Asian Penny Stocks To Watch In December 2025

As global markets react to recent economic developments, such as interest rate cuts by the Federal Reserve and concerns over technology stock valuations, investors are keeping a close eye on Asia's financial landscape. In this context, penny stocks—though an outdated term—remain relevant as they often represent smaller or newer companies with potential for growth. By focusing on those with strong financial health and clear growth trajectories, investors can uncover opportunities among these lesser-known entities.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.50 | HK$927.78M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.09 | SGD441.77M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.94 | THB2.98B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.103 | SGD53.92M | ✅ 2 ⚠️ 4 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.92 | THB882M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.52 | SGD13.85B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.78 | HK$21.14B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.80 | NZ$235.47M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 984 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Axelum Resources (PSE:AXLM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Axelum Resources Corp. is involved in the manufacture and distribution of coconut products across the Philippines, the United States, and Australia, with a market cap of ₱8.36 billion.

Operations: The company generates revenue of ₱9.79 billion from its sale of coconut-based products.

Market Cap: ₱8.36B

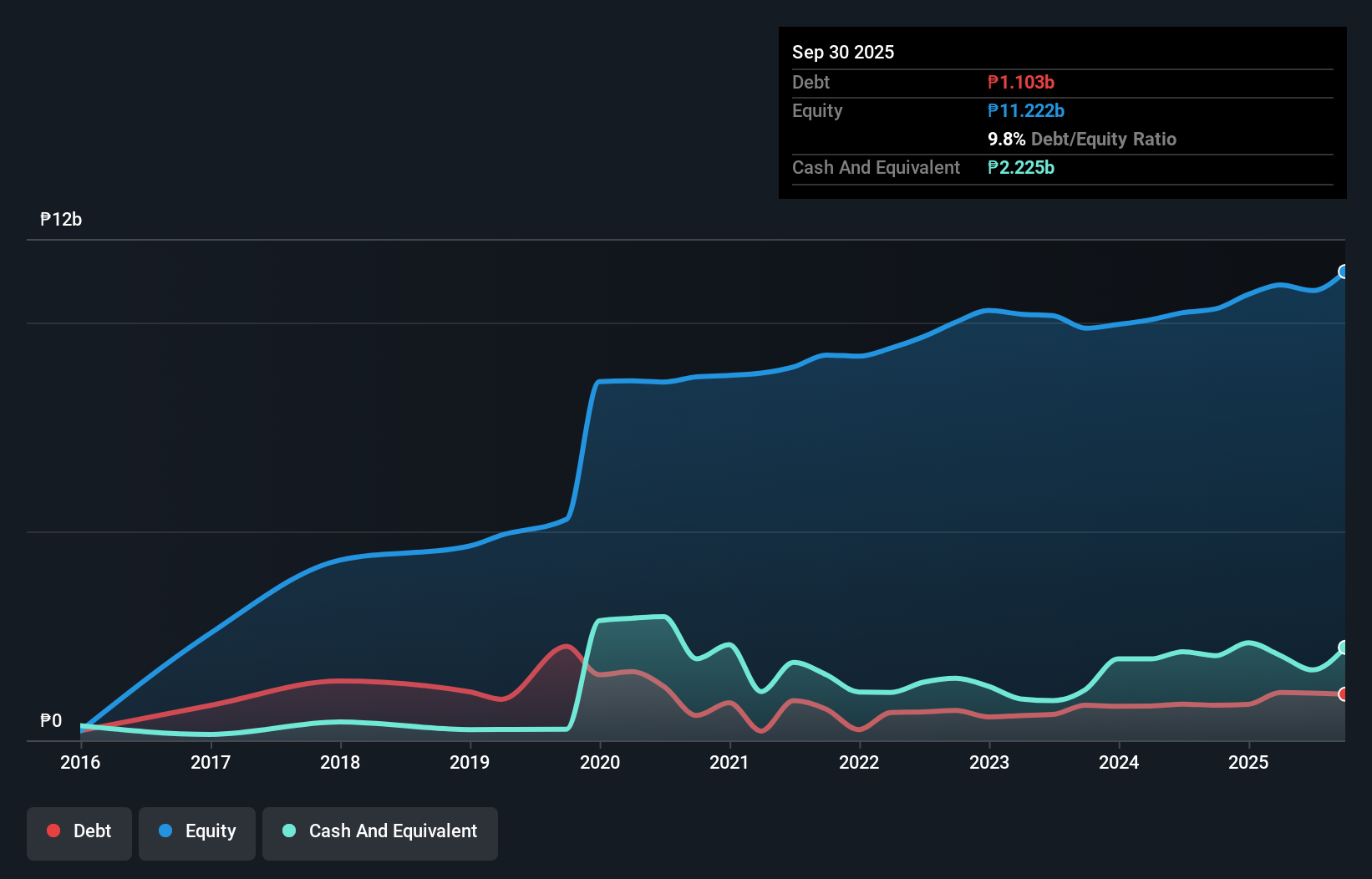

Axelum Resources Corp. has demonstrated significant financial growth, with third-quarter sales reaching ₱3.06 billion, up from ₱1.90 billion the previous year, and net income rising to ₱415.8 million from ₱130.39 million. Despite past earnings declines of 13% annually over five years, the company became profitable last year and maintains a stable financial position with short-term assets exceeding liabilities and debt well-covered by operating cash flow at 41.8%. The management team is experienced with an average tenure of 9.8 years, contributing to a stable operational environment amidst its low Return on Equity of 8.8%.

- Click here and access our complete financial health analysis report to understand the dynamics of Axelum Resources.

- Understand Axelum Resources' track record by examining our performance history report.

YH Entertainment Group (SEHK:2306)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: YH Entertainment Group is an investment holding company that operates as an artist management firm in Mainland China and Korea, with a market cap of HK$1.93 billion.

Operations: The company's revenue is primarily derived from Artist Management (CN¥748.30 million), followed by Music IP Production and Operation (CN¥43.87 million), and Pan-Entertainment Business (CN¥39.32 million).

Market Cap: HK$1.93B

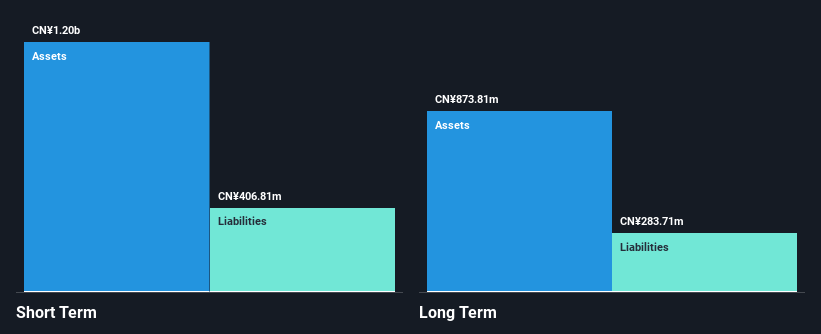

YH Entertainment Group, with a market cap of HK$1.93 billion, primarily generates revenue from Artist Management (CN¥748.30 million), supplemented by Music IP Production and Operation (CN¥43.87 million) and Pan-Entertainment Business (CN¥39.32 million). The company's financial health is supported by short-term assets exceeding both short-term and long-term liabilities, while its debt to equity ratio has significantly improved over the past five years to 4.4%. Despite a decline in earnings over the past five years, recent growth of 13.6% indicates recovery potential, though Return on Equity remains low at 5.3%. Recent share buybacks further signal management's confidence in the company's prospects.

- Jump into the full analysis health report here for a deeper understanding of YH Entertainment Group.

- Gain insights into YH Entertainment Group's past trends and performance with our report on the company's historical track record.

Inter Pharma (SET:IP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Inter Pharma Public Company Limited operates in Thailand, focusing on the manufacturing, importing, and distribution of drug and dietary supplement products for both humans and animals, with a market capitalization of THB2.82 billion.

Operations: The company's revenue is primarily derived from Human Healthcare at THB1.62 billion, followed by Animal Healthcare with THB308.27 million, and Hospital and Clinics contributing THB228.25 million.

Market Cap: THB2.82B

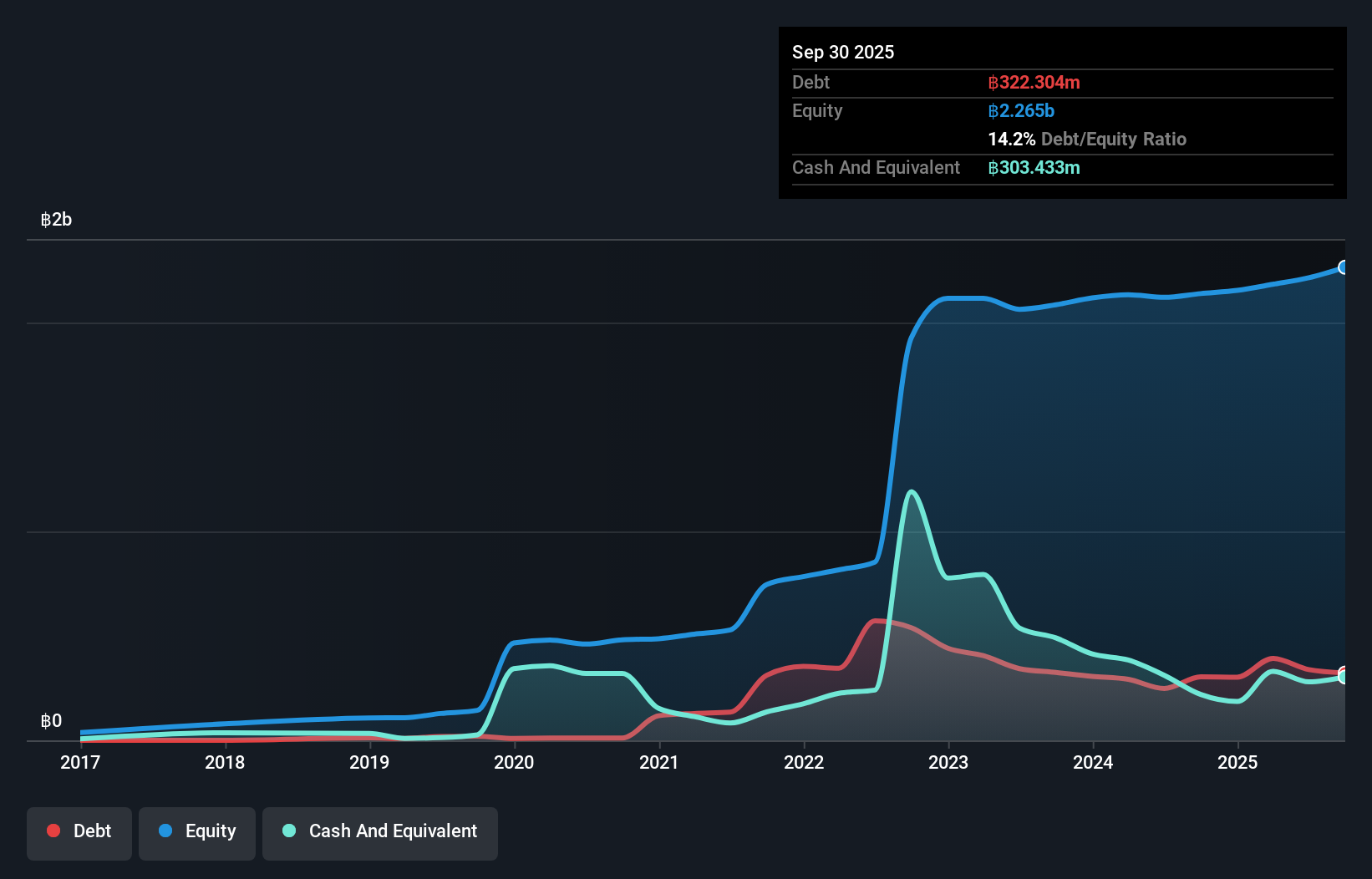

Inter Pharma Public Company Limited, with a market cap of THB2.82 billion, has shown significant earnings growth of 887.9% over the past year, exceeding industry benchmarks despite a historical decline in profits over five years. The company’s financial stability is reinforced by short-term assets surpassing both short-term and long-term liabilities and satisfactory net debt to equity ratio at 0.8%. Recent developments include acquiring full control of Interpharma-ZEAvita Company Limited, potentially enhancing its business scope. However, the stock remains volatile with low Return on Equity at 5.4%, indicating potential risks for investors in penny stocks.

- Unlock comprehensive insights into our analysis of Inter Pharma stock in this financial health report.

- Assess Inter Pharma's previous results with our detailed historical performance reports.

Next Steps

- Access the full spectrum of 984 Asian Penny Stocks by clicking on this link.

- Interested In Other Possibilities? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal