Centrus Energy (LEU) Expansion in Piketon: How the New Facility Shapes the Stock’s Nuclear Growth Valuation

Centrus Energy (LEU) just took a concrete step in its Piketon, Ohio expansion, kicking off design work for a large Training, Operations and Maintenance facility that could anchor future uranium enrichment growth.

See our latest analysis for Centrus Energy.

The Piketon buildout comes after a huge run in Centrus, with the share price still around $221.45 despite a sharp recent pullback and a powerful multi year total shareholder return that suggests long term momentum is intact even as near term enthusiasm cools.

If this kind of nuclear fuel story has your attention, it may be a good moment to explore fast growing stocks with high insider ownership for other under the radar growth candidates.

With shares sitting below analyst targets after a massive multi year run, investors now face a key question: is Centrus still trading at a discount to its nuclear growth runway, or is the market already pricing in the next leg higher?

Most Popular Narrative: 20.8% Undervalued

With Centrus closing at $221.45 against a narrative fair value near $280, the current pricing gap centers squarely on growth, margins, and dilution.

The analysts have a consensus price target of $229.3 for Centrus Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $310.0, and the most bearish reporting a price target of just $108.0.

Want to see what kind of revenue climb, profit squeeze, and future earnings multiple are built into that fair value math? The underlying assumptions may surprise you.

Result: Fair Value of $279.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could shift if nuclear demand underwhelms or if DOE funding and utility contracts arrive more slowly than expected, constraining revenue growth and margins.

Find out about the key risks to this Centrus Energy narrative.

Another Angle on Valuation

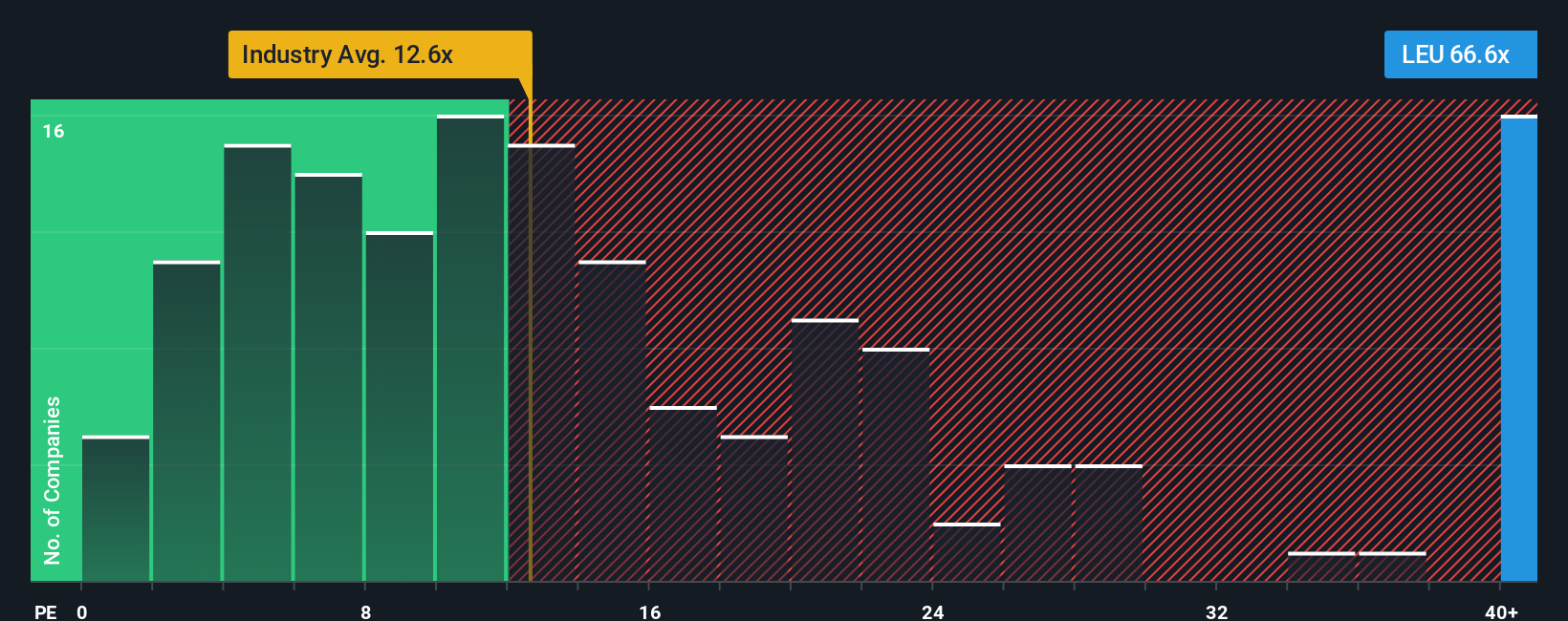

On earnings, the picture flips. Centrus trades on a rich 35.5x price to earnings ratio versus 16.6x for peers and a fair ratio of 11.2x that the market could ultimately gravitate toward, which raises the risk that even a great story might struggle to support this multiple.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Centrus Energy Narrative

If you see the numbers differently or want to kick the tires yourself, you can build a fresh narrative in minutes, Do it your way.

A great starting point for your Centrus Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction opportunities?

Before you move on, lock in your next set of ideas with the Simply Wall St Screener so you are not relying on one story alone.

- Secure more potential bargains by scanning these 911 undervalued stocks based on cash flows that the market may be overlooking despite strong underlying cash flows.

- Harness the next wave of innovation by targeting these 26 AI penny stocks positioned to benefit from accelerating AI adoption and spending.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% that can help support returns even when markets turn volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal