Risks Still Elevated At These Prices As PowerCell Sweden AB (publ) (STO:PCELL) Shares Dive 26%

The PowerCell Sweden AB (publ) (STO:PCELL) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop has obliterated the annual return, with the share price now down 9.1% over that longer period.

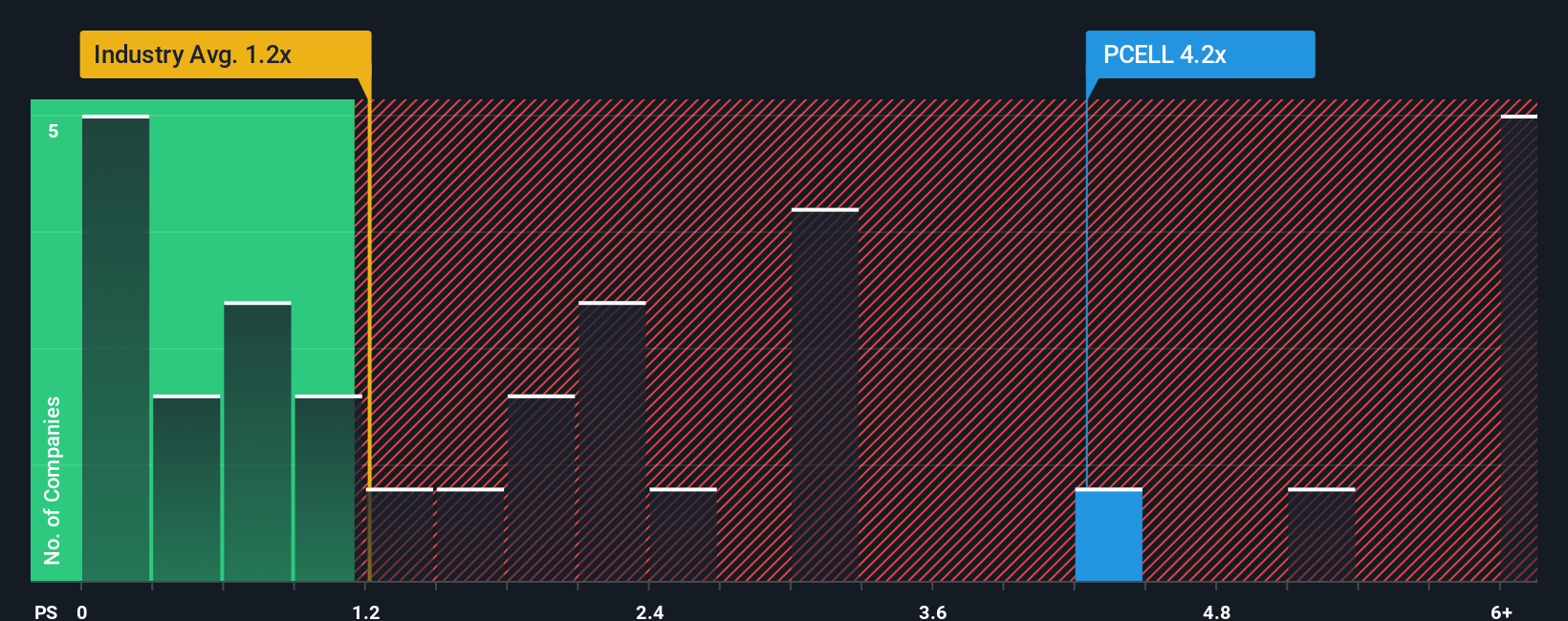

In spite of the heavy fall in price, when almost half of the companies in Sweden's Electrical industry have price-to-sales ratios (or "P/S") below 2.1x, you may still consider PowerCell Sweden as a stock not worth researching with its 4.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for PowerCell Sweden

How Has PowerCell Sweden Performed Recently?

With revenue growth that's superior to most other companies of late, PowerCell Sweden has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think PowerCell Sweden's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For PowerCell Sweden?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like PowerCell Sweden's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 37% last year. The strong recent performance means it was also able to grow revenue by 117% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 15% per annum during the coming three years according to the three analysts following the company. With the industry predicted to deliver 18% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that PowerCell Sweden is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On PowerCell Sweden's P/S

PowerCell Sweden's shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for PowerCell Sweden, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you take the next step, you should know about the 2 warning signs for PowerCell Sweden that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal