recent Pullback

EnerSys (ENS) has quietly become a strong performer, with the stock up about 52% year-to-date and roughly 50% over the past year, even after a recent pullback this week.

See our latest analysis for EnerSys.

The latest dip, including a 3.22% one day share price decline, looks more like a breather after a strong run. A 90 day share price return of 25.85% suggests momentum is still broadly intact, alongside a solid multi year total shareholder return profile.

If EnerSys has caught your attention, this is a good moment to broaden your search and discover fast growing stocks with high insider ownership.

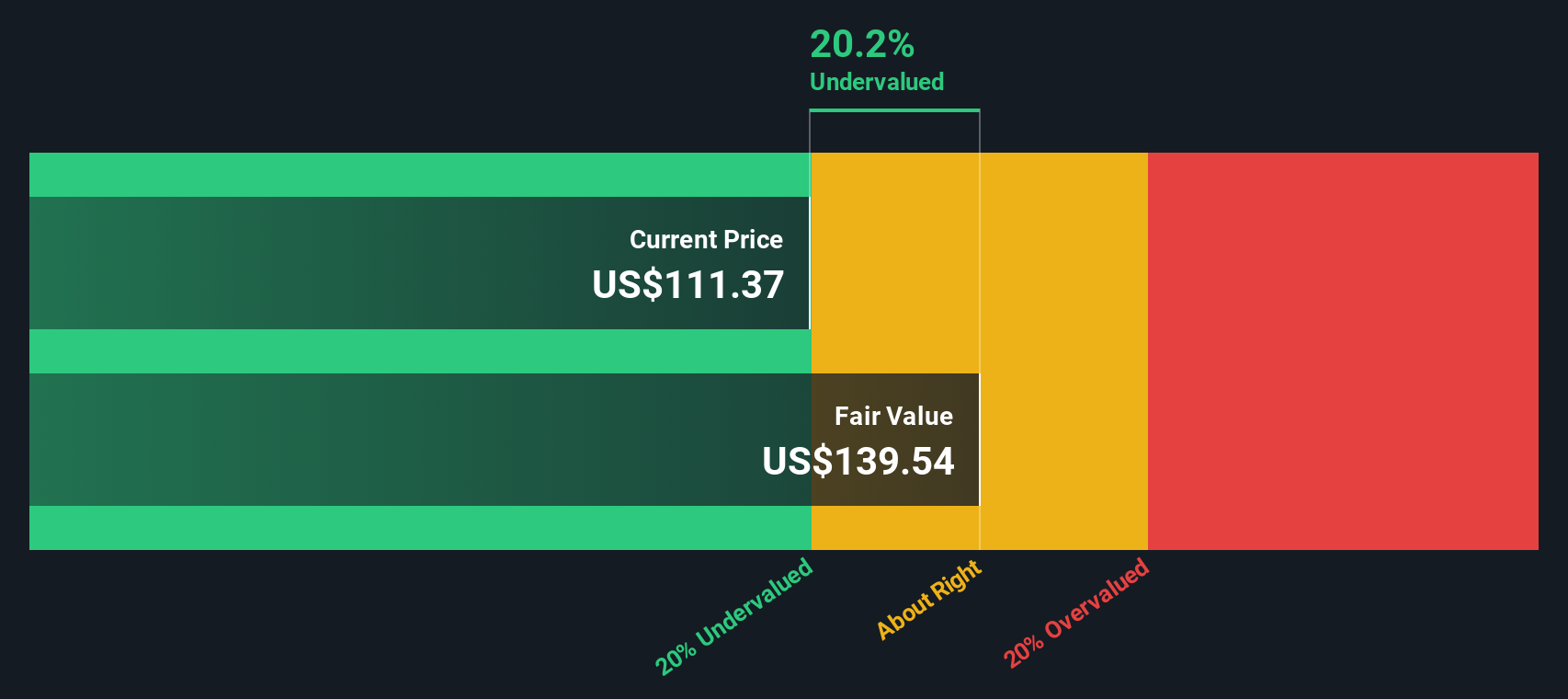

With earnings growing faster than revenue and the share price still below analyst targets, the key question now is whether EnerSys remains undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 3% Undervalued

With EnerSys last closing at $140.16 against a most popular narrative fair value of about $144, the story hinges on steady growth and expanding margins rather than explosive upside.

Major cost reduction initiatives, including a strategic realignment and transition to Centers of Excellence (CoEs), are expected to generate $80 million in annualized savings starting in fiscal 2026, structurally expanding net and operating margins. EnerSys is embedding IoT and predictive analytics capabilities into its products, enabling cross selling of higher value services and energy management solutions, which should expand the addressable market and support both top line growth and margin improvement over time.

Want to see how modest revenue growth, rising margins, and a future earnings multiple combine to justify that fair value? The narrative reveals the full playbook driving this balanced, long term outlook.

Result: Fair Value of $144 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering trade policy uncertainty and dependence on acquisition-driven growth could still derail the margin and earnings improvements underpinning this optimistic outlook.

Find out about the key risks to this EnerSys narrative.

Another Angle on Valuation

Our SWS DCF model paints a very different picture, suggesting fair value closer to $58.51 per share. This would make EnerSys look overvalued at today’s price of more than $140 per share. Is the cash flow view too harsh, or are earnings based narratives too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out EnerSys for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own EnerSys Narrative

If you see EnerSys differently or want to dig into the numbers yourself, you can craft a personalized narrative in just a few minutes, Do it your way.

A great starting point for your EnerSys research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

EnerSys might be compelling, but you will miss a broader opportunity set if you stop here. Use the Simply Wall Street Screener to uncover your next strong candidate.

- Capitalize on mispriced opportunities by targeting these 906 undervalued stocks based on cash flows that pair solid fundamentals with attractive cash flow profiles.

- Ride powerful technological shifts by focusing on these 26 AI penny stocks positioned at the heart of machine learning and automation growth.

- Strengthen your income strategy by locking in these 13 dividend stocks with yields > 3% that offer yields above 3% with the potential for long term reliability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal