3 Global Penny Stocks With At Least US$400M Market Cap

As global markets navigate the complexities of interest rate adjustments and economic uncertainties, investors continue to explore diverse opportunities. Penny stocks, despite their somewhat outdated moniker, remain an intriguing area for those interested in smaller or newer companies. With strong financial underpinnings, these stocks can offer potential growth and stability; this article will highlight several examples that demonstrate such promise.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Cloudpoint Technology Berhad (KLSE:CLOUDPT) | MYR0.65 | MYR345.54M | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.51 | HK$927.78M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.14 | £474.95M | ✅ 5 ⚠️ 0 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.52 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €223.46M | ✅ 3 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.09 | SGD441.77M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.52 | SGD13.85B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.675 | $392.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.115 | £179.44M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,641 stocks from our Global Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Guizhou Yibai Pharmaceutical (SHSE:600594)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Guizhou Yibai Pharmaceutical Co., Ltd. is engaged in the research, development, production, and sale of pharmaceutical products in China with a market cap of CN¥3.18 billion.

Operations: The company's revenue is primarily generated from its operations in China, amounting to CN¥1.91 billion.

Market Cap: CN¥3.18B

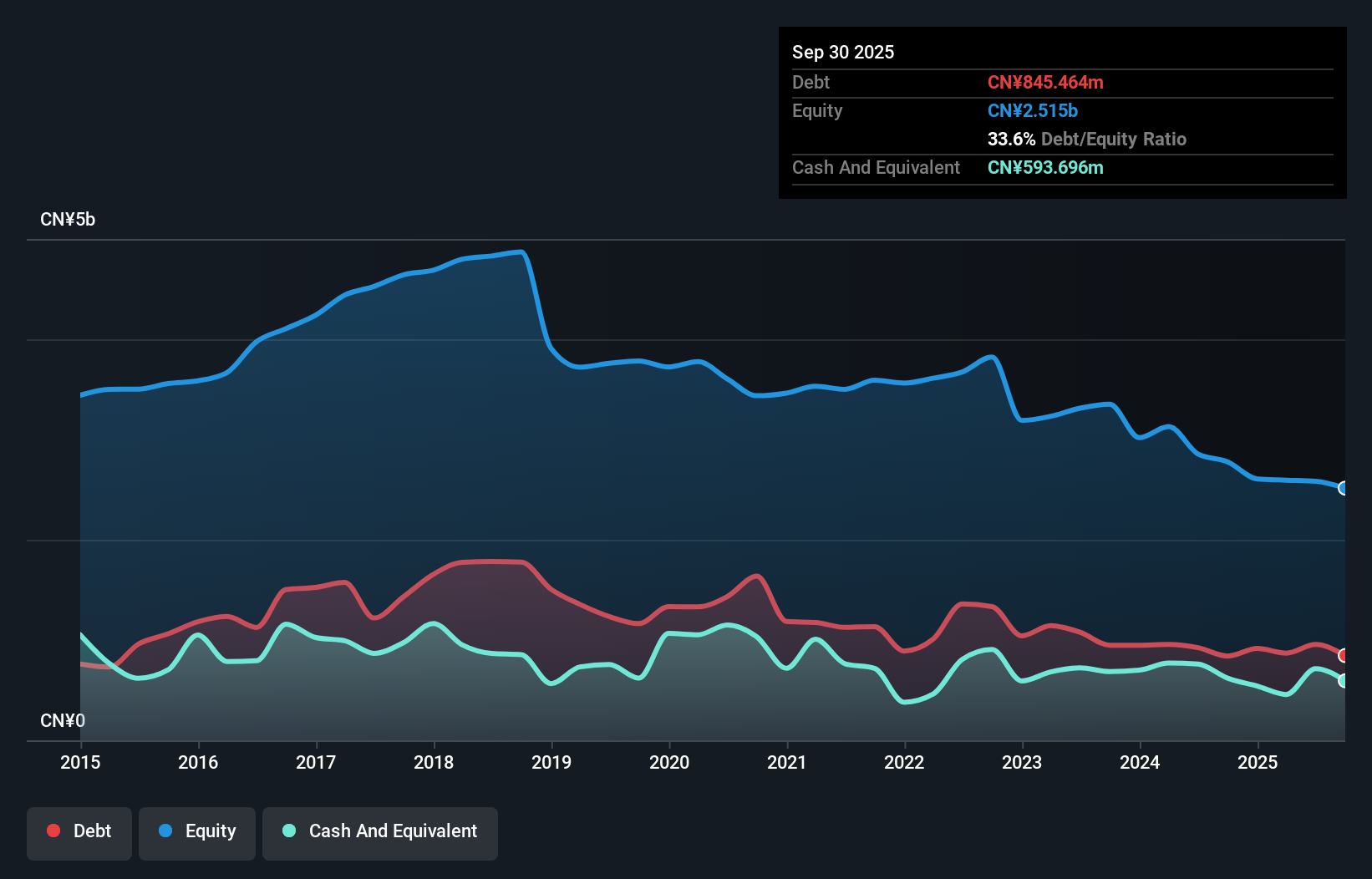

Guizhou Yibai Pharmaceutical, with a market cap of CN¥3.18 billion, faces challenges as it remains unprofitable, with losses increasing by 49.4% annually over the past five years. Despite this, its board and management are experienced, and the company has not significantly diluted shareholders recently. The debt-to-equity ratio has improved from 47.6% to 33.6% over five years, supported by short-term assets covering both short- and long-term liabilities comfortably. Recent earnings showed a net loss reduction from CN¥169.15 million to CN¥86.56 million year-over-year for nine months ending September 2025, indicating some progress in financial management despite ongoing profitability issues.

- Click to explore a detailed breakdown of our findings in Guizhou Yibai Pharmaceutical's financial health report.

- Evaluate Guizhou Yibai Pharmaceutical's historical performance by accessing our past performance report.

Wenfeng Great World Chain Development (SHSE:601010)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wenfeng Great World Chain Development Corporation operates a commercial retail chain in China with a market cap of CN¥5.40 billion.

Operations: The company's revenue is derived entirely from its operations in China, totaling CN¥1.69 billion.

Market Cap: CN¥5.4B

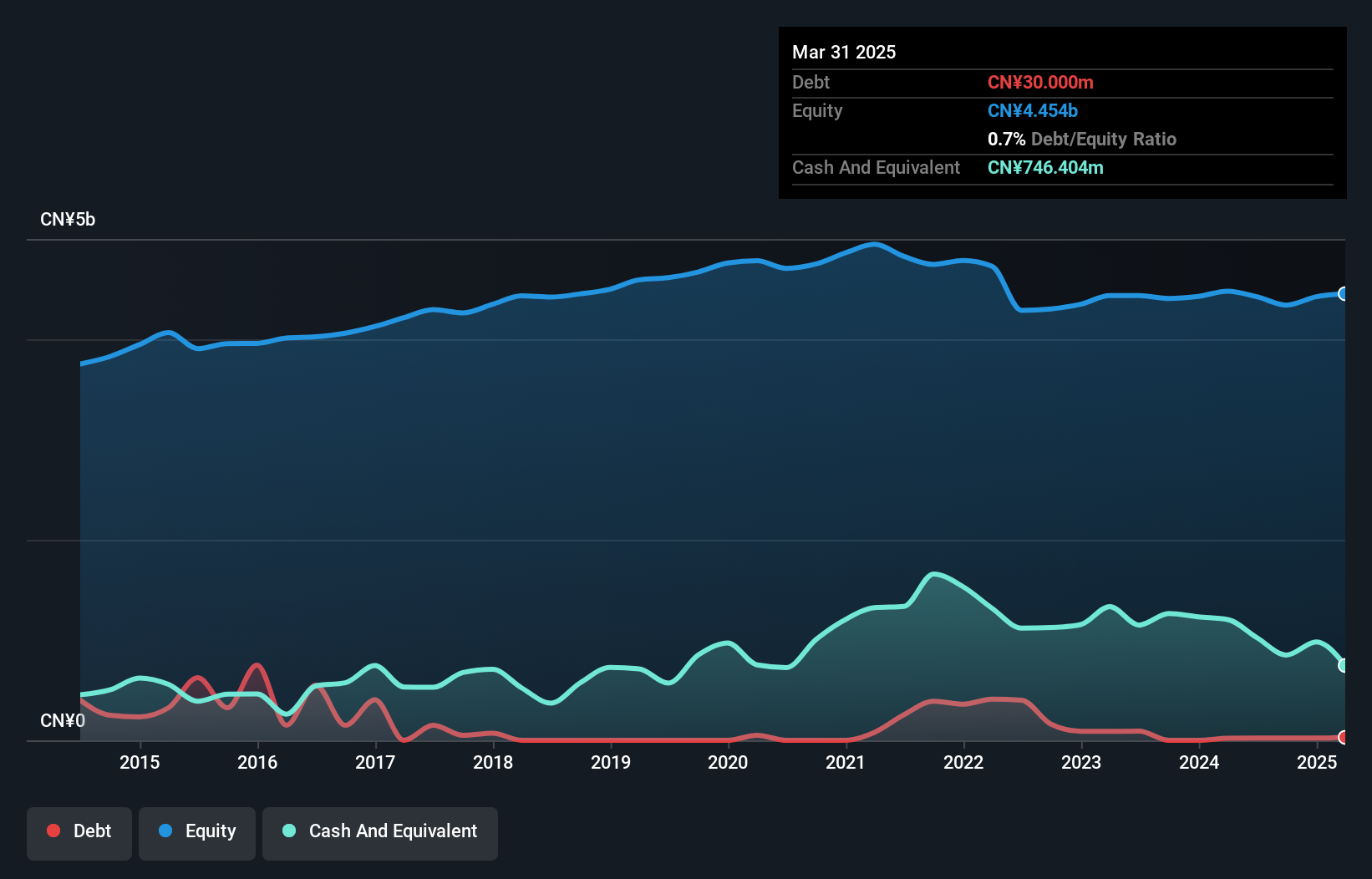

Wenfeng Great World Chain Development, with a market cap of CN¥5.40 billion, faces challenges as earnings have declined by 14.7% annually over the past five years. Despite having more cash than debt and covering interest payments comfortably, its short-term assets fall short of liabilities. The company's return on equity is low at 2.5%, and recent earnings show a significant drop in net income from CN¥69.37 million to CN¥16.99 million year-over-year for nine months ending September 2025, reflecting ongoing profitability struggles amidst stable management tenure and an inexperienced board of directors.

- Navigate through the intricacies of Wenfeng Great World Chain Development with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Wenfeng Great World Chain Development's track record.

Dezhan Healthcare (SZSE:000813)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dezhan Healthcare Company Limited focuses on the research, development, manufacture, and sale of cardiovascular and cerebrovascular drugs in China, with a market cap of CN¥8.07 billion.

Operations: Dezhan Healthcare Company Limited has not reported specific revenue segments.

Market Cap: CN¥8.07B

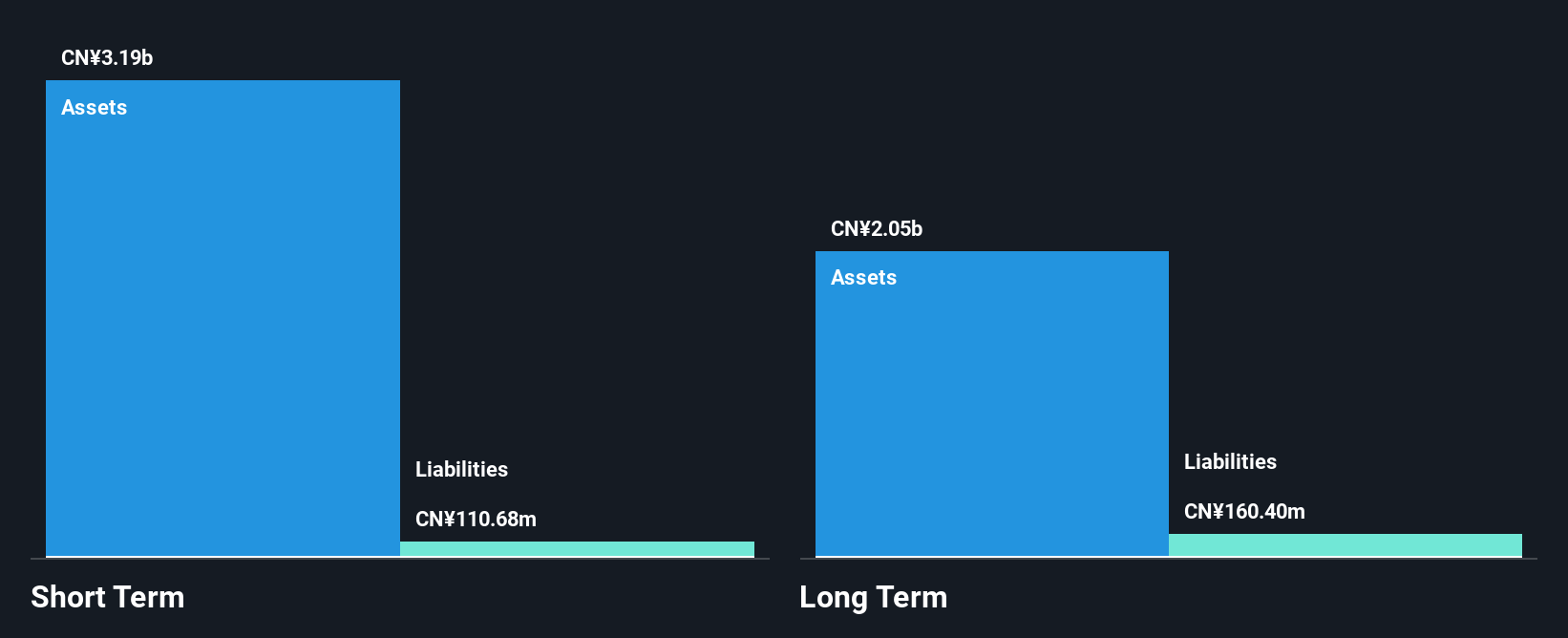

Dezhan Healthcare, with a market cap of CN¥8.07 billion, has experienced a decline in earnings, reporting sales of CN¥277.5 million for nine months ending September 2025 compared to CN¥354.47 million the previous year, and a net loss of CN¥61.03 million from a prior net income of CN¥8.09 million. Despite being unprofitable and having negative return on equity (-2.47%), the company maintains financial stability with short-term assets (CN¥3.2 billion) exceeding both short-term and long-term liabilities significantly, and its debt is well covered by operating cash flow (32.1%). Management shows moderate experience with an average tenure of 2.3 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Dezhan Healthcare.

- Assess Dezhan Healthcare's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Take a closer look at our Global Penny Stocks list of 3,641 companies by clicking here.

- Searching for a Fresh Perspective? These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal