UK Stocks Trading At Estimated Discounts In December 2025

As the United Kingdom's FTSE 100 index faces pressure from weak trade data out of China, reflecting ongoing global economic challenges, investors are increasingly seeking opportunities in undervalued stocks that may offer potential for growth amid market uncertainties. Identifying stocks trading at estimated discounts can be a strategic approach to navigating these turbulent times, as they might present value propositions that align well with the current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.34 | £12.19 | 48% |

| Pinewood Technologies Group (LSE:PINE) | £3.575 | £7.13 | 49.9% |

| PageGroup (LSE:PAGE) | £2.316 | £4.52 | 48.8% |

| Nichols (AIM:NICL) | £9.66 | £18.53 | 47.9% |

| Motorpoint Group (LSE:MOTR) | £1.36 | £2.67 | 49% |

| Ibstock (LSE:IBST) | £1.374 | £2.66 | 48.4% |

| Gym Group (LSE:GYM) | £1.48 | £2.94 | 49.6% |

| Fintel (AIM:FNTL) | £2.01 | £3.80 | 47.1% |

| Fevertree Drinks (AIM:FEVR) | £8.27 | £15.82 | 47.7% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.165 | £4.19 | 48.4% |

Let's dive into some prime choices out of the screener.

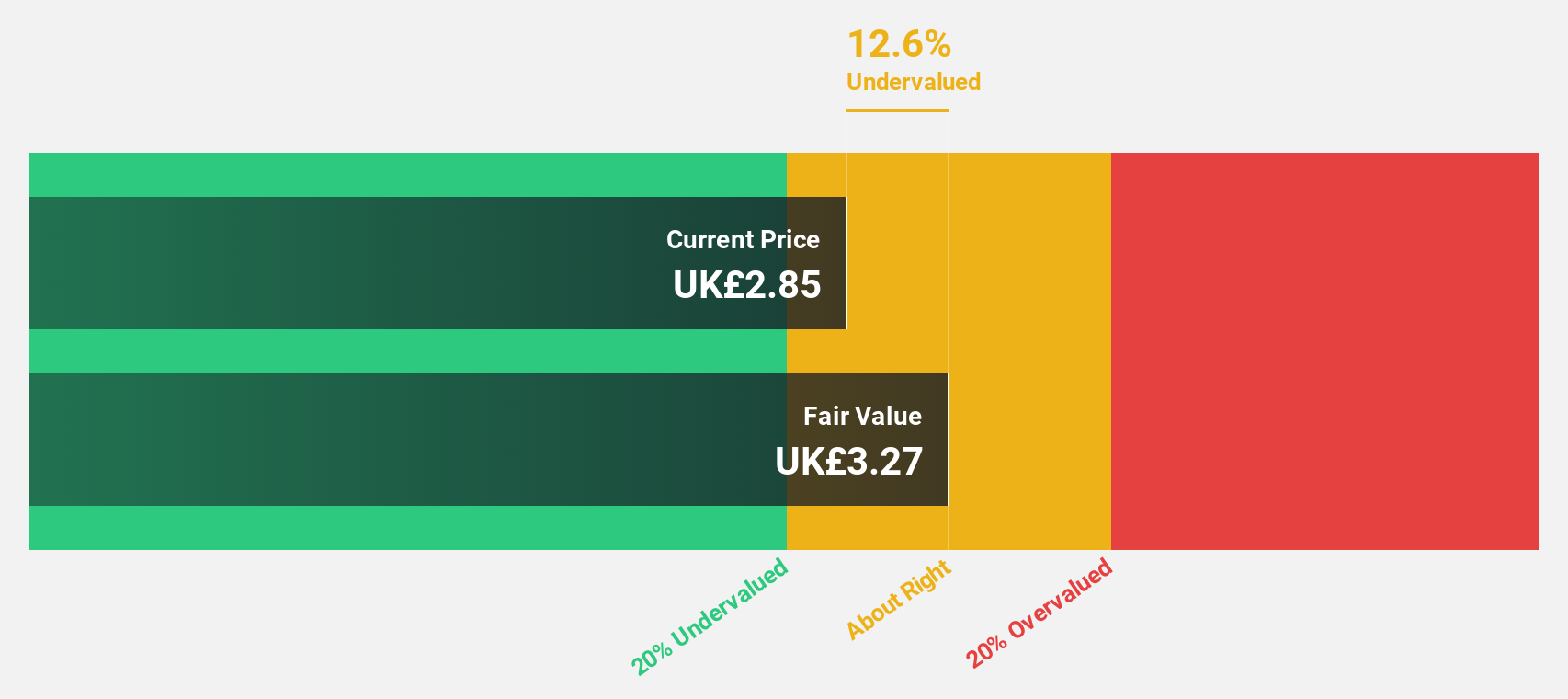

Bridgepoint Group (LSE:BPT)

Overview: Bridgepoint Group plc is a private equity and private credit firm focused on middle market to small cap investments, including growth capital and buyouts, with a market capitalization of £2.31 billion.

Operations: The company's revenue segments consist of £76.10 million from Credit and £299.10 million from Private Equity.

Estimated Discount To Fair Value: 10.6%

Bridgepoint Group's earnings are forecast to grow significantly at 35.9% annually, outpacing the UK market average. Despite trading 10.6% below its estimated fair value of £3.13, it isn't highly undervalued based on cash flows, with current trading at £2.8 per share. The dividend yield of 3.35% is not well covered by earnings or free cash flows, and profit margins have decreased from last year’s figures, reflecting some financial challenges despite growth prospects.

- Our earnings growth report unveils the potential for significant increases in Bridgepoint Group's future results.

- Get an in-depth perspective on Bridgepoint Group's balance sheet by reading our health report here.

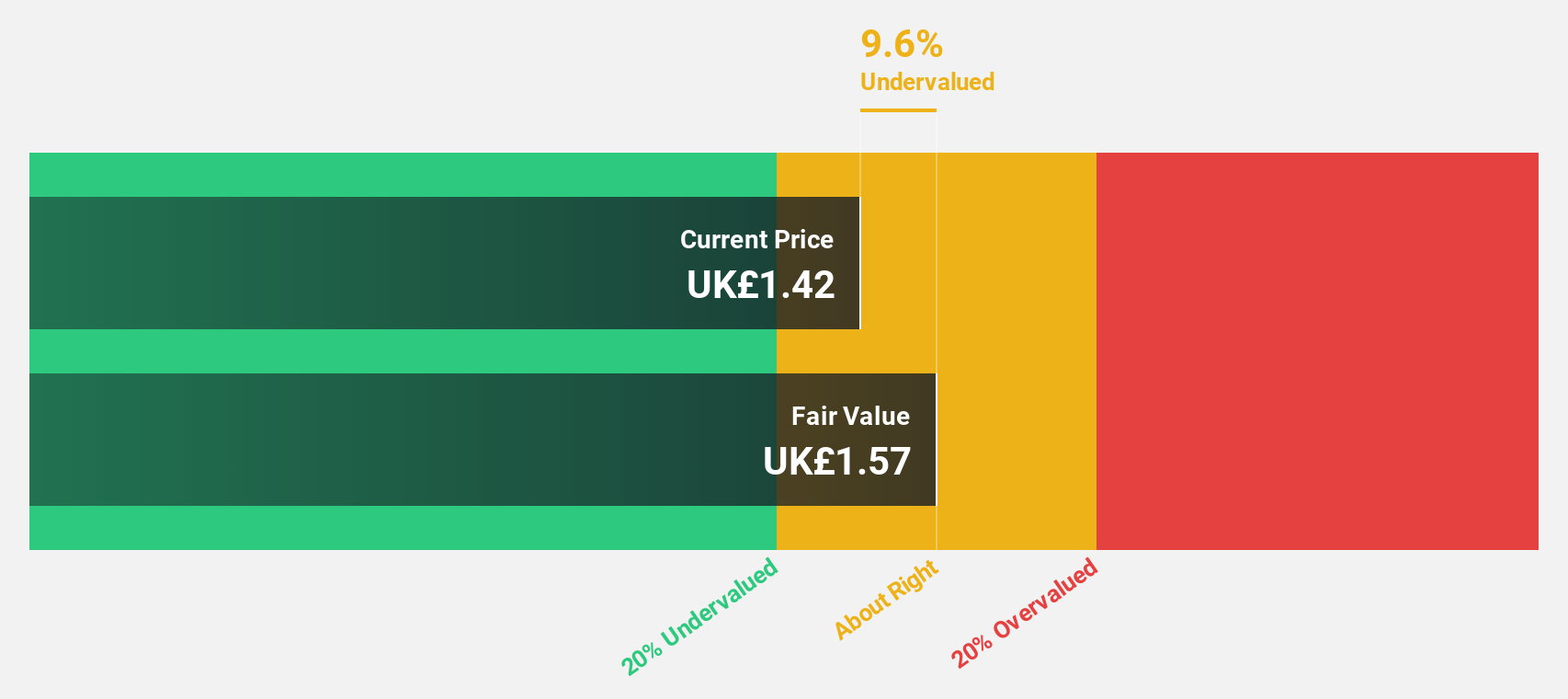

NCC Group (LSE:NCC)

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe with a market cap of £433.93 million.

Operations: The company's revenue is primarily derived from its Cyber Security segment, which generated £238.90 million.

Estimated Discount To Fair Value: 25.5%

NCC Group is trading at £1.42, significantly below its estimated fair value of £1.9, highlighting its potential as an undervalued stock based on cash flows. Despite this valuation gap, the dividend yield of 3.28% is not well covered by earnings. Earnings are forecast to grow substantially at 102.87% annually, with profitability expected in three years, outpacing market averages. Recent earnings reported sales of £238.9 million and a net income of £17.1 million for the year ended September 2025.

- Our expertly prepared growth report on NCC Group implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in NCC Group's balance sheet health report.

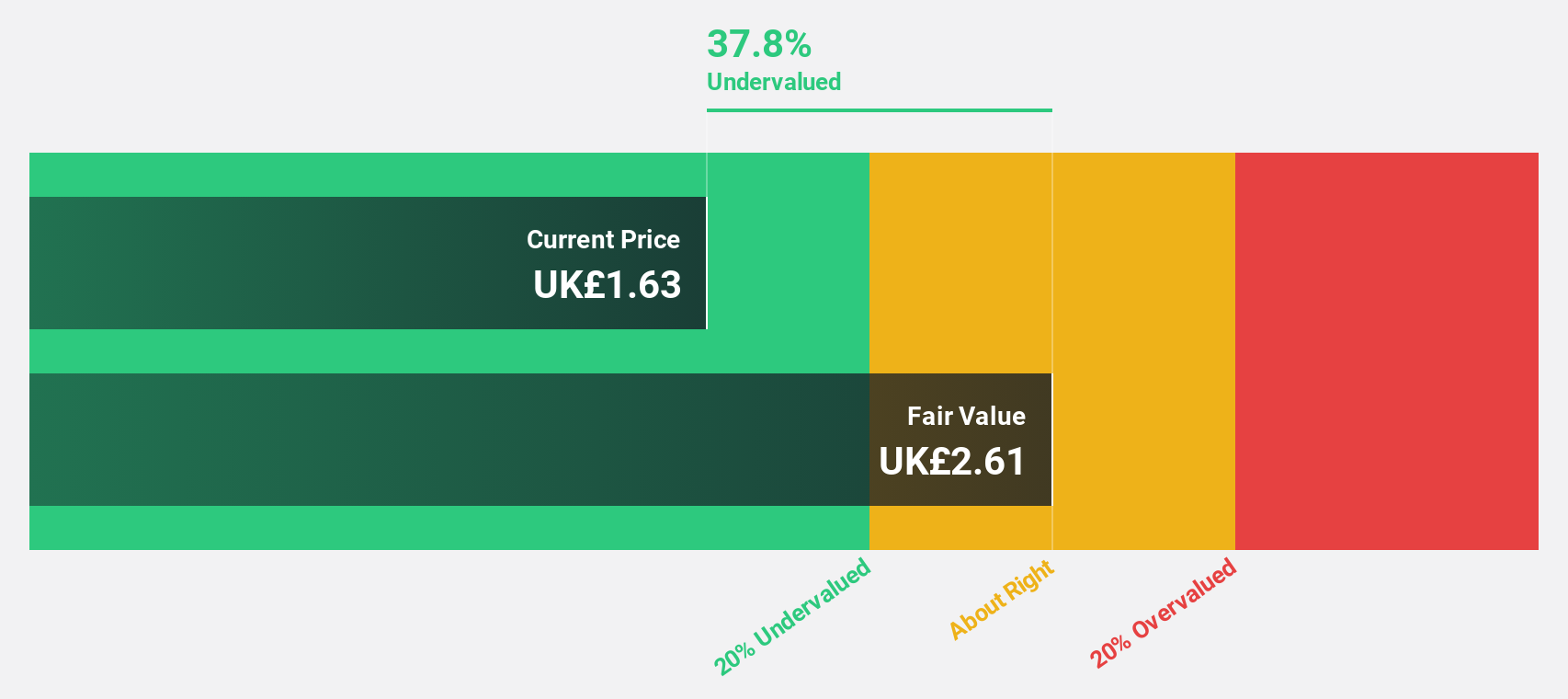

Stelrad Group (LSE:SRAD)

Overview: Stelrad Group PLC manufactures and distributes radiators across the United Kingdom, Ireland, Europe, Turkey, and internationally with a market cap of £189.76 million.

Operations: The company's revenue from the manufacture and distribution of radiators is £283.94 million.

Estimated Discount To Fair Value: 33.1%

Stelrad Group is trading at £1.49, well below its estimated fair value of £2.23, indicating it is undervalued based on cash flows. Despite a high debt level and a net profit margin decline from 5.3% to 1.8%, earnings are expected to grow significantly at 63.25% annually, surpassing UK market averages. The recent renewal of a £100 million multicurrency facility enhances liquidity for strategic investments, although the dividend yield of 5.27% remains poorly covered by earnings.

- Our growth report here indicates Stelrad Group may be poised for an improving outlook.

- Click here to discover the nuances of Stelrad Group with our detailed financial health report.

Seize The Opportunity

- Investigate our full lineup of 56 Undervalued UK Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal