Newegg Commerce (NEGG): Valuation Check After Vladimir Galkin Lifts Stake to 17.6% and Shares Jump 27%

Newegg Commerce (NEGG) just jumped about 27% in a day after investor Vladimir Galkin boosted his stake to roughly 18%, a move that quickly pulled speculative traders into the stock.

See our latest analysis for Newegg Commerce.

That surge sits on top of a huge backdrop, with Newegg’s year to date share price return of around 503% and a 1 year total shareholder return above 500% signaling strong, if volatile, momentum that traders are trying to ride as new events like the AMD Game On partnership keep the story in the headlines.

If you are wondering what else might be setting up for big moves, this is a good moment to explore high growth tech and AI stocks as potential next candidates for your watchlist.

With the share price already up more than fivefold in a year despite ongoing losses, the key question now is whether Newegg is still trading below its fundamentals or if markets are already pricing in all the future growth.

Price-to-Sales of 0.8x: Is it justified?

On valuation, Newegg’s latest close of $53.80 sits against a price-to-sales ratio of 0.8 times, which screens as expensive versus its industry but cheaper than its closest peer set.

The price-to-sales multiple compares the company’s market value with the revenue it generates, a useful lens for loss-making or low-profit retailers like Newegg where earnings can be volatile or negative.

Here, the market is assigning Newegg a richer tag than the broader US specialty retail group, which trades at about 0.5 times sales. This suggests investors are baking in stronger potential or speculative upside. Yet that 0.8 times still undercuts a 1.2 times average for peers, hinting that some relative value remains if Newegg can close the profitability gap.

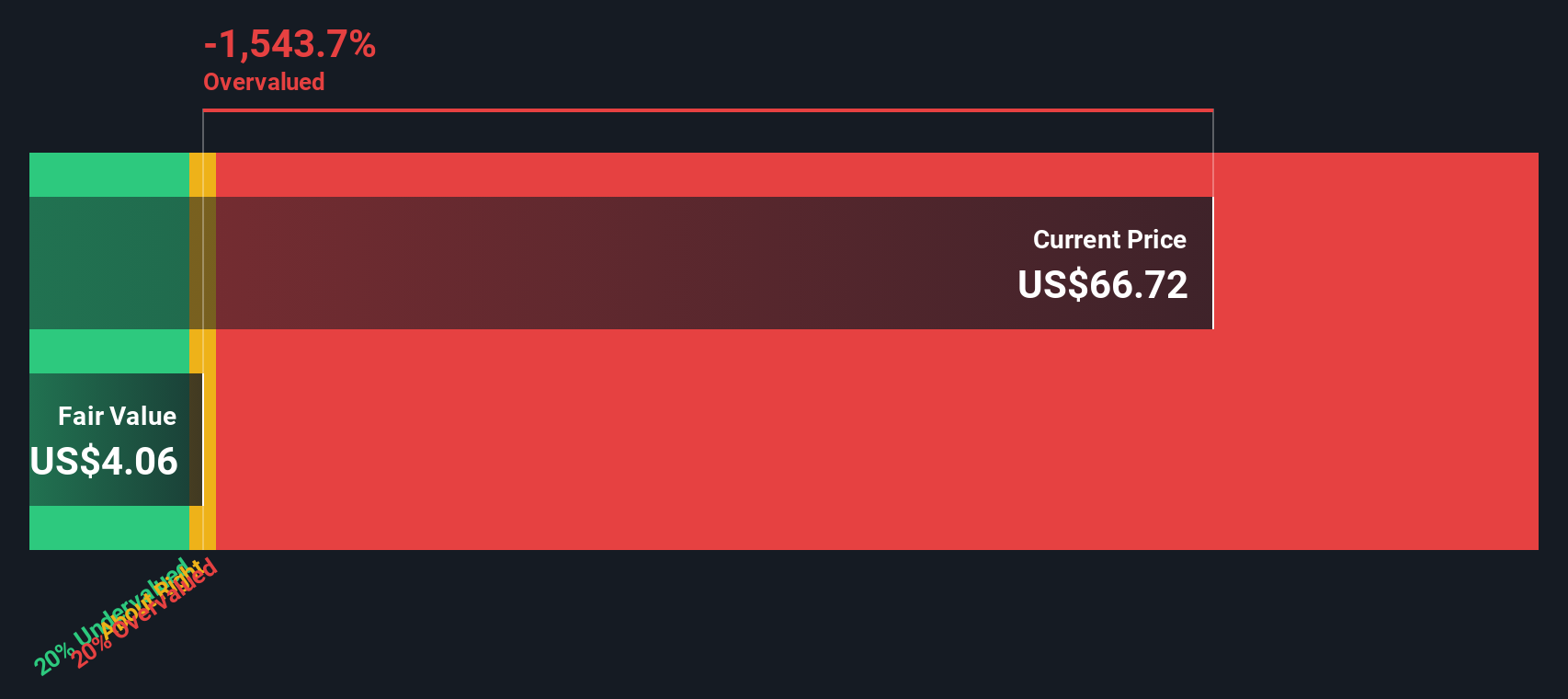

Against this backdrop, the SWS DCF model paints a far more conservative picture, with fair value estimated at just $3.96 per share. This means the current price is trading well above what long-term cash flow projections alone might justify.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 0.8x (OVERVALUED)

However, ongoing net losses and the lack of visible revenue growth leave little margin for operational missteps or weaker tech hardware demand to upset the bull case.

Find out about the key risks to this Newegg Commerce narrative.

Another View: Cash Flows Tell a Harsher Story

While the 0.8 times sales tag hints at only mild overvaluation, the SWS DCF model is far more skeptical and puts fair value at just $3.96 per share, well below today’s $53.80 price. If cash flows do not catch up, how long can sentiment keep the premium alive?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Newegg Commerce for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Newegg Commerce Narrative

If you see the data differently or prefer to dig into the numbers yourself, you can quickly assemble a personalized view in under three minutes: Do it your way.

A great starting point for your Newegg Commerce research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities by using the Simply Wall St Screener to uncover stocks that match your exact strategy and risk profile.

- Target potential multi-baggers by scanning through these 3637 penny stocks with strong financials that already show financial resilience instead of blind speculation.

- Capitalize on structural tech shifts by zeroing in on these 26 AI penny stocks positioned at the intersection of innovation and scalable business models.

- Strengthen your core portfolio by focusing on these 906 undervalued stocks based on cash flows that market sentiment has overlooked, while their cash flows tell a different story.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal