Is Buenaventura (NYSE:BVN) Overvalued After Its Recent Share Price Surge? A Fresh Look at Valuation

Compañía de Minas BuenaventuraA (NYSE:BVN) has quietly turned into a strong performer, with the stock up about 40% over the past 3 months and more than doubling over the past year.

See our latest analysis for Compañía de Minas BuenaventuraA.

That surge in the share price, now at $28.11, comes on top of a powerful trend, with a roughly 22% 1 month share price return and a striking 3 year total shareholder return above 280%. This suggests momentum is still building as investors reassess its growth and risk profile.

If Buenaventura’s run up has you thinking about what else could surprise to the upside, this might be the moment to scout fast growing stocks with high insider ownership.

Yet despite its powerful rally, Buenaventura still trades at a notable discount to some intrinsic value estimates. This raises the question: is this a fresh entry point, or are markets already pricing in the next leg of growth?

Most Popular Narrative: 14.4% Overvalued

Compared with the last close at $28.11, the most followed narrative pegs Compañía de Minas BuenaventuraA’s fair value materially lower, implying the recent surge runs ahead of fundamentals.

The analysts have a consensus price target of $17.817 for Compañía de Minas BuenaventuraA based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $14.4.

Want to see why this narrative calls for a lower valuation even as metals stay strong? The crux lies in modest growth, compressed margins and a surprisingly restrained earnings multiple. Curious how those moving parts add up to the current fair value call? Read on to unpack the full playbook behind that number.

Result: Fair Value of $24.57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several fault lines remain, from higher all in sustaining costs to potential delays at San Gabriel, any of which could quickly challenge today’s optimism.

Find out about the key risks to this Compañía de Minas BuenaventuraA narrative.

Another Lens on Valuation

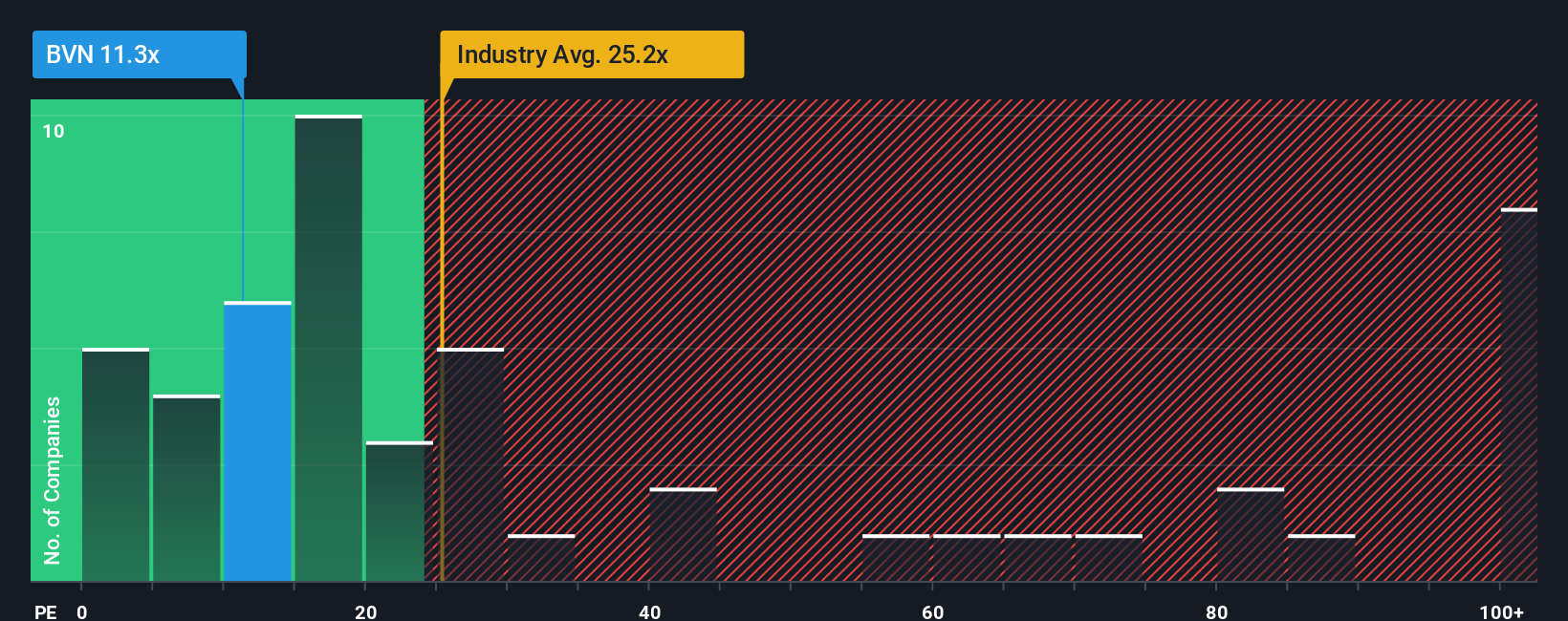

By contrast, the earnings based lens paints BVN as attractively priced. Its P/E of 16.4 times sits well below both peers at 26.2 times and a 20.8 times fair ratio. This hints the market still assigns a discount. Is that caution justified, or an opportunity in plain sight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Compañía de Minas BuenaventuraA Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Compañía de Minas BuenaventuraA.

Looking for more investment ideas?

Do not stop at one opportunity when you can quickly uncover more stocks tailored to your strategy using the Simply Wall St Screener and stay ahead of other investors.

- Fuel your growth strategy by targeting under the radar companies with powerful upside using these 912 undervalued stocks based on cash flows that the market has yet to fully appreciate.

- Capitalize on the AI revolution by focusing on innovators at the intersection of data, automation and intelligence through these 26 AI penny stocks before the crowd catches on.

- Lock in potential income streams by prioritizing reliable payers offering attractive yields with these 13 dividend stocks with yields > 3% while others overlook their compounding power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal