Liontown (ASX:LTR) Valuation Check After Canmax Offtake Deal and First Digital Spot Sales Auction

Liontown (ASX:LTR) jumped after locking in a binding offtake agreement with Canmax Technologies for 2027 to 2028 spodumene supply, alongside its first digital spot sales auction that underscored solid buyer interest.

See our latest analysis for Liontown.

Those deals have arrived on the back of powerful momentum, with the latest move adding to Liontown’s roughly 66% 90 day share price return and a hefty 175% total shareholder return over the past year. This suggests confidence is building rather than fading.

If Liontown’s run has you rethinking your growth exposure, this could be a good moment to explore fast growing stocks with high insider ownership for more potential standouts.

Yet with Liontown now trading well above analyst targets but still showing a large modelled intrinsic discount, the key question is: are investors staring at a mispriced growth story, or is future upside already baked in?

Most Popular Narrative: 41.3% Overvalued

With Liontown last closing at A$1.52 versus a narrative fair value near A$1.07, expectations imply a rich future profit profile that demands scrutiny.

Liontown is executing on optimization initiatives and technological upgrades in its processing plant, aiming for sustainable improvements in lithium recovery rates to exceed 70%, contributing positively to future revenue and net margins. The strategic decision to establish a sizable ore stockpile will support a smoother underground ramp up and potentially lower future operating costs, helping stabilize cash flow and earnings during the transition period.

Want to see why strong recovery rates, thicker margins, and a premium future earnings multiple all converge on that fair value line? The narrative reveals the full earnings runway, the expected shift from losses to profitability, and the ambitious valuation multiple that ties it all together.

Result: Fair Value of $1.07 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising lithium competition and cost inflation could squeeze margins and cash flow, which may force analysts to reassess both growth assumptions and valuation multiples.

Find out about the key risks to this Liontown narrative.

Another Lens on Value

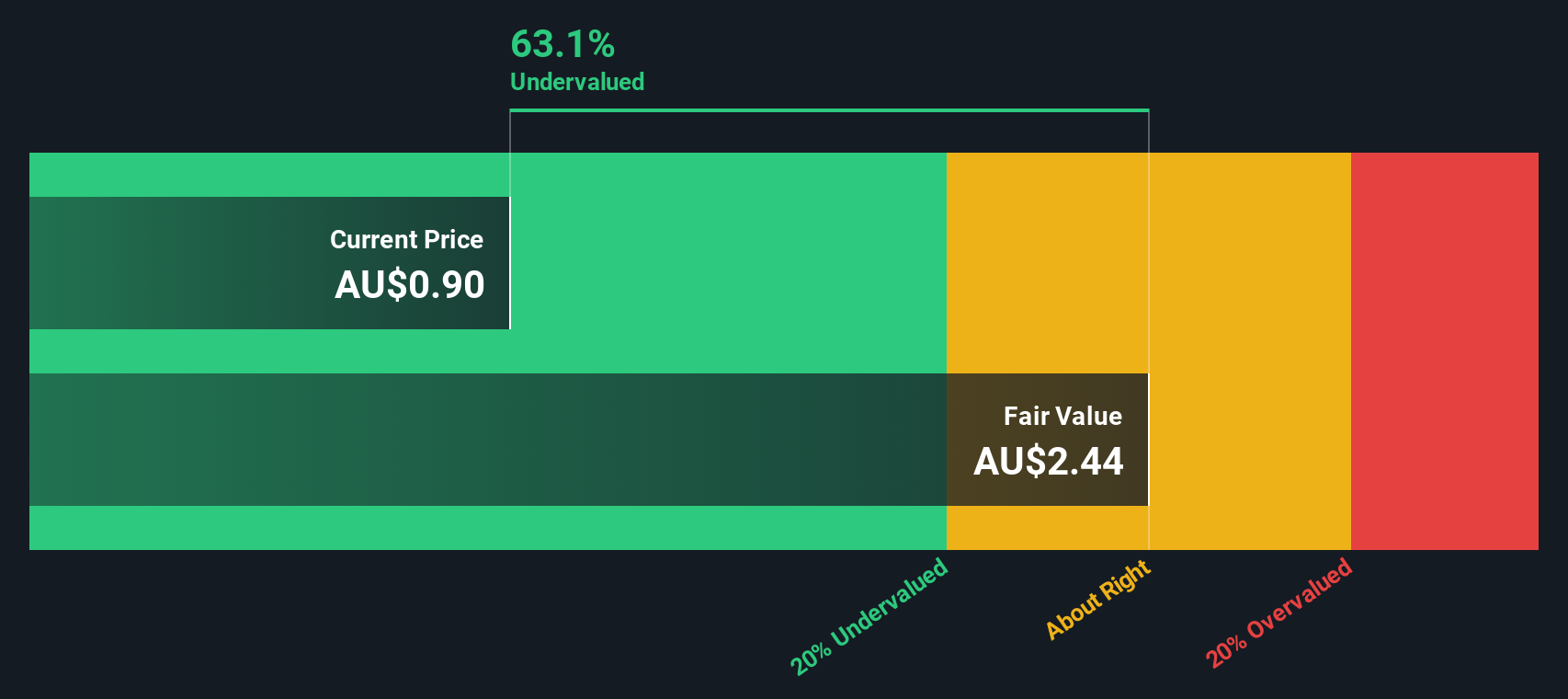

While the narrative fair value of A$1.07 flags Liontown as overvalued, our DCF model paints a very different picture, suggesting fair value closer to A$5.54 and a deep discount at current prices. Are investors overpaying for story, or underestimating long term cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Liontown for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Liontown Narrative

If you are not fully aligned with this view, or would rather rely on your own analysis of the numbers, you can build a tailored thesis in minutes: Do it your way.

A great starting point for your Liontown research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity, use the Simply Wall St Screener now to spot fresh, data backed ideas before everyone else is talking about them.

- Capture potential bargain entries by scanning these 911 undervalued stocks based on cash flows that the market may still be overlooking despite strong underlying cash flows.

- Position ahead of the next technology wave by zeroing in on these 26 AI penny stocks shaping how automation, data, and software will drive tomorrow’s earnings.

- Lock in income focused ideas by targeting these 12 dividend stocks with yields > 3% that could strengthen your portfolio’s yield while markets remain unpredictable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal