Middle Eastern Dividend Stocks Featuring Abu Dhabi Commercial Bank PJSC

As Gulf bourses experience a downturn amid anticipation of U.S. inflation data and potential shifts in Federal Reserve policy, investors in the Middle East are closely monitoring market movements. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those seeking to navigate uncertain market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.63% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.25% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.81% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.76% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.41% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.51% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.04% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.30% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.12% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.63% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top Middle Eastern Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

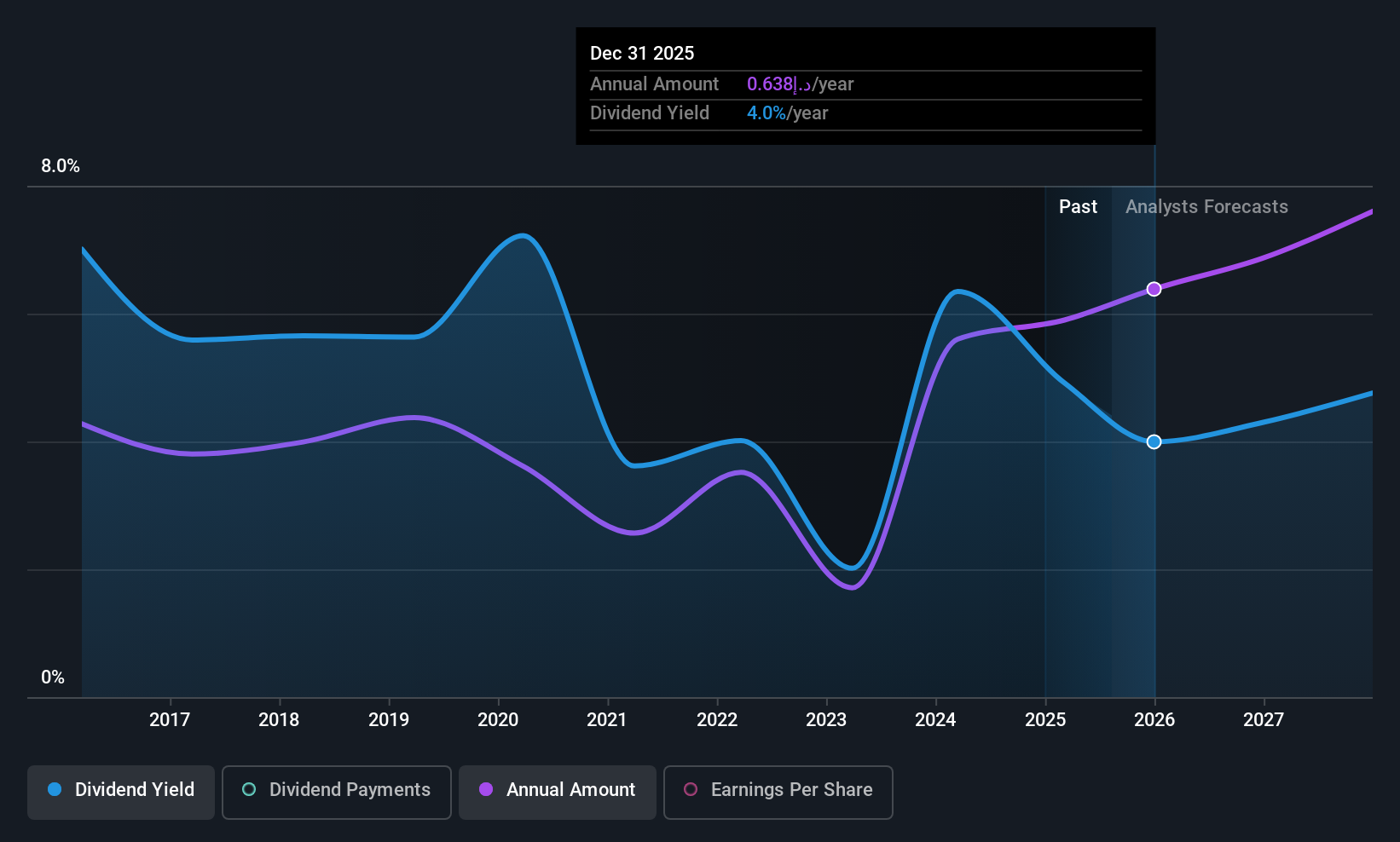

Abu Dhabi Commercial Bank PJSC (ADX:ADCB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Abu Dhabi Commercial Bank PJSC, along with its subsidiaries, offers a range of banking products and services both in the United Arab Emirates and internationally, with a market capitalization of AED 105.09 billion.

Operations: Abu Dhabi Commercial Bank PJSC generates revenue through its Retail Banking (AED 5.10 billion), Investments and Treasury (AED 5.10 billion), and Corporate and Investment Banking (AED 8.65 billion) segments.

Dividend Yield: 4.1%

Abu Dhabi Commercial Bank PJSC's recent earnings report shows strong financial performance, with net income increasing to AED 3.09 billion in Q3 2025. Despite a history of volatile dividends, the current payout ratio of 42.8% indicates dividends are well covered by earnings. However, its dividend yield is lower than the top quartile in the AE market at 4.11%. The bank's price-to-earnings ratio is favorable compared to the market average, suggesting potential value for investors seeking dividend stability and growth prospects.

- Dive into the specifics of Abu Dhabi Commercial Bank PJSC here with our thorough dividend report.

- Our valuation report here indicates Abu Dhabi Commercial Bank PJSC may be overvalued.

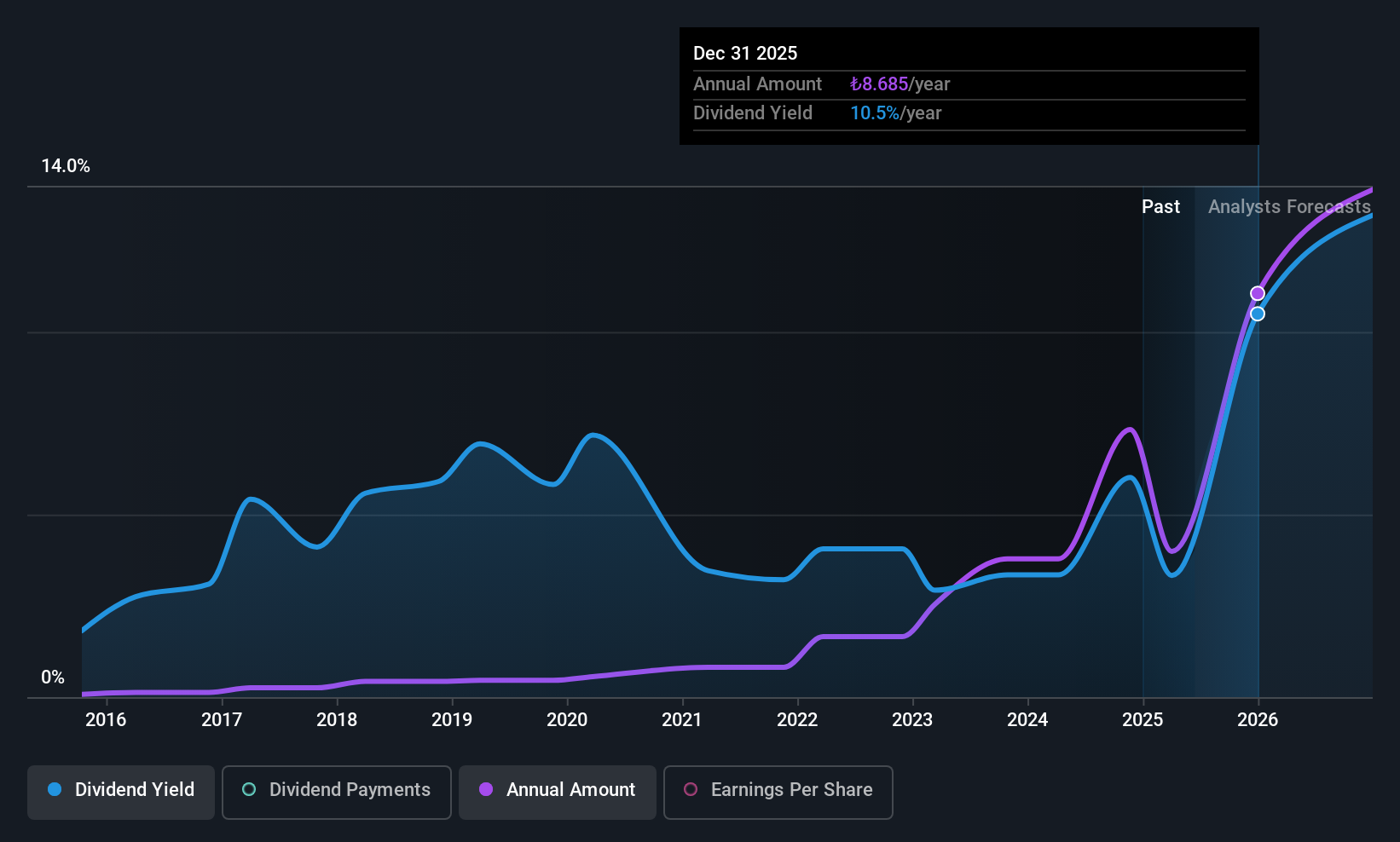

Ford Otomotiv Sanayi (IBSE:FROTO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ford Otomotiv Sanayi A.S. is involved in the manufacture, assembly, import, export, and sale of motor vehicles and spare parts in Turkey with a market cap of TRY341.26 billion.

Operations: Ford Otomotiv Sanayi's revenue is primarily derived from its operations in manufacturing, assembly, import, and sale of motor vehicles and spare parts, totaling TRY637.96 billion.

Dividend Yield: 3.2%

Ford Otomotiv Sanayi's recent earnings report indicates a decline in net income, impacting dividend sustainability. Despite a high payout ratio of 100.8%, dividends are well covered by cash flows due to a low cash payout ratio of 21.6%. The company's dividend yield is among the top quartile in the Turkish market at 3.22%, though historical volatility raises concerns about reliability. Trading at a favorable price-to-earnings ratio suggests potential value amidst financial challenges and high debt levels.

- Click here to discover the nuances of Ford Otomotiv Sanayi with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Ford Otomotiv Sanayi is priced lower than what may be justified by its financials.

Saudi Awwal Bank (SASE:1060)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Saudi Awwal Bank, along with its subsidiaries, offers banking and financial services in the Kingdom of Saudi Arabia with a market capitalization of SAR65.75 billion.

Operations: Saudi Awwal Bank's revenue segments include Treasury at SAR2.18 billion, Capital Markets at SAR468.15 million, Wealth & Personal Banking at SAR4.04 billion, and Corporate and Institutional Banking at SAR7.21 billion.

Dividend Yield: 6.2%

Saudi Awwal Bank's dividend yield of 6.25% ranks it in the top quartile of Saudi Arabian payers, but its historical volatility and unreliable track record raise concerns. The bank's dividends are currently covered by earnings with a payout ratio of 50.9%, and forecasts suggest this coverage will continue at 51.5%. Trading below market P/E ratios indicates potential value, supported by strong earnings growth over five years and recent net income increases to SAR 2.14 billion for Q3 2025.

- Take a closer look at Saudi Awwal Bank's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Saudi Awwal Bank is trading behind its estimated value.

Key Takeaways

- Delve into our full catalog of 61 Top Middle Eastern Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal