Xiaomi (SEHK:1810): Valuation Check After Industry‑First Crypto Wallet Integration With Sei

Xiaomi (SEHK:1810) just took a big swing at the future of payments, teaming up with Sei to pre install a crypto wallet and discovery app on new phones across key international markets.

See our latest analysis for Xiaomi.

Even after a sharp 90 day share price return of around negative 27 percent, Xiaomi’s HK$41.22 stock still carries a standout three year total shareholder return of roughly 290 percent. This suggests that long term momentum around initiatives like this crypto push is far from spent.

If this kind of fintech move has your attention, it could be worth exploring other ambitious tech names through high growth tech and AI stocks for more ideas with structural growth stories.

With analysts still seeing around 40 percent upside to their price targets and Xiaomi trading at a modest intrinsic discount, is the market underestimating this next leg of growth, or already pricing in its crypto ambitions?

Most Popular Narrative Narrative: 28.9% Undervalued

Compared with Xiaomi's last close at HK$41.22, the most followed narrative points to a meaningfully higher fair value anchored in long term earnings power.

The company's successful push into premiumization, evidenced by growing sales of high end smartphones, appliances, and electric vehicles, along with the launch of proprietary 3nm chips and advanced AI features, supports higher average selling prices and improves net margins as Xiaomi captures greater value per customer.

Want to see what kind of revenue surge, margin lift, and future earnings multiple are incorporated into that premium strategy, and how they stack up over time? You can review the full narrative to examine the assumptions that underpin this valuation perspective.

Result: Fair Value of $57.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing smartphone and IoT momentum, alongside rising component costs, could compress margins and challenge the premiumization thesis that supports Xiaomi’s valuation.

Find out about the key risks to this Xiaomi narrative.

Another Way to Look at Value

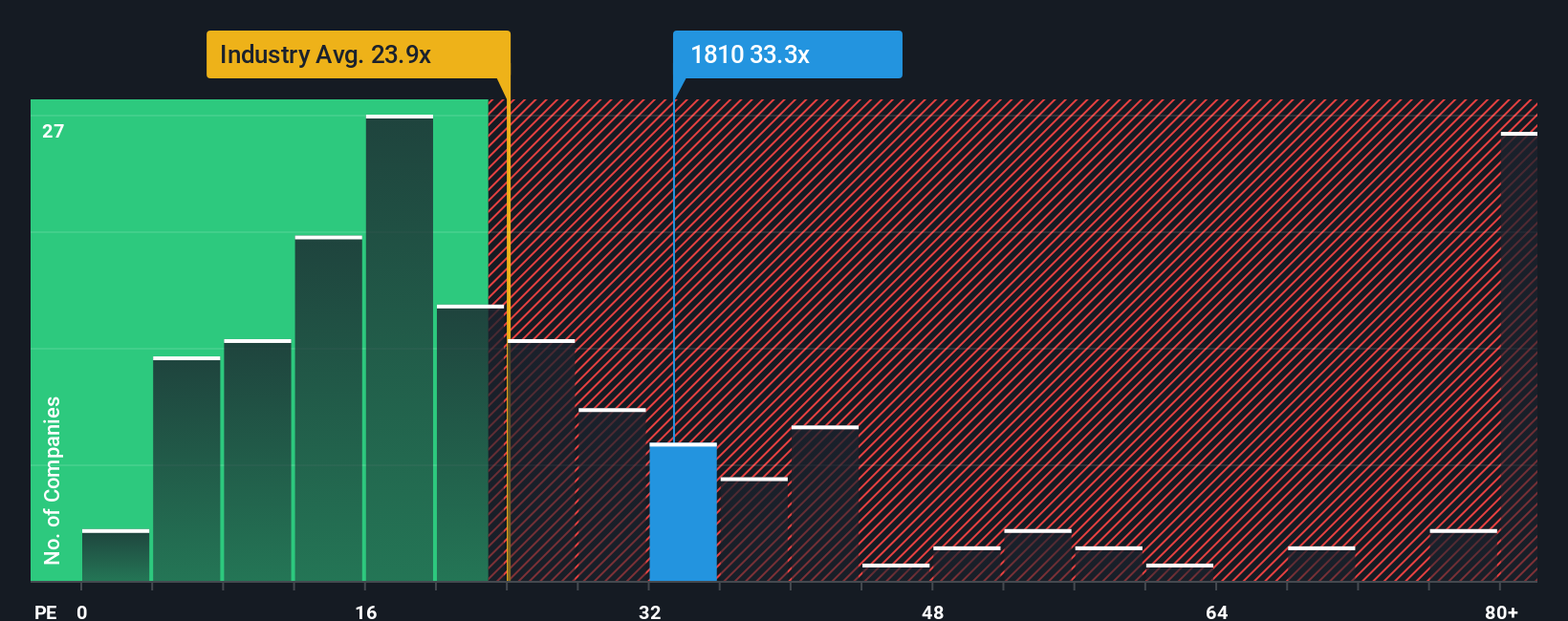

On earnings, Xiaomi looks stretched. It trades on about 22 times earnings, above both the Asian tech average of 21.8 times and peers at 16.8 times, and above a 20.4 times fair ratio that the market could drift toward, posing downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xiaomi Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a customized thesis in minutes with Do it your way.

A great starting point for your Xiaomi research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before the market makes its next big rotation, put Simply Wall St’s Screener to work and line up fresh opportunities that match your strategy with precision.

- Capture early-stage growth potential by reviewing these 3640 penny stocks with strong financials that pair tiny market caps with underlying financials and execution that meet your criteria.

- Position yourself for the next wave of innovation by scanning these 26 AI penny stocks focused on real world applications in automation, data intelligence, and machine learning.

- Seek quality at compelling prices by targeting these 911 undervalued stocks based on cash flows where cash flow strength supports a margin of safety that some investors may not fully consider.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal