Tokyo Seimitsu (TSE:7729) Valuation After New AI-Focused Semiconductor Testing Collaboration With Advantest

Tokyo Seimitsu (TSE:7729) just teamed up with Advantest to co develop a die level prober aimed at AI and high performance computing chips, a move that goes straight to the heart of next generation semiconductor testing demand.

See our latest analysis for Tokyo Seimitsu.

The partnership news lands as Tokyo Seimitsu enjoys solid momentum, with a roughly 43% year to date share price return and a powerful 3 year total shareholder return above 160%, suggesting investors are warming to its growth story.

If this AI testing collaboration has your attention, it could be a good moment to explore other high growth tech names using Simply Wall St's high growth tech and AI stocks.

But with the share price already up sharply and trading only modestly below analyst targets, investors now face a tougher question: is Tokyo Seimitsu still a compelling opportunity, or is future growth already priced in?

Price to Earnings of 19.6x: Is it justified?

On a last close of ¥10,500, Tokyo Seimitsu trades on a 19.6x price to earnings ratio, pointing to reasonable pricing versus semiconductor peers rather than an obvious bargain.

The price to earnings multiple compares the current share price with the company’s earnings, a key yardstick for profitable, established semiconductor and equipment makers where earnings power matters more than raw sales growth.

In Tokyo Seimitsu’s case, the 19.6x multiple suggests the market is willing to pay a solid premium for its earnings profile, but not an extreme one, especially given earnings are forecast to grow faster than the broader Japanese market and have compounded at a double digit pace over five years. With the market multiple sitting very close to our estimated fair price to earnings ratio of 20.1x, there is a strong signal that investors may already be pricing the stock near a level our fair ratio indicates it could gravitate toward.

Compared with the Japanese semiconductor industry average multiple of 19.9x, Tokyo Seimitsu is trading at a slight discount, and the gap is far wider versus the peer group average of 59.1x, underscoring how restrained the current valuation looks against some faster growing or more speculative names in the space.

Explore the SWS fair ratio for Tokyo Seimitsu

Result: Price to Earnings of 19.6x (ABOUT RIGHT)

However, investors should watch for a cyclical semiconductor downturn or delays in AI related demand, either of which could quickly compress Tokyo Seimitsu’s earnings multiple.

Find out about the key risks to this Tokyo Seimitsu narrative.

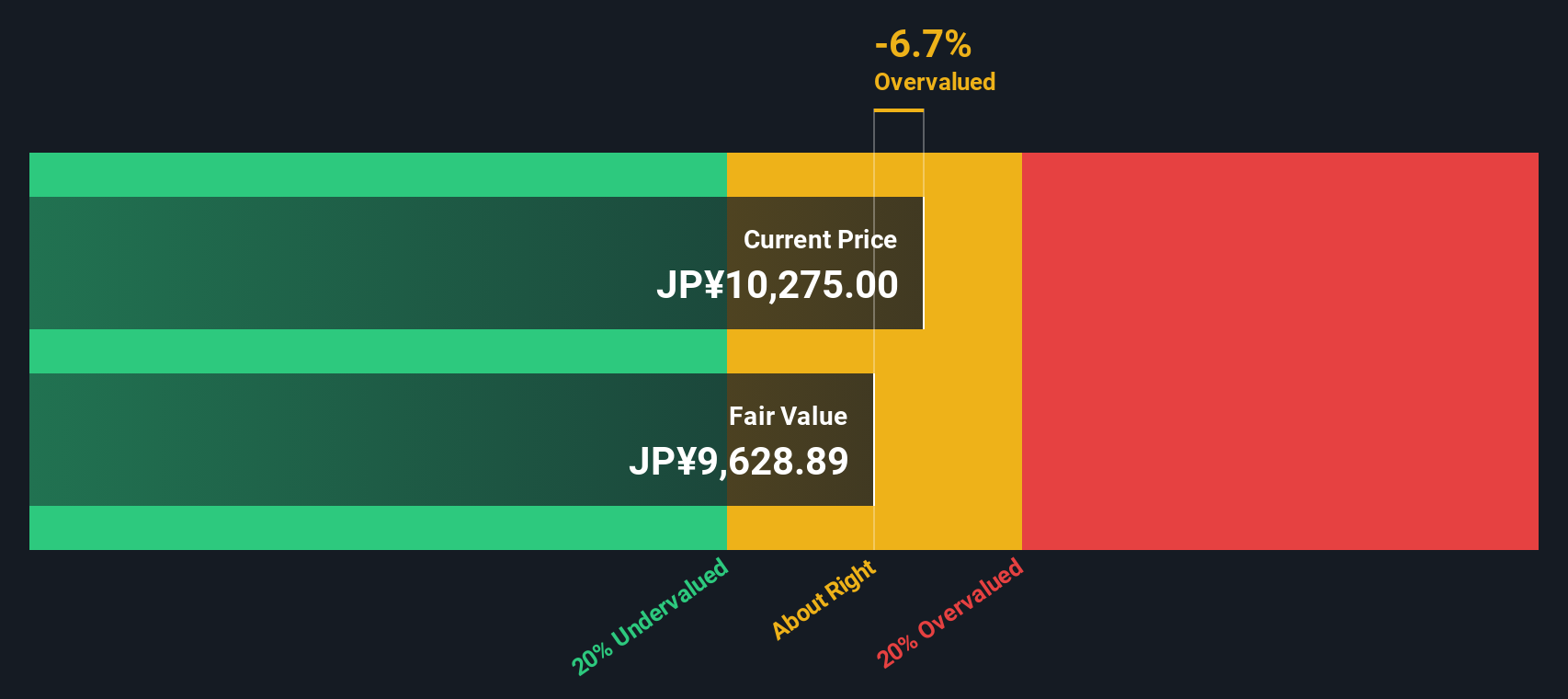

Another View, SWS DCF Model Says Overvalued

While earnings multiples suggest Tokyo Seimitsu is roughly fairly priced, our DCF model tells a different story. With the shares at ¥10,500 versus an estimated fair value of about ¥9,709, the DCF view implies the stock may be modestly overvalued. Which lens should investors trust more at this point in the cycle?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokyo Seimitsu for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokyo Seimitsu Narrative

If you see things differently, or simply prefer to dig into the numbers yourself, you can craft a personalized view in just minutes: Do it your way.

A great starting point for your Tokyo Seimitsu research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single opportunity when a whole universe of potential winners is already mapped out for you in our screeners.

- Capture overlooked value by reviewing these 912 undervalued stocks based on cash flows, where strong cash flows meet prices that have not yet caught up.

- Ride structural growth by focusing on these 29 healthcare AI stocks, blending powerful data analytics with long term healthcare demand.

- Position yourself at the edge of financial innovation with these 80 cryptocurrency and blockchain stocks, targeting businesses building real utility around digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal