Golden Energy Offshore Services ASA (OB:GEOS) Stock's 56% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The Golden Energy Offshore Services ASA (OB:GEOS) share price has fared very poorly over the last month, falling by a substantial 56%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 60% loss during that time.

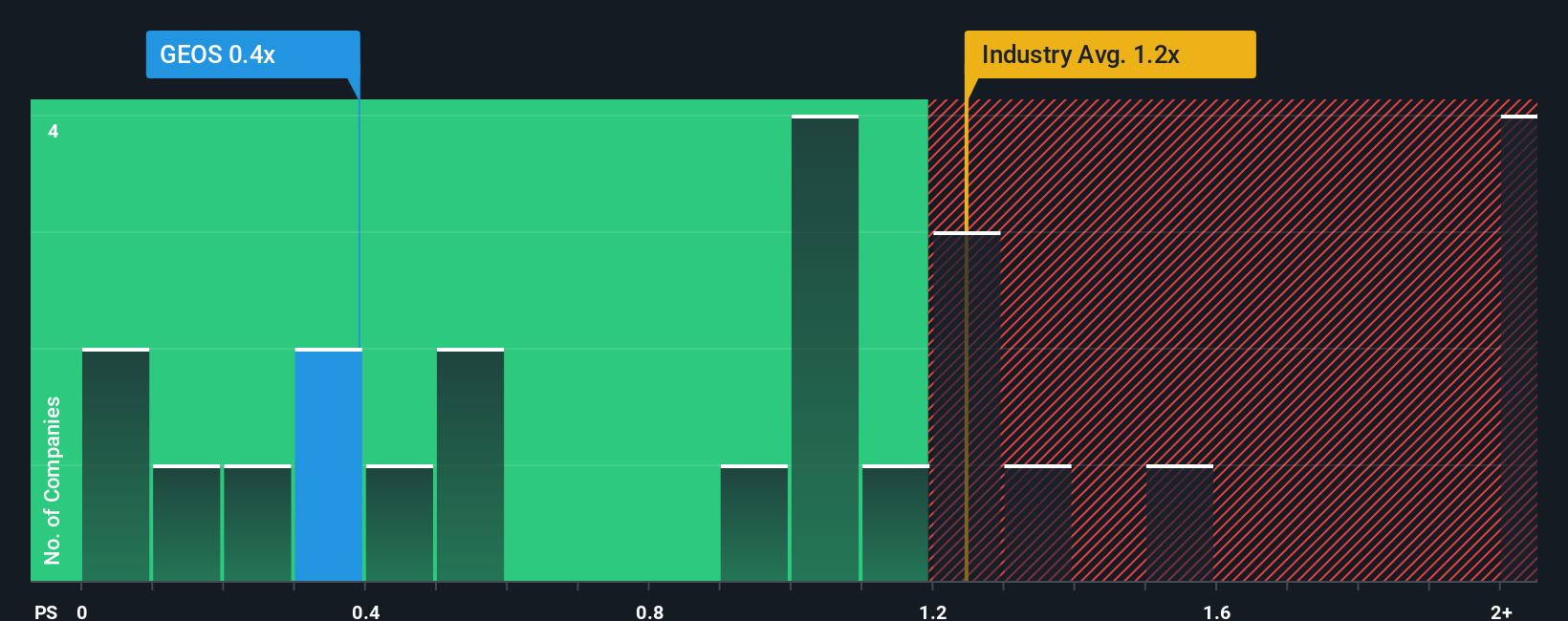

Following the heavy fall in price, it would be understandable if you think Golden Energy Offshore Services is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in Norway's Oil and Gas industry have P/S ratios above 1.1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Golden Energy Offshore Services

How Has Golden Energy Offshore Services Performed Recently?

The revenue growth achieved at Golden Energy Offshore Services over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Golden Energy Offshore Services will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Golden Energy Offshore Services?

The only time you'd be truly comfortable seeing a P/S as low as Golden Energy Offshore Services' is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. Pleasingly, revenue has also lifted 263% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 8.0% shows it's a great look while it lasts.

In light of this, it's quite peculiar that Golden Energy Offshore Services' P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Golden Energy Offshore Services' P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at the figures, it's surprising to see Golden Energy Offshore Services currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. One assumption would be that there are some underlying risks to revenue that are keeping the P/S from rising to match the its strong performance. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

You need to take note of risks, for example - Golden Energy Offshore Services has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal