Tokyo Electron (TSE:8035) Valuation Check After Cooling Share Price and Strong Multi‑Year Returns

Tokyo Electron (TSE:8035) has quietly outperformed many chip peers over the past year, riding demand for advanced fabrication gear even as the stock has cooled in the past month after a strong run.

See our latest analysis for Tokyo Electron.

Short term, the share price has cooled with a 1 month share price return of minus 5.95% after a hot run, but a 1 year total shareholder return of 34.98% and 3 year total shareholder return of 145.10% still show strong underlying momentum.

If Tokyo Electron has you thinking more broadly about chip demand and automation, this could be a good moment to explore other high growth tech names through high growth tech and AI stocks.

With earnings still growing and the stock trading below consensus price targets despite a big multi year run, investors now face a key question: Is Tokyo Electron still mispriced, or is future chip growth already fully baked in?

Most Popular Narrative: 9.8% Undervalued

With Tokyo Electron last closing at ¥31,320 versus a narrative fair value of ¥34,725, the valuation case leans in favor of more upside and hinges on key long term earnings drivers.

The imminent launch of next-generation AI servers by 2027, which will require much denser, more advanced chips (for example, 3nm nodes, 2.5x transistor counts, and 4x memory/HBM stack), is set to drive a significant and sustained increase in customer capital expenditures for advanced semiconductor equipment beginning in the second half of 2026. This is expected to position Tokyo Electron to benefit from renewed order growth and potential top-line acceleration.

Curious how steady mid single digit growth, rising margins and a richer future earnings multiple can still imply upside from here? The narrative shows exactly how those moving parts stack together.

Result: Fair Value of ¥34,725 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could wobble if China exposure collides with tougher export controls or if customers stretch out capex cycles longer than expected.

Find out about the key risks to this Tokyo Electron narrative.

Another Angle on Value

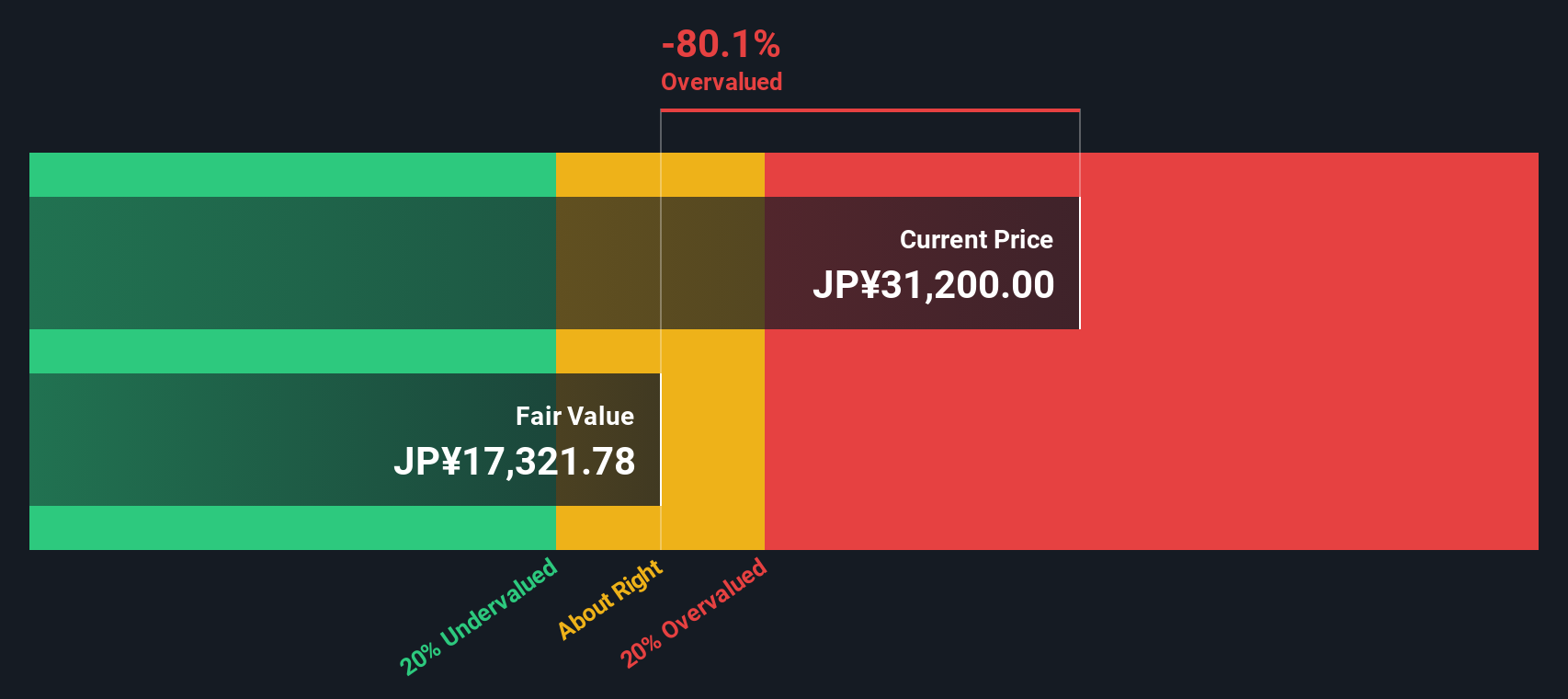

Our SWS DCF model paints a much tougher picture, suggesting Tokyo Electron is trading well above its estimated fair value of ¥17,352. This implies the market may already be pricing in a very optimistic future. Are narrative driven forecasts stretching too far ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokyo Electron for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokyo Electron Narrative

If you see the numbers differently or want to stress test your own assumptions, you can spin up a fresh narrative in minutes by using Do it your way.

A great starting point for your Tokyo Electron research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop with a single great idea. Use the Simply Wall Street Screener to pinpoint your next moves before the market catches on.

- Capture growth potential in emerging innovation by scanning these 28 quantum computing stocks that could ride the next wave of computing breakthroughs.

- Lock in potential income streams by targeting these 13 dividend stocks with yields > 3% offering attractive yields without sacrificing balance sheet quality.

- Ride powerful structural shifts in automation and data by focusing on these 26 AI penny stocks positioned at the heart of intelligent software and hardware adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal