Not Many Are Piling Into Castro Model Ltd. (TLV:CAST) Stock Yet As It Plummets 25%

Castro Model Ltd. (TLV:CAST) shares have had a horrible month, losing 25% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 53% in the last year.

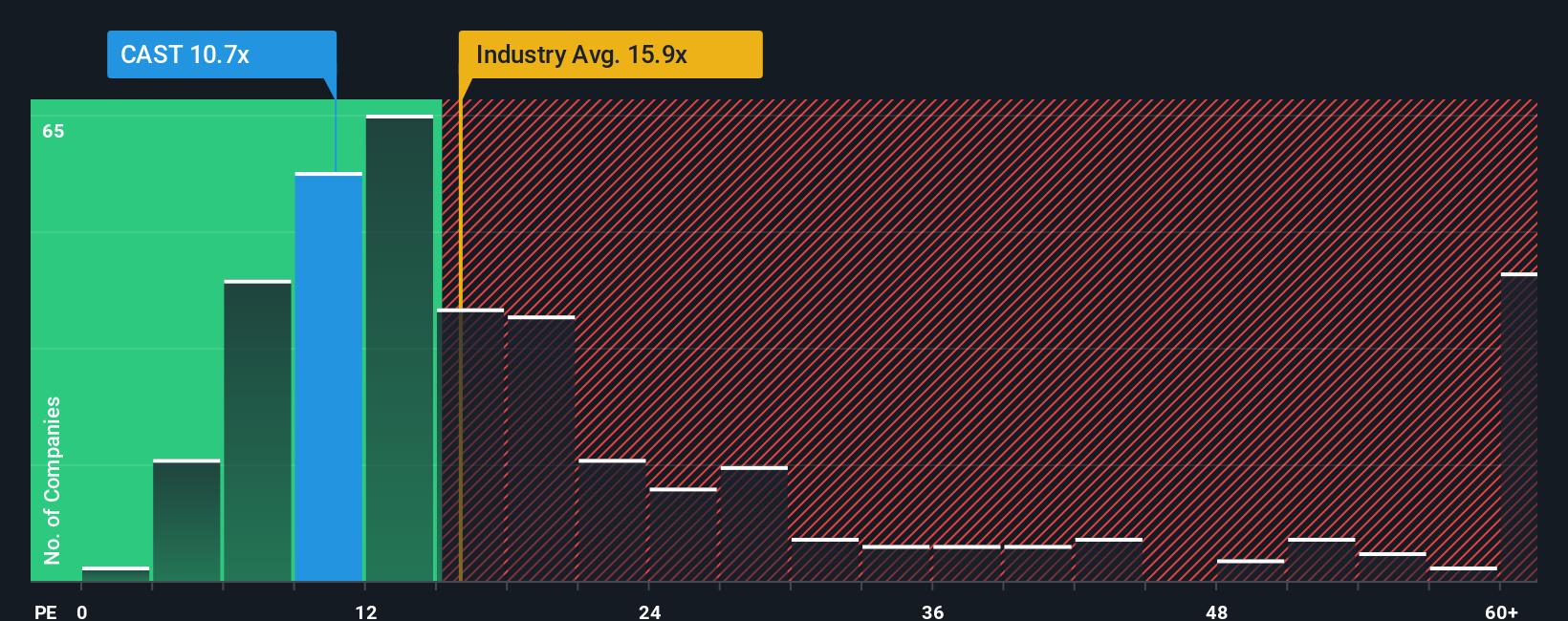

In spite of the heavy fall in price, Castro Model may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10.7x, since almost half of all companies in Israel have P/E ratios greater than 16x and even P/E's higher than 27x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For instance, Castro Model's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Castro Model

Is There Any Growth For Castro Model?

In order to justify its P/E ratio, Castro Model would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 3.6%. Still, the latest three year period has seen an excellent 263% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 23% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Castro Model is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Castro Model's P/E has taken a tumble along with its share price. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Castro Model currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 1 warning sign for Castro Model that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal