Interest rate hike cycle begins, Japanese treasury bonds become the “new favorite” for household financial management: retail sales hit an 18-year record

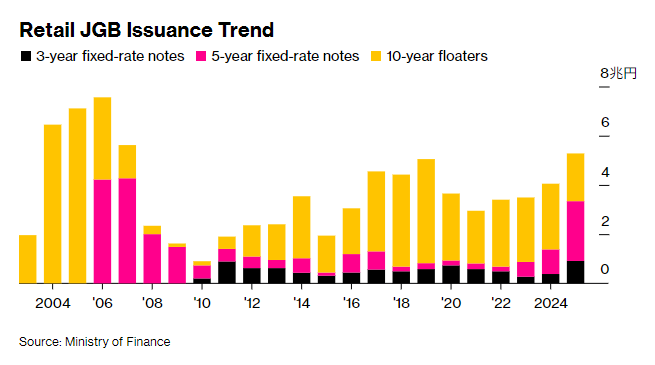

The Zhitong Finance App learned that with the Bank of Japan initiating policy tightening, rising interest rates are driving household funds to flow from bank deposits to the treasury bond market. Japan's government bond sales to individual investors have surpassed 5 trillion yen (about 32 billion US dollars) this year, the highest since 2007.

According to data from Japan's Ministry of Finance, the total amount of treasury bonds issued from January to December reached 5.28 trillion yen. Among them, the coupon interest rate for five-year retail treasury bonds issued in November reached 1.22%, almost 2.7 times the 0.46% interest rate in the same period last year.

At a time when the central bank is gradually reducing the scale of large-scale debt purchases under the ultra-loose policy, household investors are participating more actively in the treasury bond market. Higher yields and almost capital protection have revitalized the demand for treasury bonds.

It is worth noting that the treasury bonds issued this year include a ten-year variable interest rate of about 1.9 trillion yen. The coupon interest rate for such bonds is dynamically adjusted according to the overall interest rate trend in the market, and has unique allocation value during the monetary policy austerity cycle.

Kyoko Takahata, a 37-year-old housewife from Okayama Prefecture, said she took out her bank deposit in October last year and purchased a ten-year variable interest rate treasury bond at a local branch. “Interest rates on treasury bonds are higher than deposit interest rates, and the principal amount is guaranteed. The floating interest calculation method makes me think that earnings will gradually increase over time,” she admits. “I know this income cannot beat inflation, but the stock market fluctuates too much, so it's easy to lose money.” Takahata added that buying treasury bonds is a safer way to save money for children's education and retirement.

Taking Mizuho Bank as an example, even for ten-year term deposits of 10 million yen or more, the interest rate is only about 0.5%, which explains from the side why some savers choose to switch their funds to treasury bond products with significantly higher returns.

According to the latest issuance schedule, the coupon interest rate for retail treasury bonds to be settled in January next year has been determined: 1.1% for the three-year fixed interest rate type, 1.35% for the five-year fixed interest rate type, and 1.23% for the ten-year variable interest rate type. Among them, the 5-year interest rate hit a new high since 2007, and the 10-year floating interest rate set a new record for the highest since the product was launched in 2003.

The final issuance scale of retail treasury bonds will be determined based on the cumulative subscription amount of individual investors.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal