Planet Fitness (PLNT) Valuation Check After $750m Refinancing and Expanded Share Buyback Plans

Planet Fitness (PLNT) just reshaped its balance sheet and capital return playbook, closing a $750 million refinancing while simultaneously leaning into share buybacks with a $350 million accelerated repurchase and a fresh $500 million authorization.

See our latest analysis for Planet Fitness.

Those moves land during a solid upswing, with the 1 month share price return at 7.6 percent and the 3 year total shareholder return above 40 percent. This suggests momentum is quietly rebuilding as investors warm to the growth and capital return story.

If Planet Fitness's capital shuffle has you thinking more broadly about where growth and ownership conviction align, now is a good time to explore fast growing stocks with high insider ownership.

Yet with Planet Fitness growing double digits and still trading nearly 19 percent below the average analyst target, investors now face a key question: Is Wall Street underestimating the upside or already baking in future gains?

Most Popular Narrative: 15.7% Undervalued

With Planet Fitness closing at $110 and the most followed narrative pointing to fair value just above $130, the story leans toward meaningful upside built on growth and margins.

Analysts are assuming Planet Fitness's revenue will grow by 11.6% annually over the next 3 years. Analysts assume that profit margins will increase from 16.2% today to 19.3% in 3 years time.

Want to see what happens when steady double digit growth meets rising margins and a premium earnings multiple usually reserved for market darlings? The assumptions behind this target might surprise you.

Result: Fair Value of $130.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could unravel if online cancellations keep attrition elevated, or if aggressive club expansion cannibalizes existing locations and pressures franchise economics.

Find out about the key risks to this Planet Fitness narrative.

Another View: Rich on Earnings

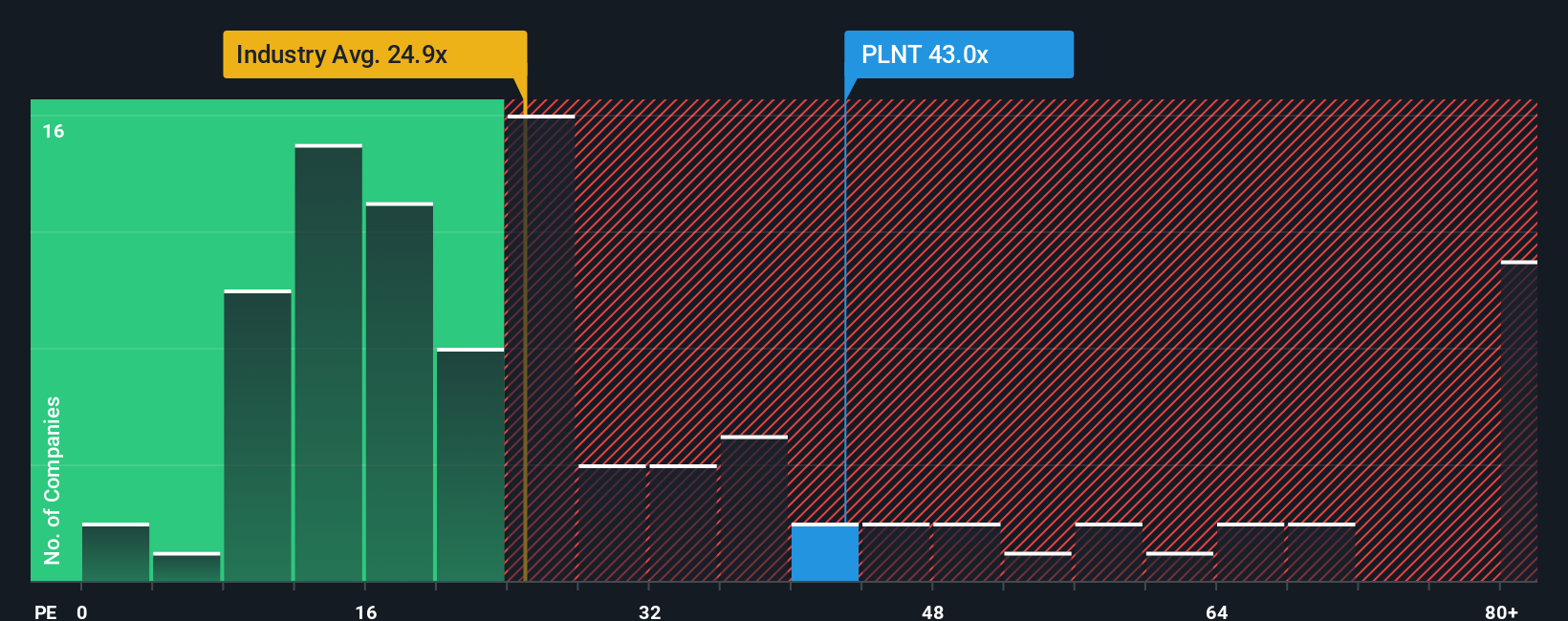

While the narrative points to upside versus analyst targets, our valuation checks based on the price to earnings ratio flash a very different signal. Planet Fitness trades at 44.4 times earnings, well above the US Hospitality average of 24.1 times and above its own fair ratio of 23.7 times.

In practice, that means investors are already paying a premium price that assumes years of strong execution and growth, leaving less room for error if churn, leverage, or expansion stumble. Is this a quality growth story worth that kind of multiple risk, or has optimism run a bit too far ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Planet Fitness for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Planet Fitness Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom view in just minutes: Do it your way.

A great starting point for your Planet Fitness research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Before you move on, you can scan curated stock ideas on Simply Wall Street’s powerful screener so new opportunities do not slip past you.

- Consider mispriced quality by targeting companies trading below their cash flow potential with these 912 undervalued stocks based on cash flows.

- Explore the next wave of innovation by focusing on cutting edge automation and data driven businesses using these 26 AI penny stocks.

- Develop your income strategy by reviewing companies with reliable payouts and attractive yields through these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal