It's Down 29% But Interoil Exploration and Production ASA (OB:IOX) Could Be Riskier Than It Looks

Unfortunately for some shareholders, the Interoil Exploration and Production ASA (OB:IOX) share price has dived 29% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 64% share price decline.

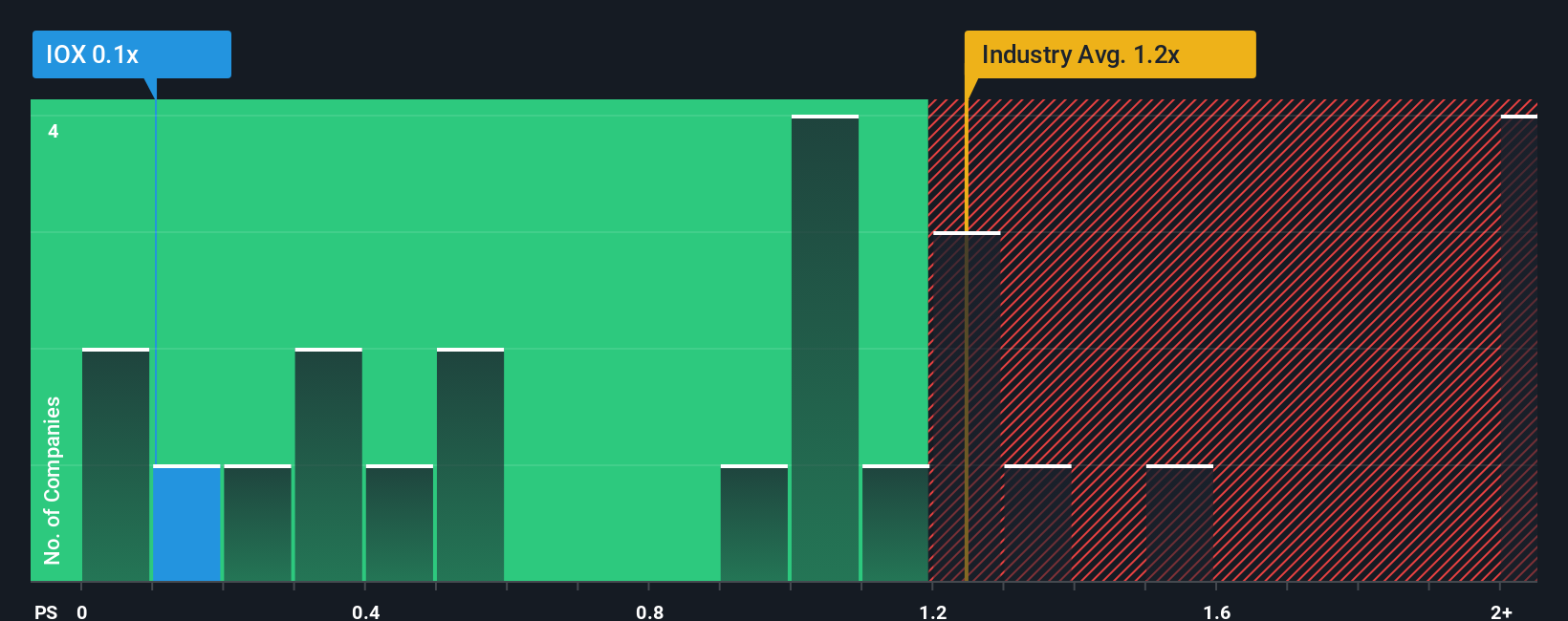

Following the heavy fall in price, given about half the companies operating in Norway's Oil and Gas industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider Interoil Exploration and Production as an attractive investment with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Interoil Exploration and Production

How Has Interoil Exploration and Production Performed Recently?

For example, consider that Interoil Exploration and Production's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Interoil Exploration and Production will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Interoil Exploration and Production's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 35%. As a result, revenue from three years ago have also fallen 8.4% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to shrink 8.0% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

In light of this, the fact Interoil Exploration and Production's P/S sits below the majority of other companies is peculiar but certainly not shocking. There's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. There is still potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Final Word

The southerly movements of Interoil Exploration and Production's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look into numbers has shown it's somewhat unexpected that Interoil Exploration and Production has a lower P/S than the industry average, given its recent three-year revenue performance which was better than anticipated for an industry facing challenges. When we see better than average revenue growth but a lower than average P/S, we must assume that potential risks are what might be placing significant pressure on the P/S ratio. Perhaps there is some hesitation about the company's ability to stay its recent course and resist the broader industry turmoil. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Having said that, be aware Interoil Exploration and Production is showing 5 warning signs in our investment analysis, and 4 of those are a bit concerning.

If these risks are making you reconsider your opinion on Interoil Exploration and Production, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal