Boston Scientific (BSX): Revisiting Valuation After Recent Pullback and Ongoing Growth Momentum

Recent trading context and performance snapshot

Boston Scientific (BSX) has been quietly grinding higher, with the stock gaining about 2 % over the past week even after a roughly 7 % pullback over the past month.

See our latest analysis for Boston Scientific.

Zooming out, that recent 1 week share price gain sits against a modest year to date share price return in the mid single digits, while a strong multi year total shareholder return suggests the longer term momentum story is still very much intact.

If Boston Scientific has your attention, this could also be a good moment to explore other healthcare names and see what is working across the sector via healthcare stocks.

With revenue and earnings still growing double digits, a long runway in structural heart and neuromodulation, and a sizable gap to analyst targets, is Boston Scientific still a buyable compounder, or is the market already discounting tomorrow’s growth?

Most Popular Narrative: 25.3% Undervalued

Against Boston Scientific’s last close of $94.48, the most popular narrative’s fair value of about $126 implies a sizeable upside if its growth roadmap lands.

Investment in proprietary, high margin technologies (e.g., next gen mapping, advanced diagnostic tools, differentiated urology/neuromodulation pipelines) combined with successful integration of recent acquisitions (Axonics, SoniVie, Intera, Silk Road) expands Boston Scientific's addressable market and is likely to drive margin expansion as product mix improves.

Want to see what kind of revenue climb, margin lift, and future earnings multiple it takes to back that price? The narrative spells it out in full.

Result: Fair Value of $126.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures and intensifying competition could squeeze margins and slow growth, challenging the upbeat narrative around multi year earnings and valuations.

Find out about the key risks to this Boston Scientific narrative.

Another Angle on Valuation

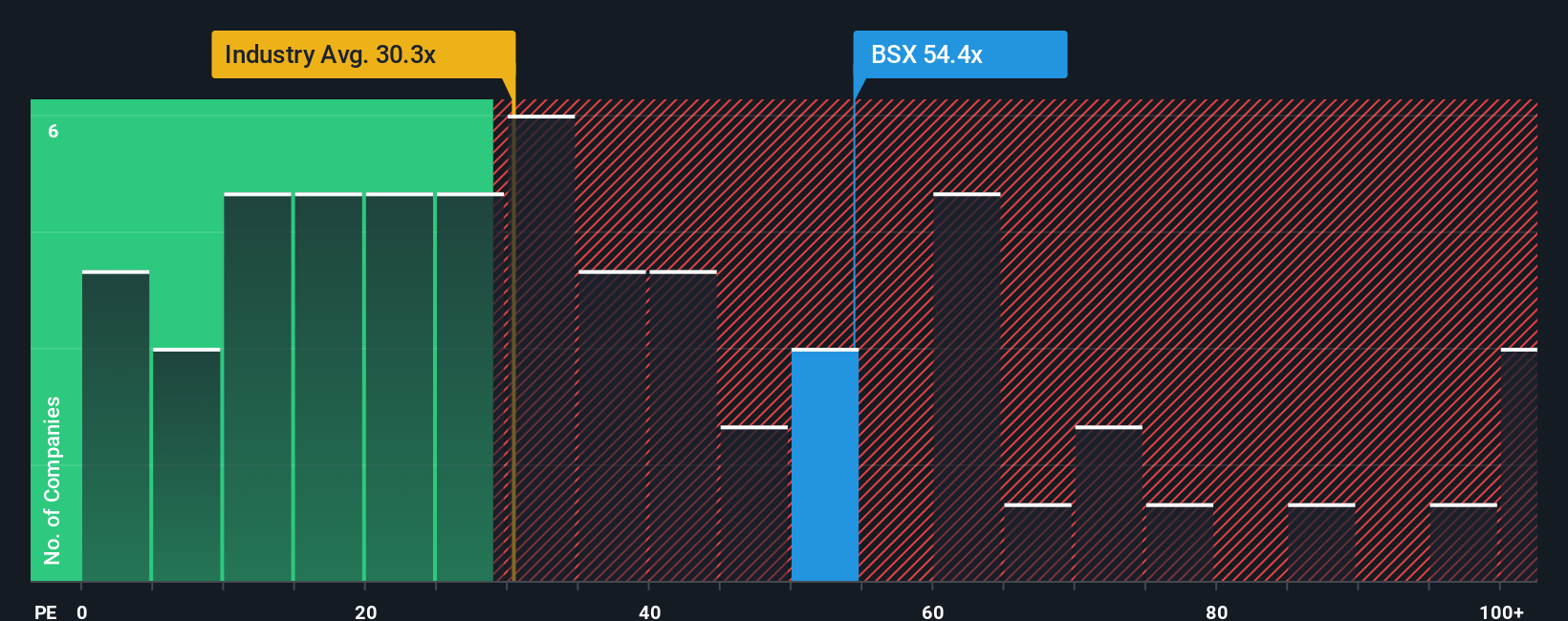

While the narrative points to upside, a closer look at earnings multiples paints a tougher picture. Boston Scientific trades on a rich 50.2x earnings ratio versus 30x for the wider US Medical Equipment group and 39.9x for peers, well above its 38.1x fair ratio, which hints at downside risk if growth expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boston Scientific Narrative

If you see the story differently or want to stress test the assumptions yourself, you can assemble a custom narrative in just a few minutes: Do it your way.

A great starting point for your Boston Scientific research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, give yourself an edge by scanning fresh opportunities from our screener shortlists so you are not leaving potential returns on the table.

- Capture momentum early by reviewing these 26 AI penny stocks that could benefit most from the accelerating adoption of artificial intelligence across industries.

- Lock in potential income streams by assessing these 12 dividend stocks with yields > 3% that combine meaningful yields with solid underlying businesses.

- Position ahead of the next market narrative shift by tracking these 80 cryptocurrency and blockchain stocks at the intersection of blockchain innovation and listed equities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal